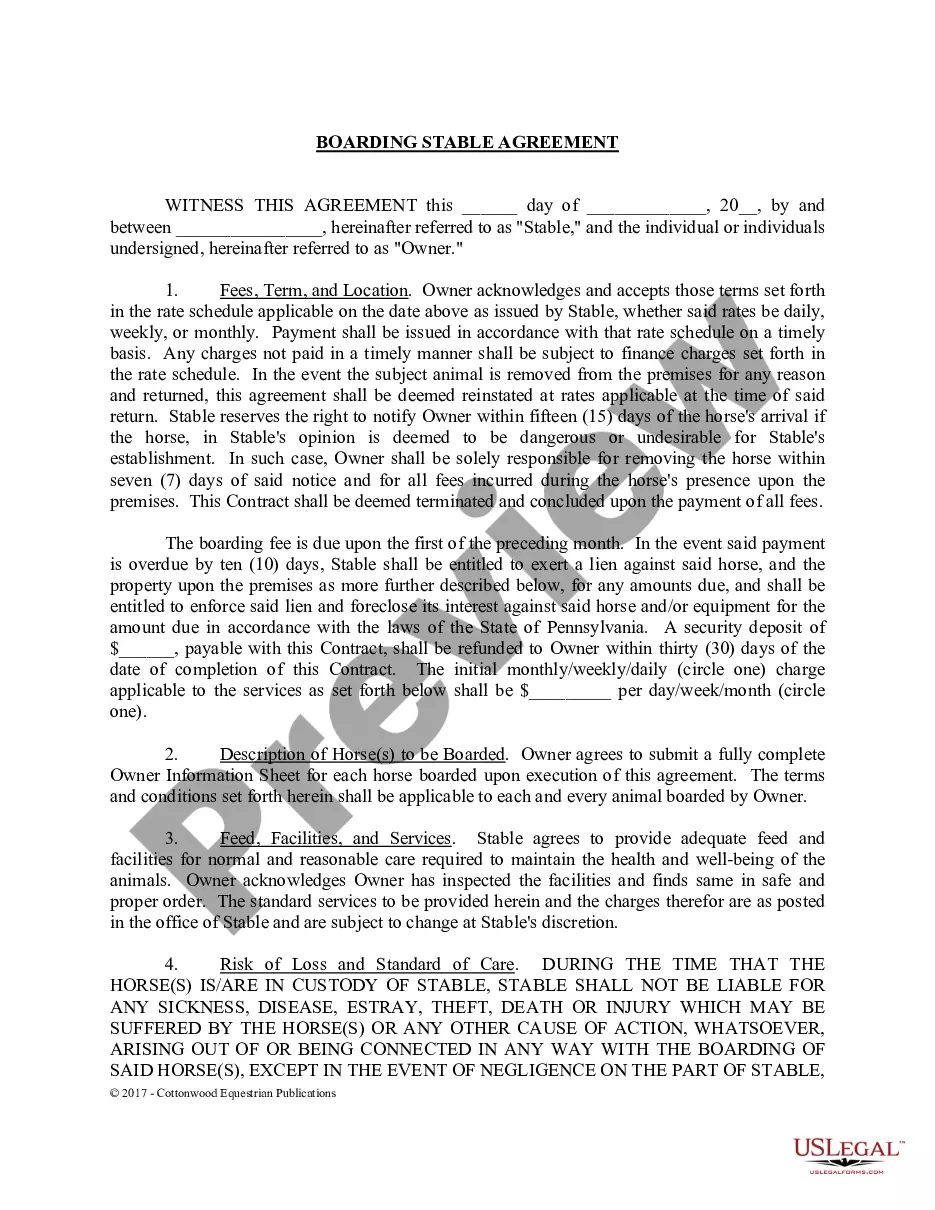

Phoenix Arizona Electronics Assembly Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions of the relationship between a self-employed individual and a company engaging their services for electronics assembly work. This agreement establishes the rights, obligations, and responsibilities of both parties involved. The Phoenix Arizona Electronics Assembly Agreement — Self-Employed Independent Contractor typically includes the following key elements: 1. Scope of Work: This section details the specific electronics assembly services the independent contractor will provide. It may cover tasks such as soldering, component assembly, circuit board assembly, wiring, testing, and quality control. 2. Compensation: The agreement outlines the payment structure for the independent contractor's services. This may include an hourly rate, piece-rate, or a total project fee. Payment terms, invoicing procedures, and any additional expenses reimbursed by the company should be clearly stated. 3. Work Schedule: The agreement specifies the expected work schedule and deadlines. It may include provisions for the independent contractor to work remotely or on-site at the company's facility in Phoenix, Arizona. 4. Intellectual Property: This section addresses the ownership of intellectual property related to the electronics assembly work. It defines who retains the rights to any inventions, designs, or proprietary information created during the project. 5. Confidentiality and Non-Disclosure: To protect sensitive company information, the agreement includes confidentiality clauses that prevent the independent contractor from disclosing any proprietary data, trade secrets, or client information to third parties. 6. Indemnification: This provision protects the company from any liability arising from the independent contractor's work. It states that the contractor will be responsible for any damages, losses, or claims resulting from their actions or negligence. 7. Termination: The agreement includes terms for early termination by either party. It outlines the notice period and any penalties or obligations upon termination. Types of Phoenix Arizona Electronics Assembly Agreements — Self-Employed Independent Contractor: 1. One-Time Electronics Assembly Agreement: This agreement applies to a single electronics assembly project requiring the expertise of a self-employed professional. It is specific to that project and concludes upon completion. 2. Ongoing Electronics Assembly Agreement: This type of agreement is for an independent contractor who regularly provides electronics assembly services to a company in Phoenix, Arizona. It establishes a long-term working relationship and may cover multiple projects over a specified period. 3. Remote Electronics Assembly Agreement: Some self-employed independent contractors work remotely and provide electronics assembly services from their own location. This agreement would cater specifically to those individuals working off-site but still providing electronics assembly services to Phoenix, Arizona-based clients. In summary, the Phoenix Arizona Electronics Assembly Agreement — Self-Employed Independent Contractor is a crucial legal document that ensures clarity, protection, and a mutually beneficial working relationship between a self-employed individual and a company requiring electronics assembly services in Phoenix, Arizona.

