Middlesex Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Middlesex Massachusetts Electronics Assembly Agreement - Self-Employed Independent Contractor?

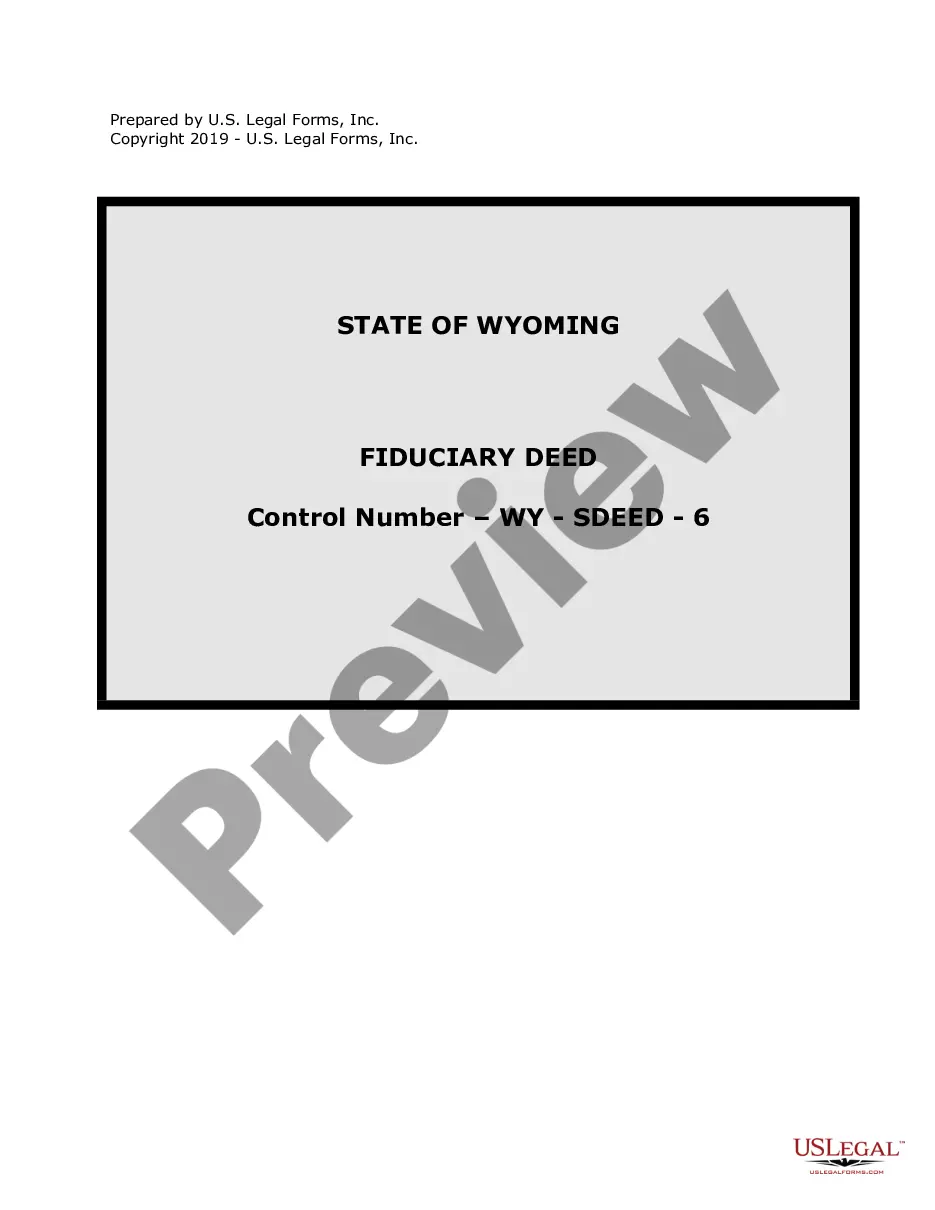

If you need to find a reliable legal form provider to get the Middlesex Electronics Assembly Agreement - Self-Employed Independent Contractor, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it simple to locate and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Middlesex Electronics Assembly Agreement - Self-Employed Independent Contractor, either by a keyword or by the state/county the form is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

