Santa Clara California Bookkeeping Agreement — Self-Employed Independent Contractor A Santa Clara California Bookkeeping Agreement — Self-Employed Independent Contractor is a legal document that establishes the terms and conditions between a bookkeeper and their client. This agreement outlines the responsibilities and expectations of both parties involved in the bookkeeping services being provided. It is crucial for every self-employed bookkeeper in Santa Clara, California to have a well-drafted agreement in place to avoid misunderstandings and disputes. In a typical Santa Clara California Bookkeeping Agreement — Self-Employed Independent Contractor, the following details are covered: 1. Identification of the parties involved: This section includes the names, addresses, and contact information of both the bookkeeper and the client. 2. Scope of services: This part outlines the specific bookkeeping tasks and responsibilities that the bookkeeper will undertake. It may include tasks such as recording financial transactions, reconciling accounts, generating financial reports, and managing payroll. 3. Duration and termination: This section clarifies the duration of the agreement and the procedures for termination, whether through mutual agreement or breach of contract. 4. Compensation and payment terms: The agreement clearly states the amount the client will pay the bookkeeper, along with the payment schedule and preferred method of payment (e.g., check, electronic transfer). Additional details may include any late payment penalties or reimbursement of expenses incurred by the bookkeeper. 5. Confidentiality: A clause on confidentiality ensures the bookkeeper will maintain strict confidentiality regarding the client's financial information and not disclose it to third parties without prior consent. 6. Ownership of records: This provision outlines who maintains ownership of the financial records created during the provision of bookkeeping services. It may specify whether the client retains ownership or if the bookkeeper has the right to retain copies for their records. 7. Independent contractor status: As a self-employed independent contractor, the bookkeeper is not considered an employee of the client. This section clarifies that the bookkeeper is responsible for their own taxes, insurance, and other liabilities. Other types of Santa Clara California Bookkeeping Agreements — Self-Employed Independent Contractor may include: 1. Monthly bookkeeping agreement: This type of agreement is tailored for ongoing bookkeeping services on a monthly basis, typically involving regular maintenance of the client's financial statements and records. 2. Project-based bookkeeping agreement: A project-based agreement is suitable when the bookkeeper is hired for a specific project or a finite period, such as conducting an audit or assisting with year-end financial reports. 3. On-call bookkeeping agreement: This agreement caters to clients who need occasional bookkeeping assistance but do not require ongoing services. It allows for ad hoc bookkeeping support as needed. In conclusion, a Santa Clara California Bookkeeping Agreement — Self-Employed Independent Contractor serves as a vital legal tool to establish the terms and conditions between a bookkeeper and their client. It ensures clarity and protection for both parties involved in the provision of bookkeeping services in Santa Clara, California.

Santa Clara California Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out Santa Clara California Bookkeeping Agreement - Self-Employed Independent Contractor?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Santa Clara Bookkeeping Agreement - Self-Employed Independent Contractor is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Santa Clara Bookkeeping Agreement - Self-Employed Independent Contractor. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law requirements.

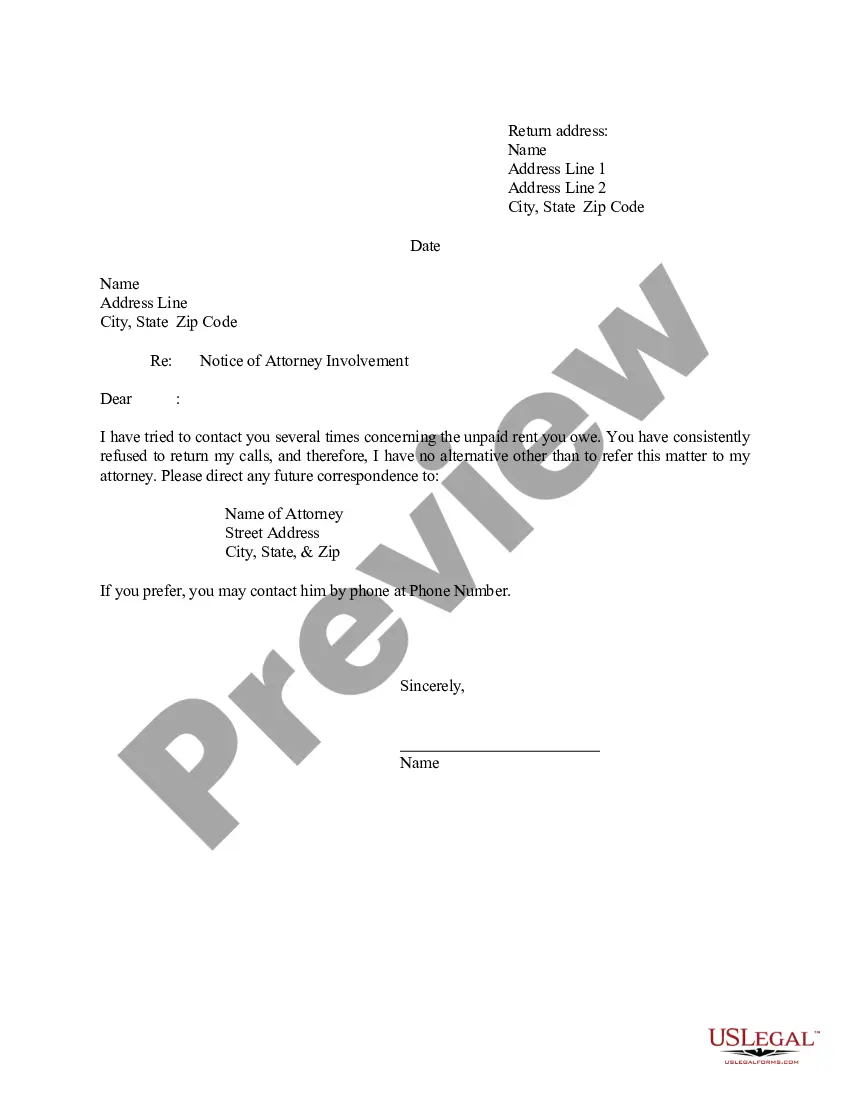

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Bookkeeping Agreement - Self-Employed Independent Contractor in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!