Harris Texas Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

A documentation procedure invariably accompanies any legal endeavor you undertake.

Establishing a business, applying for or accepting an employment offer, transferring ownership, and numerous other life situations necessitate you to prepare formal documentation that varies across the nation.

That is the reason having everything gathered in one location is so beneficial.

US Legal Forms is the largest online collection of current federal and state-specific legal documents.

Select the preferred payment method (via credit card or PayPal) to proceed further. Choose a file format and save the Harris Self-Employed Independent Contractor Consideration For Hire Form on your device. Utilize it as needed: print it out or fill it in electronically, sign it, and submit it where required. This is the simplest and most dependable method to acquire legal documents. All templates available in our library are expertly drafted and verified for consistency with local laws and regulations. Prepare your documents and handle your legal matters effectively with US Legal Forms!

- Here, you can effortlessly find and obtain a document for any personal or commercial purpose utilized in your jurisdiction, including the Harris Self-Employed Independent Contractor Consideration For Hire Form.

- Finding samples on the site is exceptionally simple.

- If you already possess a subscription to our library, Log In to your account, find the sample using the search function, and click Download to save it onto your device.

- After that, the Harris Self-Employed Independent Contractor Consideration For Hire Form will be available for additional use in the My documents section of your profile.

- If you are using US Legal Forms for the first occasion, adhere to this brief guideline to acquire the Harris Self-Employed Independent Contractor Consideration For Hire Form.

- Ensure you have accessed the correct page featuring your localized document.

