San Antonio Texas Payroll Specialist Agreement — Self-Employed Independent Contractor: A San Antonio Texas Payroll Specialist Agreement is a legally binding contract that outlines the terms and conditions between a payroll specialist and a company or individual who chooses to hire them as a self-employed independent contractor. This agreement ensures that both parties are clear on their rights, responsibilities, and compensation related to payroll services. The Payroll Specialist Agreement addresses various aspects of the working relationship, including the scope of work, payment terms, confidentiality, termination conditions, and dispute resolution. It is crucial for both the payroll specialist and the hiring party to thoroughly review and understand the agreement before signing it to avoid any potential misunderstandings or conflicts in the future. The San Antonio Texas Payroll Specialist Agreement may have different variations or types depending on the specific requirements of the parties involved. These variations can be categorized based on the following factors: 1. Scope of Work: Different types of payroll specialists may offer various services depending on their expertise and qualifications. For example, there could be Payroll Specialist Agreements specifically tailored for those who specialize in handling payroll tax compliance, year-end payroll processing, or payroll software implementation. 2. Compensation Structure: Payroll Specialist Agreements may differ in terms of how the payroll specialist is compensated for their services. Some agreements may establish a fixed hourly, weekly, or monthly rate, while others may involve a commission-based or project-based payment structure. 3. Duration of Agreement: The agreement can also vary in terms of its duration. Some Payroll Specialist Agreements may be valid for a specific project or a fixed period, while others may be ongoing until either party decides to terminate the contract. 4. Confidentiality and Non-Compete Clauses: Depending on the sensitivity of the information handled by the payroll specialist, some agreements may include specific clauses related to confidentiality, non-disclosure, and non-compete obligations. These clauses aim to protect the hiring party's sensitive payroll data and prevent the payroll specialist from competing with the hiring party during and after the agreement's term. It is essential for both parties to clearly define their expectations, responsibilities, and any additional terms within the San Antonio Texas Payroll Specialist Agreement to ensure a smooth and mutually beneficial working relationship. Seeking legal advice while drafting or reviewing the agreement can help protect the interests of both parties and ensure compliance with local laws and regulations.

San Antonio Texas Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

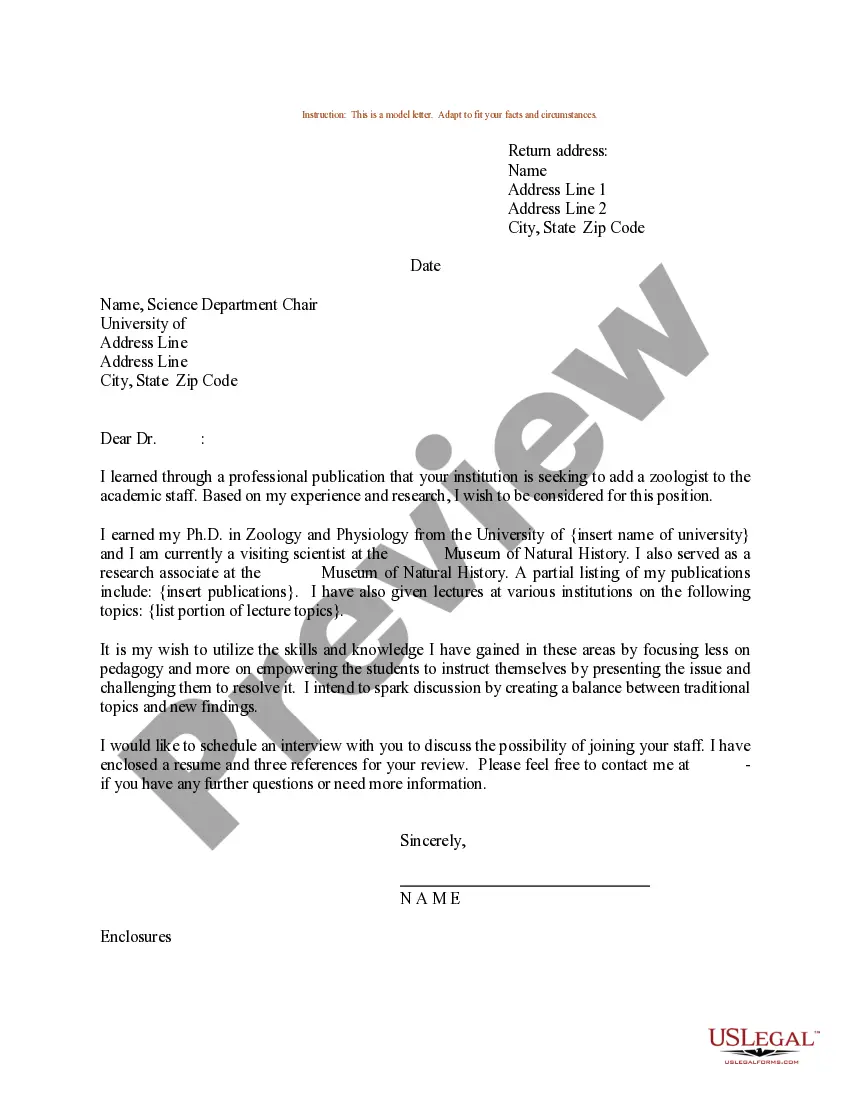

How to fill out San Antonio Texas Payroll Specialist Agreement - Self-Employed Independent Contractor?

Creating documents, like San Antonio Payroll Specialist Agreement - Self-Employed Independent Contractor, to manage your legal matters is a difficult and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms intended for various scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the San Antonio Payroll Specialist Agreement - Self-Employed Independent Contractor form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before downloading San Antonio Payroll Specialist Agreement - Self-Employed Independent Contractor:

- Ensure that your form is compliant with your state/county since the regulations for writing legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the San Antonio Payroll Specialist Agreement - Self-Employed Independent Contractor isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our service and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!