Montgomery Maryland Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Montgomery Maryland Social Worker Agreement - Self-Employed Independent Contractor?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Montgomery Social Worker Agreement - Self-Employed Independent Contractor, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how to find and download Montgomery Social Worker Agreement - Self-Employed Independent Contractor.

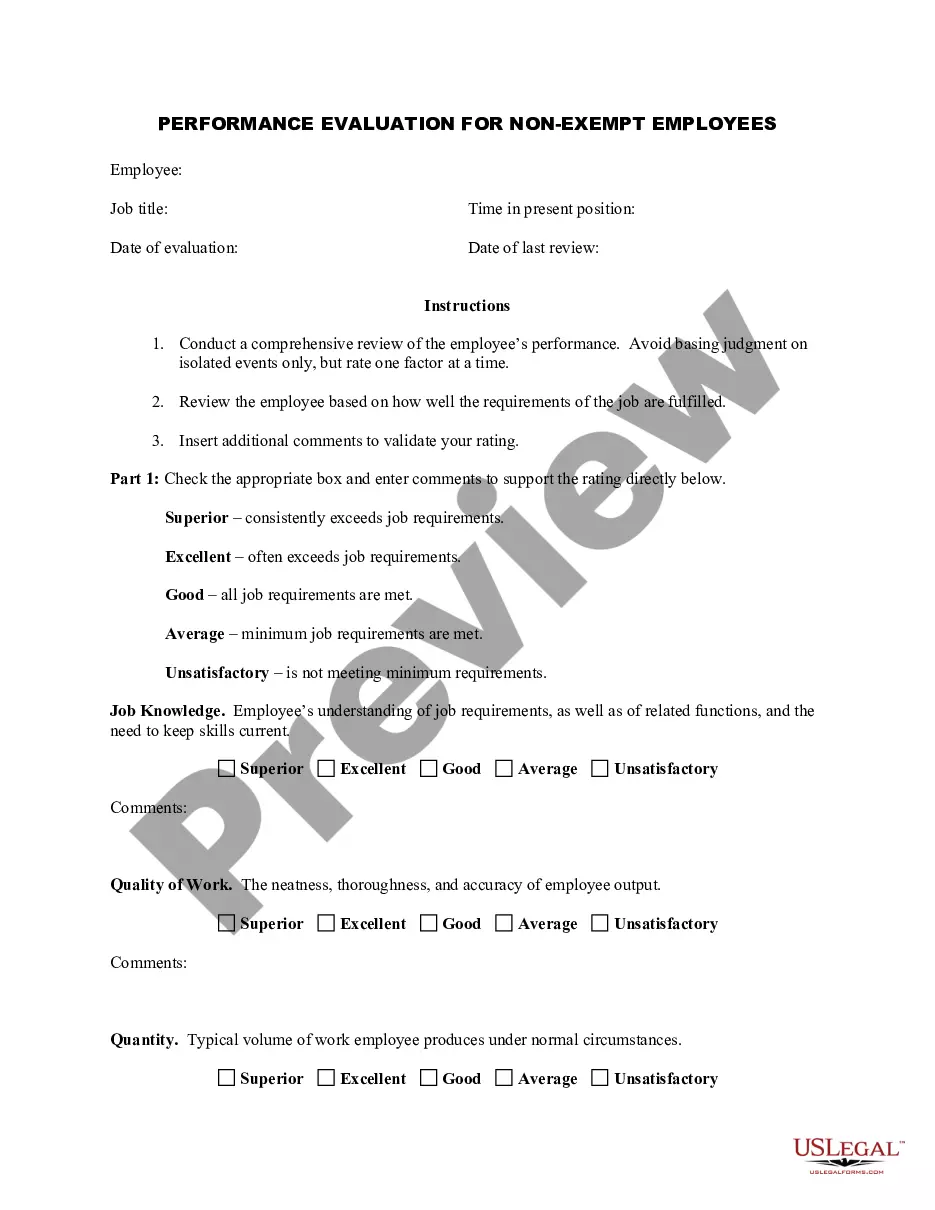

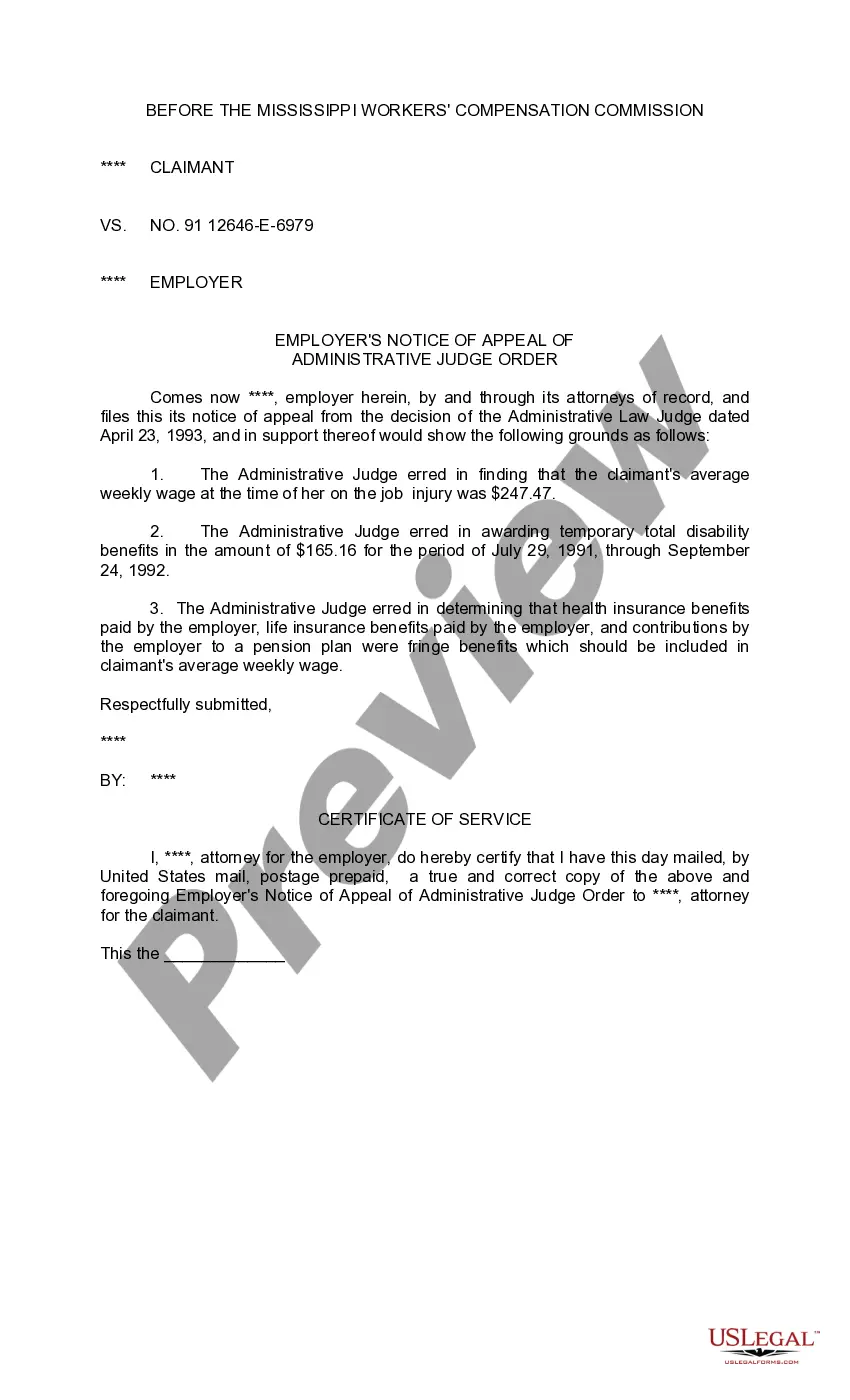

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the validity of some records.

- Check the related document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and buy Montgomery Social Worker Agreement - Self-Employed Independent Contractor.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Montgomery Social Worker Agreement - Self-Employed Independent Contractor, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you have to deal with an exceptionally complicated situation, we recommend getting a lawyer to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!

Form popularity

FAQ

What to Include in a Contract The date the contract begins and when it expires. The names of all parties involved in the transaction. Any key terms and definitions. The products and services included in the transaction. Any payment amounts, project schedules, terms, and billing dates.

An independent contractor is distinct from an employee who works regularly for a single employer. Independent contractors are not employees of the business or entity they are providing services for. However, the employer is paying the independent contractor for their work.

Generally, the employer is not responsible for the actions and illegal activities of the independent contractor unless certain conditions exist such as a direct connection to the activity or delegating tasks that should not go to the IC.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Financial control If the worker is paid a salary or guaranteed a regular company wage, they're probably classified as an employee. If the worker is paid a flat fee per job or project, they're more likely to be classified as an independent contractor.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Wage & Hour Law Independent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

If you create one of these things as an independent contractor, it will belong to the firm that hired you to create it if you have entered into a written agreement to that effect. If you don't have a written agreement, you will own the work.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.