San Antonio Texas Collections Agreement — Self-Employed Independent Contractor A San Antonio Texas Collections Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between a self-employed independent contractor and a company or individual seeking collection services. This agreement is essential for establishing a clear understanding of the responsibilities, obligations, and rights of both parties involved. Keywords: — San Antonio Texas: This refers to the specific location where the collections' agreement is being created and enforced. It signifies the jurisdiction and laws that will govern the agreement. — Collections Agreement: This agreement pertains to the arrangement between a collector and a company or individual seeking assistance in collecting outstanding debts or payments. — Self-Employed: This term indicates that the independent contractor is not an employee of the hiring party but operates their own business. Being self-employed provides certain benefits and responsibilities in this context. — Independent Contractor: This refers to an individual or business entity that provides services to another entity but does not have an employee-employer relationship. Independent contractors have greater independence and control over their work process. Different types of San Antonio Texas Collections Agreement — Self-Employed Independent Contractor may include variations such as: 1. Commission-Based Collections Agreement: This type of agreement specifies that the self-employed independent contractor receives a percentage or fixed commission from the collected amount as compensation for their services. It details how and when the commission will be determined and paid. 2. Retainer-Based Collections Agreement: In this agreement, the self-employed independent contractor receives a pre-determined retainer fee for their services, regardless of the actual collections made. Additional terms may be included to outline the scope of work covered by the retainer and any conditions for its renewal or termination. 3. Hybrid Collections Agreement: This type of agreement combines elements of both commission-based and retainer-based models. It may specify a minimum retainer fee and include a commission structure based on the total amount collected. Details about the commission percentages, payment schedules, and conditions are outlined in this agreement. 4. Exclusive Collection Agreement: This variant refers to an agreement where the self-employed independent contractor is the sole provider of collection services for the hiring party. It may include exclusivity clauses, limitations on engaging with competitors, and performance requirements. 5. Limited Term Collections Agreement: This type of agreement specifies a predetermined contractual period during which the self-employed independent contractor will provide collection services. It outlines the start and end dates, termination clauses, and any renewal options. It is important for both parties involved in a San Antonio Texas Collections Agreement — Self-Employed Independent Contractor to carefully review and understand the terms and conditions before signing. Consulting with legal professionals is advisable to ensure compliance with local laws and regulations.

San Antonio Texas Collections Agreement - Self-Employed Independent Contractor

Description

How to fill out San Antonio Texas Collections Agreement - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your county, including the San Antonio Collections Agreement - Self-Employed Independent Contractor.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the San Antonio Collections Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the San Antonio Collections Agreement - Self-Employed Independent Contractor:

