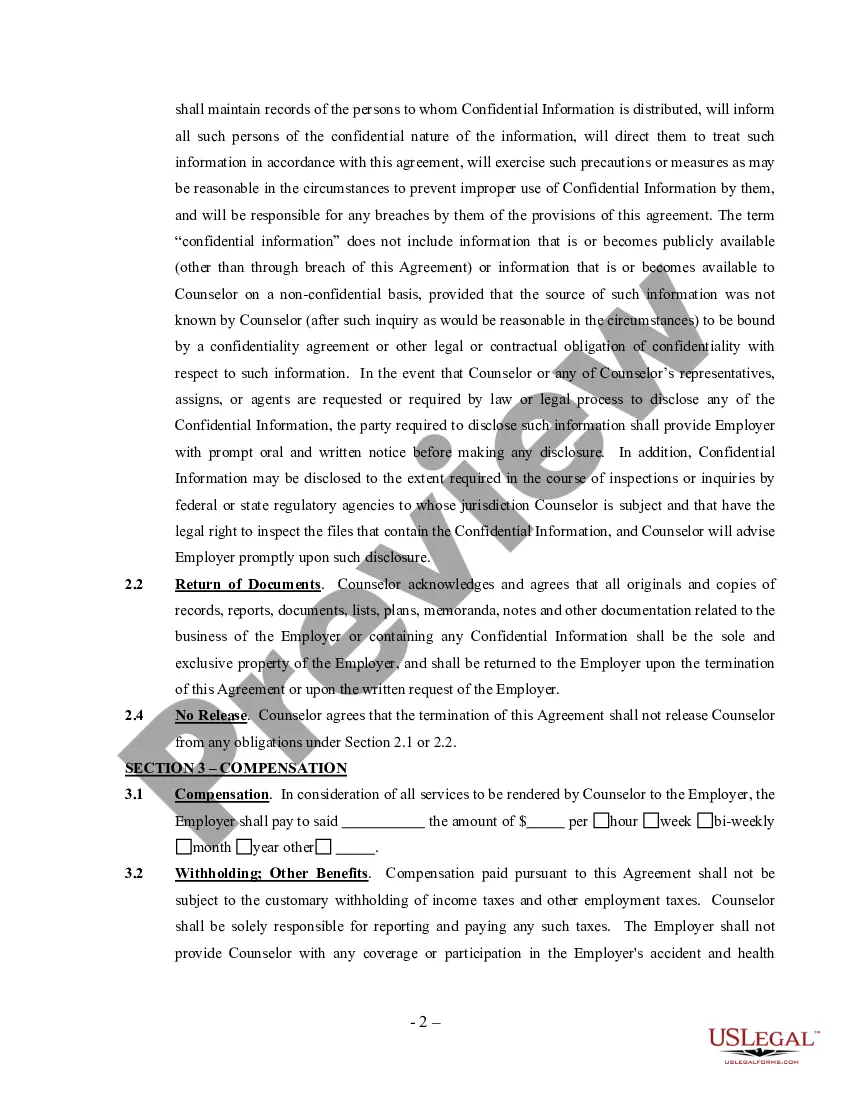

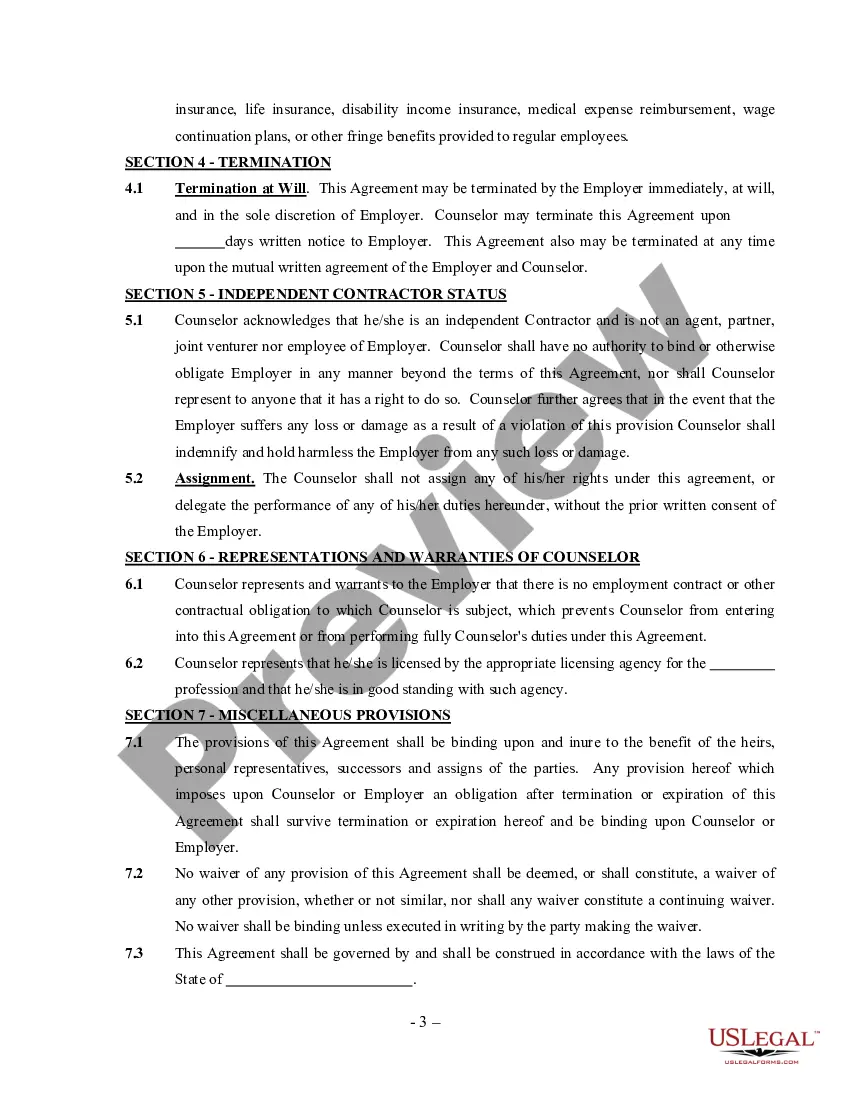

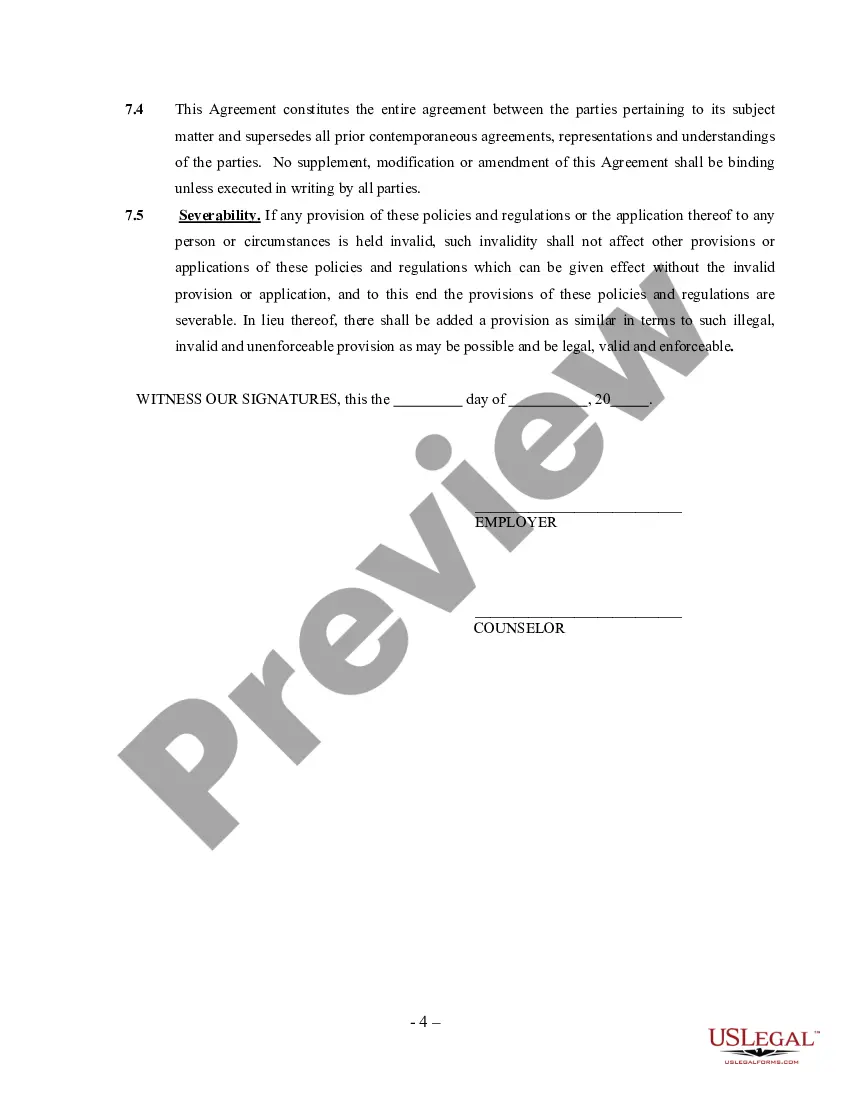

Bronx New York Counselor Agreement — Self-Employed Independent Contractor: A Bronx New York Counselor Agreement is a legally binding contract that outlines the relationship between a counselor and their client. In particular, this agreement pertains to self-employed independent contractors in the Bronx, New York area. This document regulates the terms and conditions that both parties must adhere to in order to ensure a successful counseling experience. Keywords: Bronx New York, counselor agreement, self-employed, independent contractor, relationship, terms and conditions, counseling experience Types of Bronx New York Counselor Agreement — Self-Employed Independent Contractor: 1. Substance Abuse Counselor Agreement: This type of agreement specifically caters to counselors specializing in substance abuse counseling in the Bronx, New York area. It outlines specific terms related to the treatment of individuals struggling with addiction and substance dependence. The agreement may cover topics such as confidentiality, treatment plans, and ethical responsibilities. 