Kings New York Bookkeeping Agreement — Self-Employed Independent Contractor is a detailed contract that outlines the terms and conditions between a bookkeeping service provider, Kings New York, and a self-employed independent contractor. This agreement is specifically designed for professionals in New York who offer bookkeeping services as individuals or businesses. With keywords like "bookkeeping agreement," "self-employed," and "independent contractor," the content will focus on these aspects. The Kings New York Bookkeeping Agreement covers various key points, including the scope of work, payment terms, and responsibilities of both parties. It ensures that both Kings New York and the self-employed bookkeeping professional are on the same page regarding the nature and expectations of their professional relationship. Under the Kings New York Bookkeeping Agreement, there might be a few different types, depending on the specific needs and requirements of the self-employed independent contractor. These may include: 1. Basic Bookkeeping Agreement: This type of agreement covers the essential bookkeeping services provided by Kings New York to the self-employed independent contractor. It includes tasks such as recording financial transactions, maintaining general ledgers, and generating financial reports. 2. Customized Bookkeeping Agreement: Kings New York can offer a customized agreement tailored to the specific needs of the self-employed independent contractor. This may include additional services like budgeting, financial analysis, tax preparation assistance, or any other specialized bookkeeping tasks. 3. Project-Based Bookkeeping Agreement: Sometimes, self-employed independent contractors require bookkeeping services for specific projects or events. Kings New York can provide a project-based agreement that outlines the scope of work, deadlines, and payment terms for these temporary assignments. The Kings New York Bookkeeping Agreement — Self-Employed Independent Contractor ensures that all parties involved understand their rights and responsibilities, sets clear expectations for the quality and timeliness of services, and provides a framework for resolving disputes if any arise. It is essential to review and understand the terms and conditions of this agreement before commencing any bookkeeping services with Kings New York as a self-employed independent contractor.

Kings New York Bookkeeping Agreement - Self-Employed Independent Contractor

Description

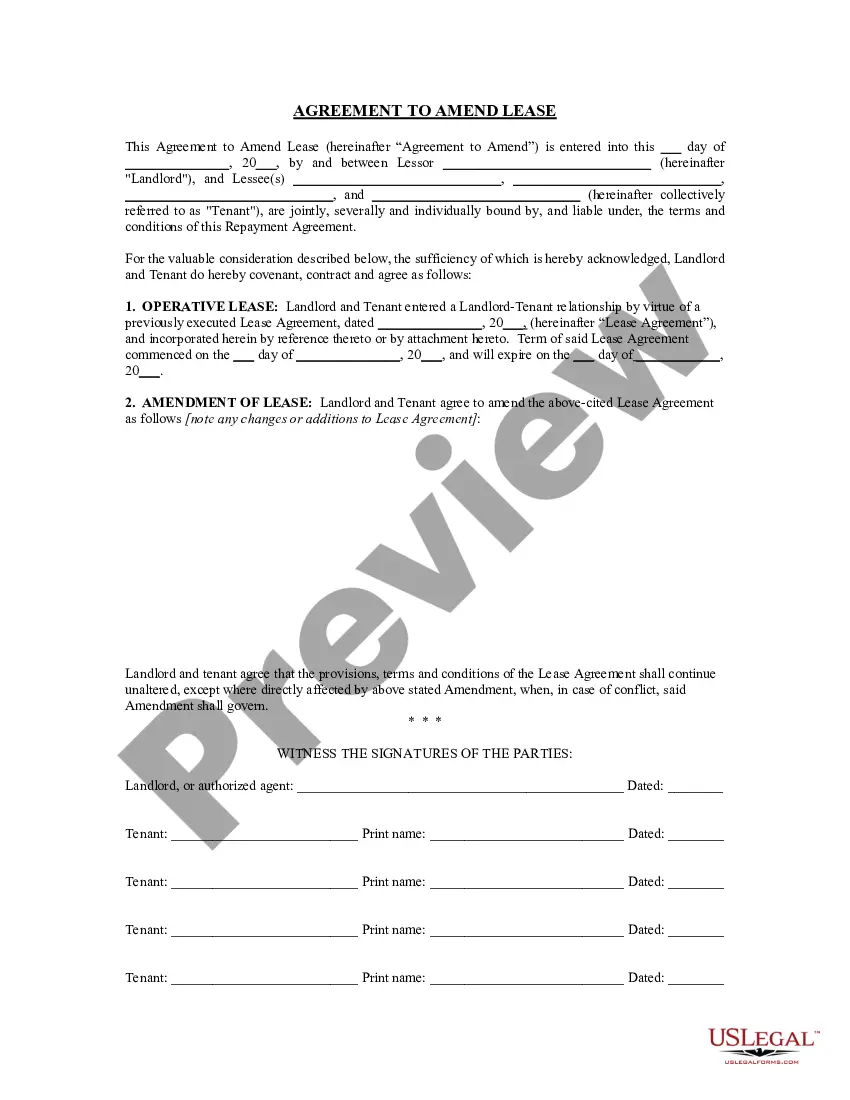

How to fill out Kings New York Bookkeeping Agreement - Self-Employed Independent Contractor?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Kings Bookkeeping Agreement - Self-Employed Independent Contractor, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed materials and tutorials on the website to make any tasks associated with document execution simple.

Here's how to find and download Kings Bookkeeping Agreement - Self-Employed Independent Contractor.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Check the related document templates or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Kings Bookkeeping Agreement - Self-Employed Independent Contractor.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Kings Bookkeeping Agreement - Self-Employed Independent Contractor, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you need to deal with an exceptionally difficult situation, we advise getting a lawyer to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!