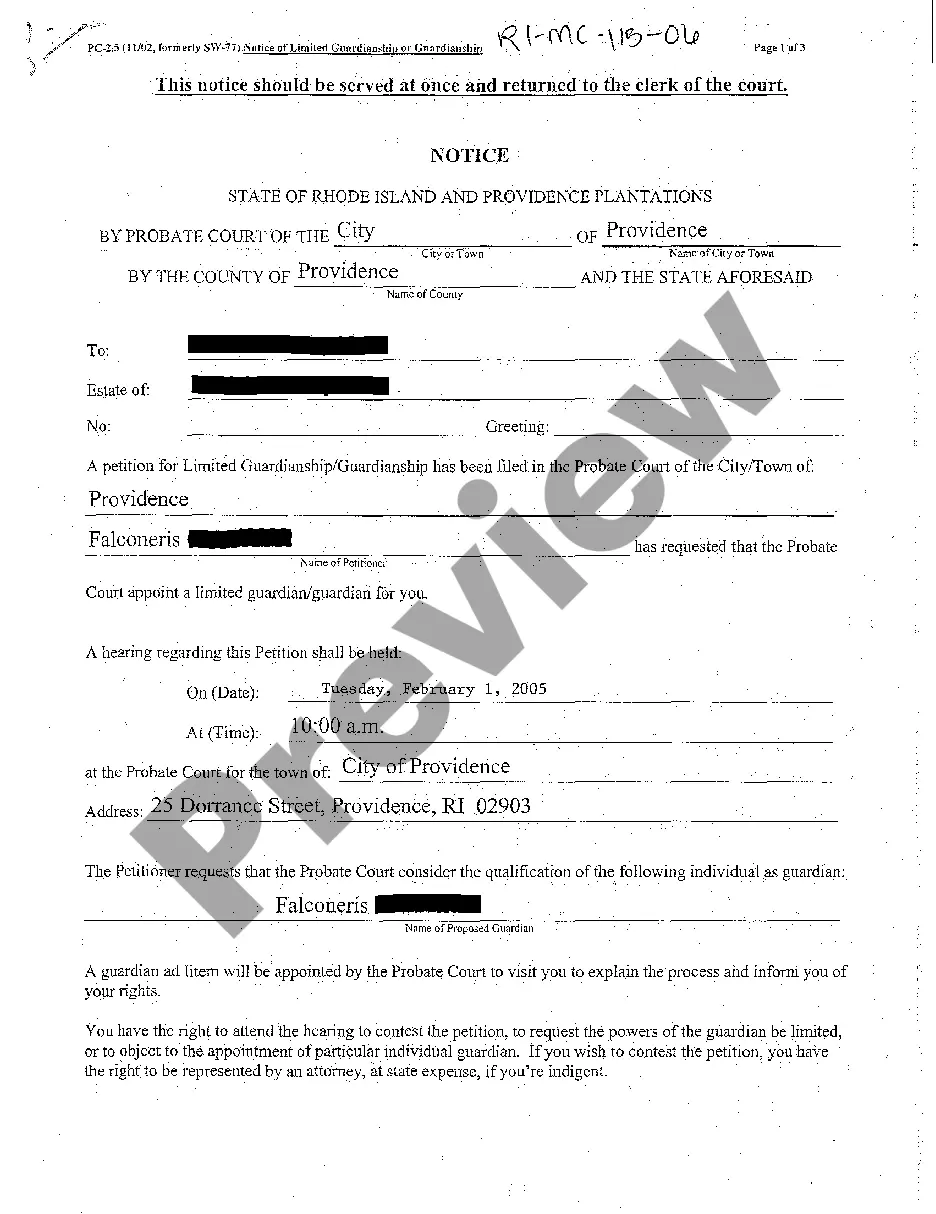

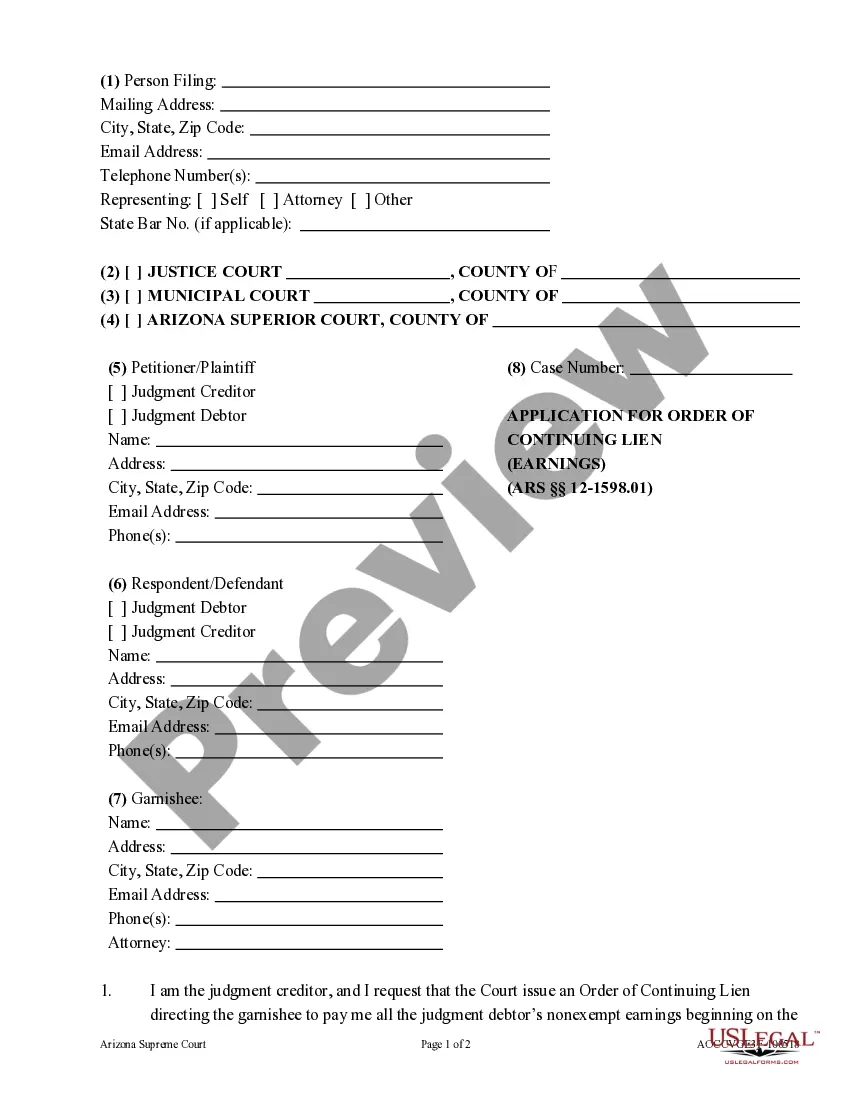

- Make sure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the San Antonio Collections Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!