Phoenix Arizona Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Phoenix Arizona Electronics Assembly Agreement - Self-Employed Independent Contractor?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Phoenix Electronics Assembly Agreement - Self-Employed Independent Contractor, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Phoenix Electronics Assembly Agreement - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Phoenix Electronics Assembly Agreement - Self-Employed Independent Contractor:

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

You are typically considered an independent contractor if: you determine what work you perform, where you perform it and how it's performed; you decide whether you want to subcontract the work to other independent contractors; and. you have the opportunity to make a profit (or loss) in your own personal capacity.

A California Independent Contractor Agreement is a contract between an independent contractor and a client where the client hires an individual or an organization in the state of California.

You provide equipment or supplies: A hallmark of independent contractors is the fact they supply their own tools, equipment, and supplies. After all, contractors are, by definition, independent professionals. It makes sense they would have their own ladder, laptop, or lawnmower.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Filing taxes as an independent contractor in Canada As an independent contractor, you include all of your revenue as income on your personal tax return every April. However, as indicated above, you claim independent contractor tax deductions to reduce your taxable income and your tax bill!

Does the worker own his or her equipment? Independent contractors should use their own computer, work vehicle, tools, etc.

As an independent contractor, the terms and conditions of the work you perform are set out in a contract between you and the employer. Even though you are not considered an ?employee? under federal labor law, you may still join a union.

Yes, a subcontractor generally provides his own tools and materials and can hire employees or subcontractors himself. 7. If my worker invests in his own equipment does it change his status? Yes, if the worker owns or rents costly equipment to do the work, he may be a subcontractor.

Generally, to be legally valid, most contracts must contain two elements: All parties must agree about an offer made by one party and accepted by the other. Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Interesting Questions

More info

The Escrow Instructions are for the “Cancel and Pay” portion of your Employment Agreement. It is intended to be as detailed and precise as possible. The form is intended to be completed by the person requesting the Escrow, and not by the employer or person being paid. There is no penalty for submitting an incorrect form. However, failure to send all needed Forms and Instructions within 10 days will automatically forfeit the entire Escrow Fee (described in Article 12 & Article 13). The Escrow Form is only a guideline, and it is intended to help in completing the form. It is not required information. If the employer fails to send all required forms and instructions within 10 days, then the Escrow Agreement will be considered invalid, and the contract would be deemed invalid (as it was never signed). This means that the employer and person being paid would have to pay the Escrow on that portion of the contract (i.e. The Escrow Fee) when the contract is paid.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.