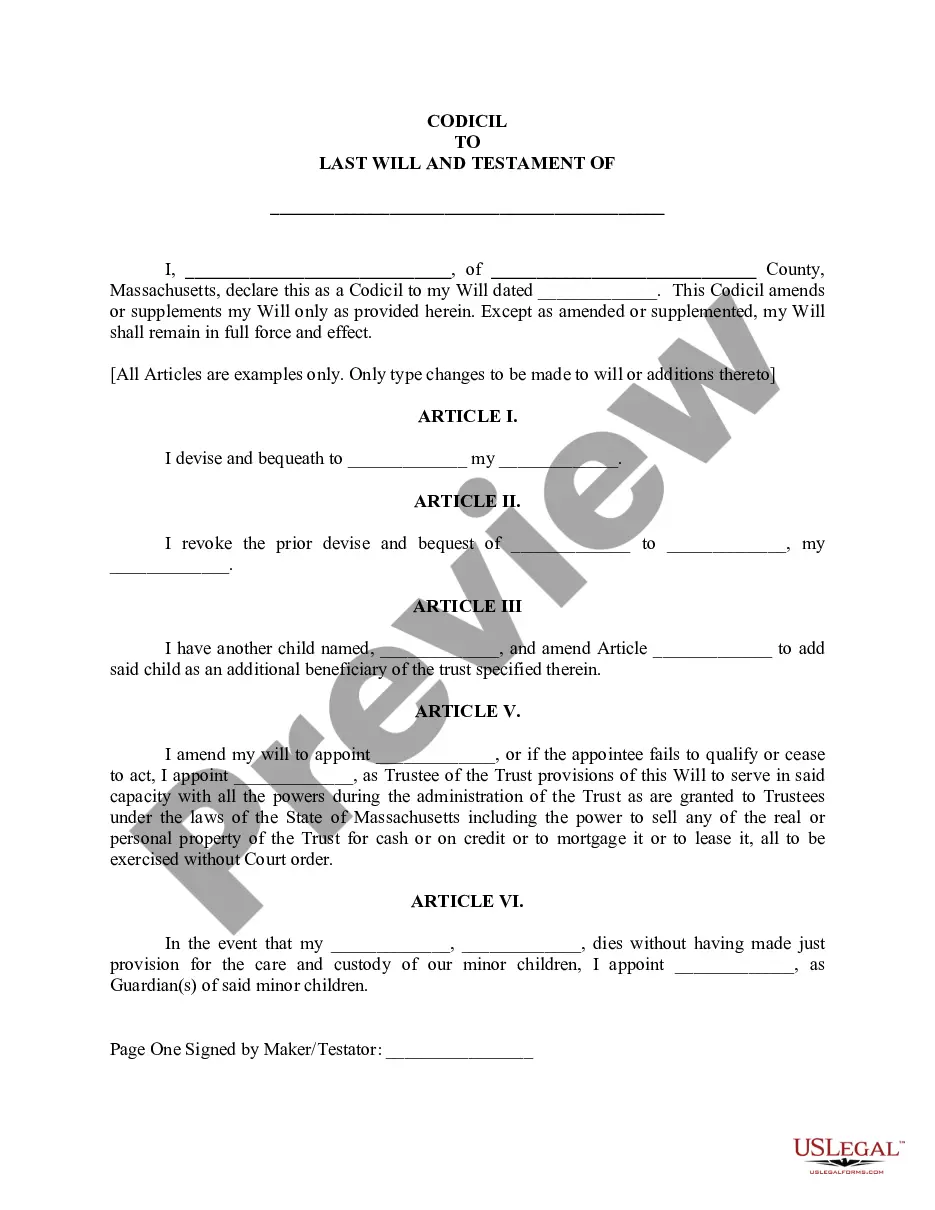

Chicago Illinois Bookkeeping Agreement — Self-Employed Independent Contractor A bookkeeping agreement is a legally binding document that outlines the terms and conditions of the professional relationship between a self-employed independent contractor and a client for bookkeeping services. In the bustling city of Chicago, Illinois, there are various types of bookkeeping agreements catered to the unique needs and preferences of self-employed individuals seeking professional assistance in managing their financial records. These agreements ensure transparency, protect the interests of both parties, and establish clear expectations. Key Features of a Chicago Illinois Bookkeeping Agreement — Self-Employed Independent Contractor: 1. Scope of Work: The agreement should clearly define the scope of services provided by the self-employed independent contractor, including tasks such as bank reconciliation, financial statement preparation, expense tracking, payroll processing, and tax preparation. 2. Compensation: The agreement must outline the payment terms, rates, and methods of invoicing. It should specify whether the contractor charges an hourly rate, a fixed fee, or operates on a retainer basis. 3. Confidentiality: Given the sensitive nature of financial information, the agreement should incorporate clauses that outline the contractor's responsibility to keep all client information confidential and ensure data protection. 4. Duration: The agreement should specify the commencement date and duration of the agreement, including any provisions for termination with or without cause by either party. 5. Ownership of Records: It is essential to establish who retains ownership of the financial records and documents maintained by the contractor during the engagement. Types of Chicago Illinois Bookkeeping Agreements — Self-Employed Independent Contractor: 1. Hourly Rate Agreement: This type of agreement involves the bookkeeper charging an hourly rate for their services. It provides flexibility and is suitable for clients with fluctuating bookkeeping needs or project-based requirements. 2. Fixed Fee Agreement: With this agreement, the bookkeeper charges a predetermined fixed fee for a specific set of services or a defined period, regardless of the actual hours worked. It offers predictability and is beneficial for clients with stable bookkeeping needs. 3. Retainer Agreement: A retainer agreement involves the client paying a recurring fee upfront to secure the bookkeeper's services on an ongoing basis. This arrangement guarantees the availability of the bookkeeper and is suitable for clients requiring regular, continuous bookkeeping support. 4. Task-Based Agreement: In this type of agreement, the bookkeeper charges a pre-determined fee for specific bookkeeping tasks requested by the client. It allows flexibility for clients who only require assistance with specific aspects of their financial records. 5. Project-Based Agreement: This agreement is designed for clients with one-time or short-term bookkeeping projects. The bookkeeper and client agree upon the scope of work and a fixed fee is charged for the completion of the project. Whether you are a freelancer, entrepreneur, or self-employed professional based in Chicago, Illinois, a bookkeeping agreement tailored to your unique requirements is crucial to maintaining accurate financial records and ensuring compliance with tax obligations. Consulting an attorney or a qualified professional is recommended to ensure your bookkeeping agreement covers all necessary aspects and adheres to the legal regulations and guidelines specific to the State of Illinois.

Chicago Illinois Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out Chicago Illinois Bookkeeping Agreement - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business purpose utilized in your county, including the Chicago Bookkeeping Agreement - Self-Employed Independent Contractor.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Chicago Bookkeeping Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Chicago Bookkeeping Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Chicago Bookkeeping Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!