Kings New York Social Worker Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions of a self-employed social worker's engagement with Kings New York. This agreement is designed for social workers who provide their services on a contractual basis rather than being employed by the organization. It is crucial for both parties to have a clear understanding of their rights, responsibilities, and expectations in order to ensure a fair and mutually beneficial working relationship. Some key components typically included in the Kings New York Social Worker Agreement — Self-Employed Independent Contractor are: 1. Scope of Work: This section outlines the specific services that the contractor will be providing to Kings New York. It may include details about the target population, therapeutic interventions, assessment tools, and any other specific requirements. 2. Contract Period: The agreement specifies the duration of the contractual relationship between the social worker and Kings New York. It may be for a fixed-term or ongoing arrangement, depending on the needs of both parties. 3. Compensation and Payment Terms: The compensation structure is clearly defined in this section, including the fee rates, billing frequency, and payment method. It is important to outline how the self-employed social worker will invoice Kings New York and the payment terms, such as net 30 days or upon completion of services. 4. Independent Contractor Status: This agreement emphasizes the self-employed nature of the social worker's relationship with Kings New York. It clarifies that the social worker is not an employee but an independent contractor responsible for their own taxes, insurance, and other statutory obligations. 5. Confidentiality and Non-Disclosure: Social workers often deal with sensitive and confidential information. This section defines the obligations of the contractor to maintain privacy and confidentiality in accordance with applicable laws and professional ethics. 6. Termination Clause: The agreement should include a clause outlining the conditions under which either party can terminate the engagement. This may include reasons such as breach of contract, non-performance, or mutual agreement. 7. Intellectual Property and Ownership: If the social worker produces any original work or intellectual property during the engagement, this section will detail who owns the rights to such work and how it can be used by both parties. Variations of the Kings New York Social Worker Agreement — Self-Employed Independent Contractor may exist depending on the specific role or requirements involved. For example, Kings New York may have different agreements for social workers specializing in child welfare, mental health, substance abuse, or geriatric care. Each agreement would cater to the unique needs and regulations pertinent to the respective area of focus.

Kings New York Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Kings New York Social Worker Agreement - Self-Employed Independent Contractor?

Draftwing forms, like Kings Social Worker Agreement - Self-Employed Independent Contractor, to manage your legal affairs is a challenging and time-consumming task. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents crafted for a variety of cases and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Kings Social Worker Agreement - Self-Employed Independent Contractor form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Kings Social Worker Agreement - Self-Employed Independent Contractor:

- Ensure that your document is compliant with your state/county since the rules for creating legal documents may vary from one state another.

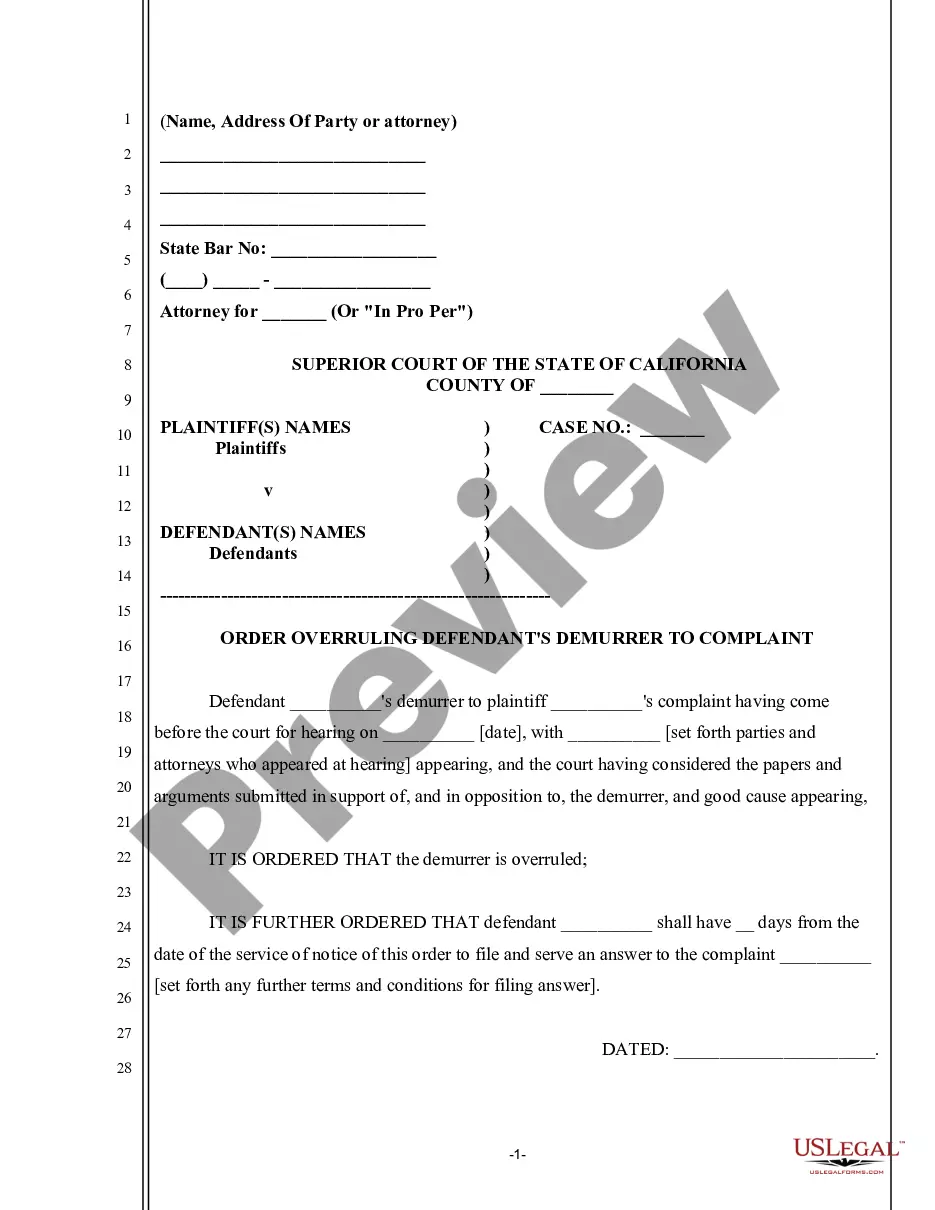

- Learn more about the form by previewing it or reading a brief intro. If the Kings Social Worker Agreement - Self-Employed Independent Contractor isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!