2. Mental Health Counselor Agreement: This agreement is tailored for mental health counselors operating as self-employed independent contractors in Bronx, New York. It focuses on providing counseling services to individuals with mental health concerns. The agreement may address topics like confidentiality, treatment modalities, client progress assessments, and professional liability. 3. Marriage and Family Therapist Agreement: This type of agreement is designed for marriage and family therapists working as independent contractors in the Bronx area. It outlines specific terms related to providing counseling services to couples and families. The agreement may cover areas such as conflict resolution, communication strategies, confidentiality, and the therapist's role in family dynamics. 4. Career Counselor Agreement: This agreement caters to career counselors who operate as independent contractors in the Bronx, New York area. It focuses specifically on career counseling services, including career assessments, job search strategies, resume building, and interview skills. The agreement may address factors such as confidentiality, client goal setting, and the counselor's responsibility in guiding career decisions. In summary, a Bronx New York Counselor Agreement — Self-Employed Independent Contractor is a crucial document that establishes a legal framework between a counselor and their client in the Bronx, New York area. Counselors specializing in different areas such as substance abuse, mental health, marriage and family therapy, and career counseling may have their specific agreements to cater to the unique nature of their practice.

Bronx New York Counselor Agreement - Self-Employed Independent Contractor

Description

How to fill out Bronx New York Counselor Agreement - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Bronx Counselor Agreement - Self-Employed Independent Contractor.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Bronx Counselor Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Bronx Counselor Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Bronx Counselor Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Known as poaching, having contractors contact your own clients is a risk every business takes when bringing on contractors. Poaching can happen either while the worker is on contract with you or afterward. Either way, though, you can lose the ability to do business with that client.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)