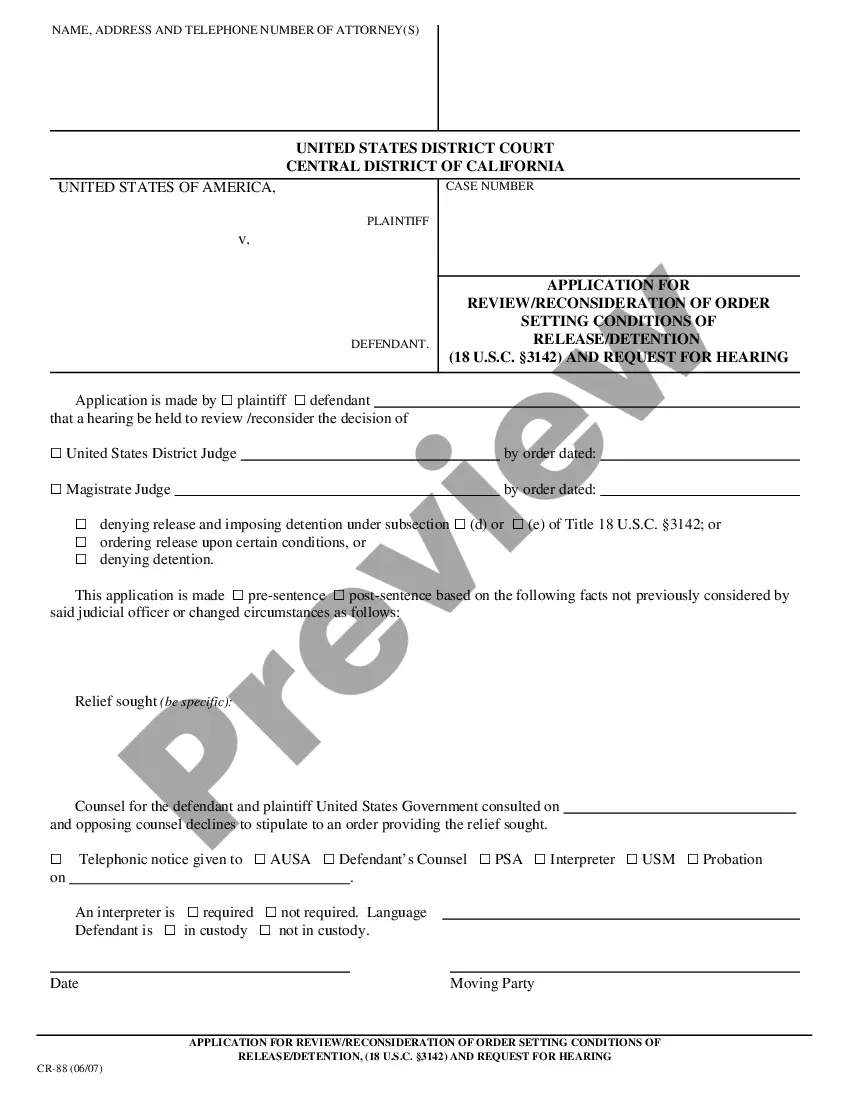

Don't have an account? It's easy to start! Simply find the Middlesex Electronics Assembly Agreement - Self-Employed Independent Contractor template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less pricey and more reasonably priced. Set up your first company, organize your advance care planning, create a real estate agreement, or complete the Middlesex Electronics Assembly Agreement - Self-Employed Independent Contractor - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Assuming you are already registered with SARS personally, then by default your sole proprietorship will also be registered. If you are not yet registered with SARS, you can register at a physical SARS branch, or online through the SARS eFiling service.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How to become an independent contractor Identify your business structure.Choose and register your business name.Get business licenses and permit.Get a business number and find your taxation requirements.Get insurance for your business.Establish the requirements for your workplace safety.Manage your business well.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.