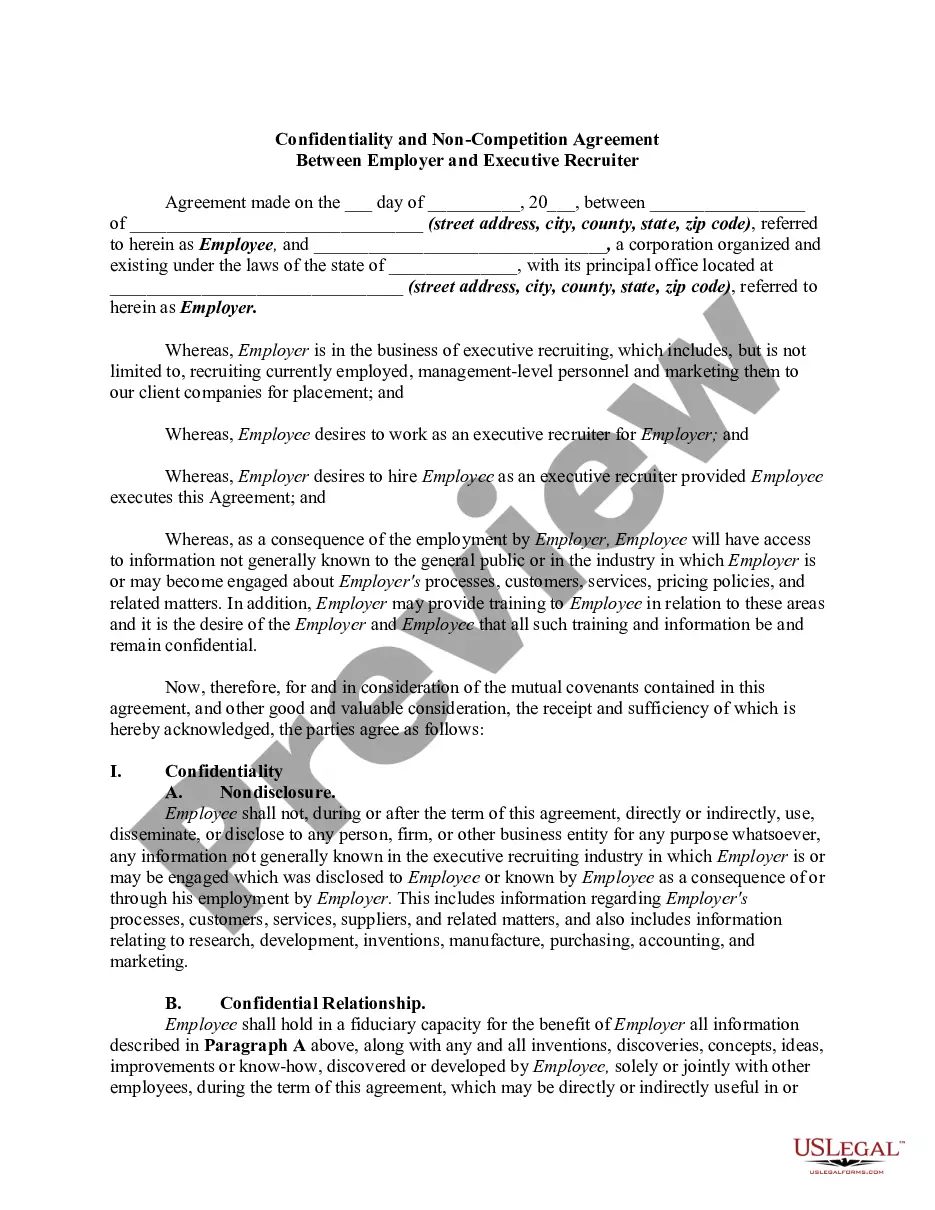

The Fairfax Virginia Payroll Specialist Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between a payroll specialist and an employer in Fairfax, Virginia. This comprehensive agreement serves as a crucial framework, establishing the rights, responsibilities, and expectations of both parties involved in the payroll process. Keywords: Fairfax Virginia, payroll specialist, agreement, self-employed, independent contractor. The Payroll Specialist Agreement specifies the nature of the working relationship between the payroll specialist and the employer. As a self-employed independent contractor, the payroll specialist operates their own business and provides specialized payroll services to the employer as outlined in the agreement. The agreement covers various aspects of the partnership, including the scope of services to be rendered. It may include tasks such as calculating wages, processing employee payments, tax withholding, managing benefits and deductions, maintaining payroll records, generating reports, and ensuring compliance with relevant federal, state, and local laws and regulations. Additionally, the agreement may outline the payment terms, specifying the compensation structure, whether it's a fixed fee, hourly rate, or project-based payment. It may also address any additional expenses, reimbursement policies, and the agreed-upon invoicing and payment schedule. In some cases, there may be different types of Fairfax Virginia Payroll Specialist Agreements — Self-Employed Independent Contractor, depending on the specific needs and requirements of different businesses. These variations can include: 1. Basic Payroll Specialist Agreement: This agreement lays out the fundamental obligations, responsibilities, and compensation details of the payroll specialist. 2. Comprehensive Payroll Specialist Agreement: This type of agreement includes a more extensive scope of services, encompassing not only payroll processing but also services like HR administration, benefits management, and tax reporting. 3. Project-Based Payroll Specialist Agreement: When businesses require payroll services for a specific project or short-term duration, this agreement outlines the specific project details, duration, and compensation structure related to the project at hand. 4. Non-Disclosure Agreement (NDA): A separate NDA may be included as an addendum to the Payroll Specialist Agreement, ensuring the confidentiality of sensitive employee and financial information handled by the payroll specialist. It's crucial for both parties to carefully review the Fairfax Virginia Payroll Specialist Agreement — Self-Employed Independent Contractor before signing to ensure a clear understanding of their respective rights, obligations, and protections. Seeking legal advice is advisable to ensure compliance with relevant laws and regulations specific to Fairfax, Virginia.

Fairfax Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Fairfax Virginia Payroll Specialist Agreement - Self-Employed Independent Contractor?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life scenario, locating a Fairfax Payroll Specialist Agreement - Self-Employed Independent Contractor meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Fairfax Payroll Specialist Agreement - Self-Employed Independent Contractor, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Fairfax Payroll Specialist Agreement - Self-Employed Independent Contractor:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Fairfax Payroll Specialist Agreement - Self-Employed Independent Contractor.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!