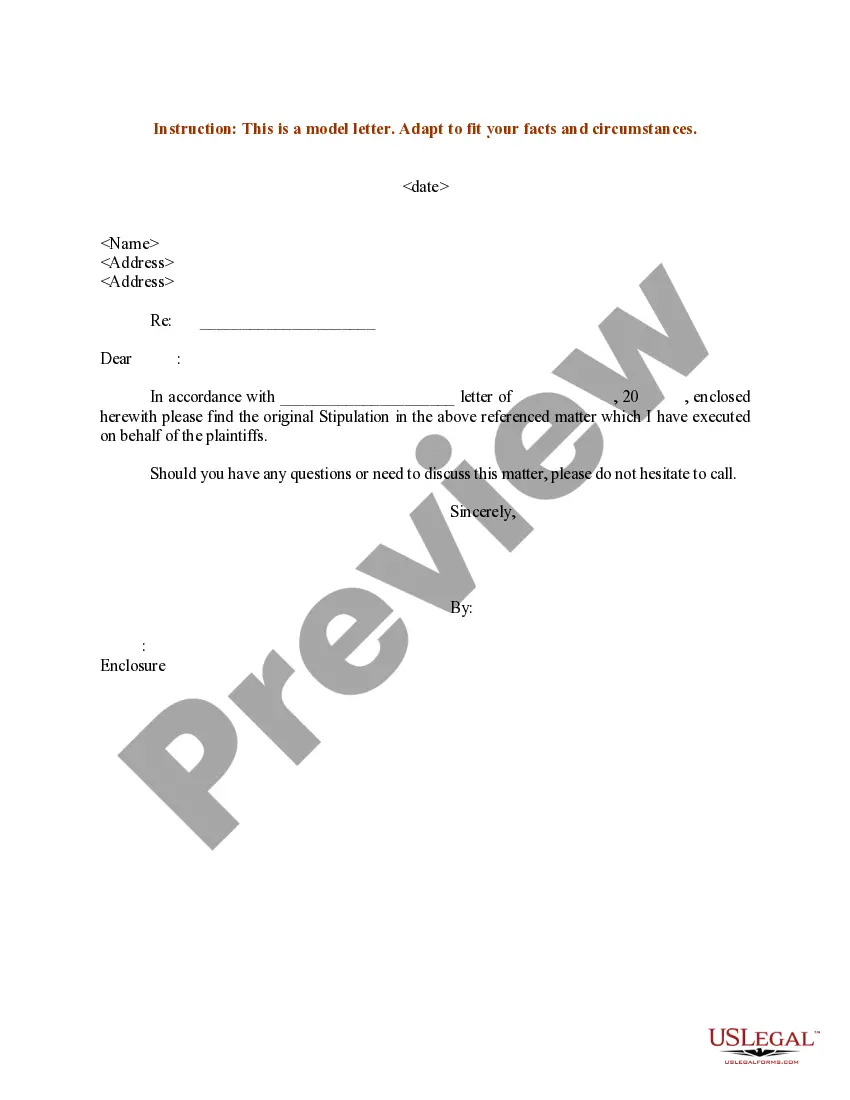

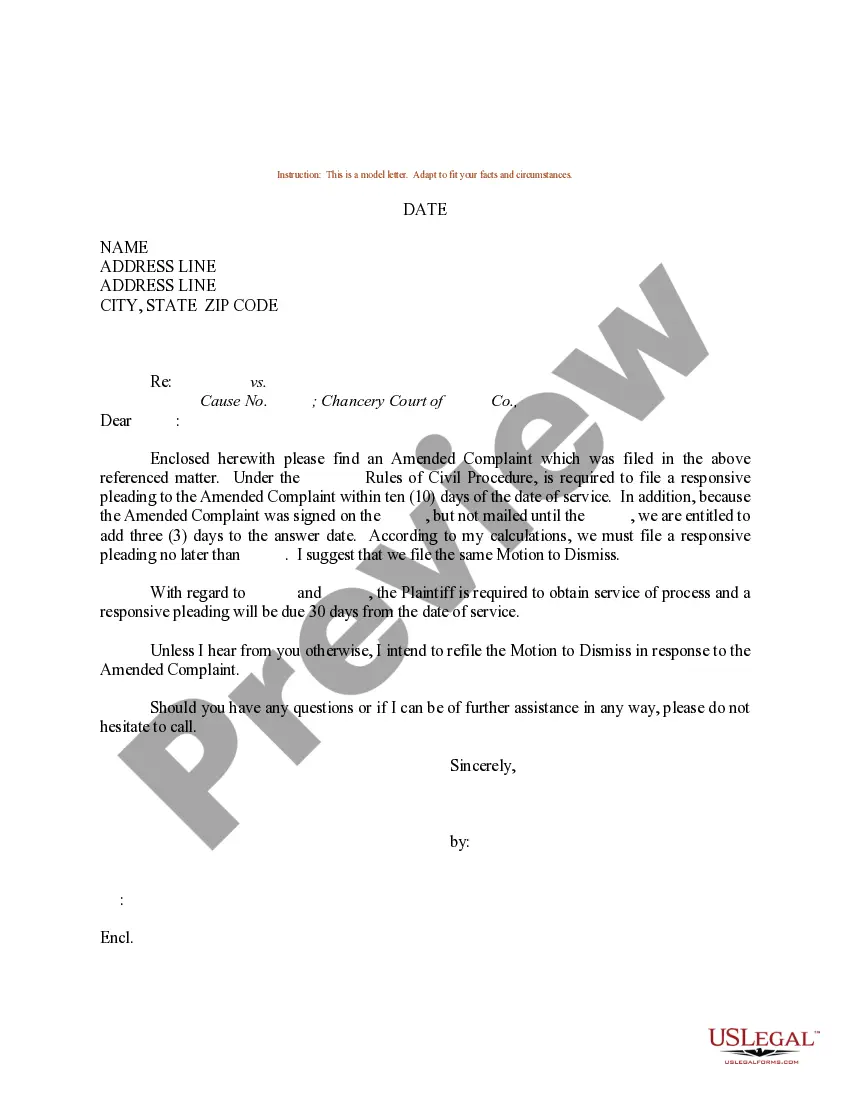

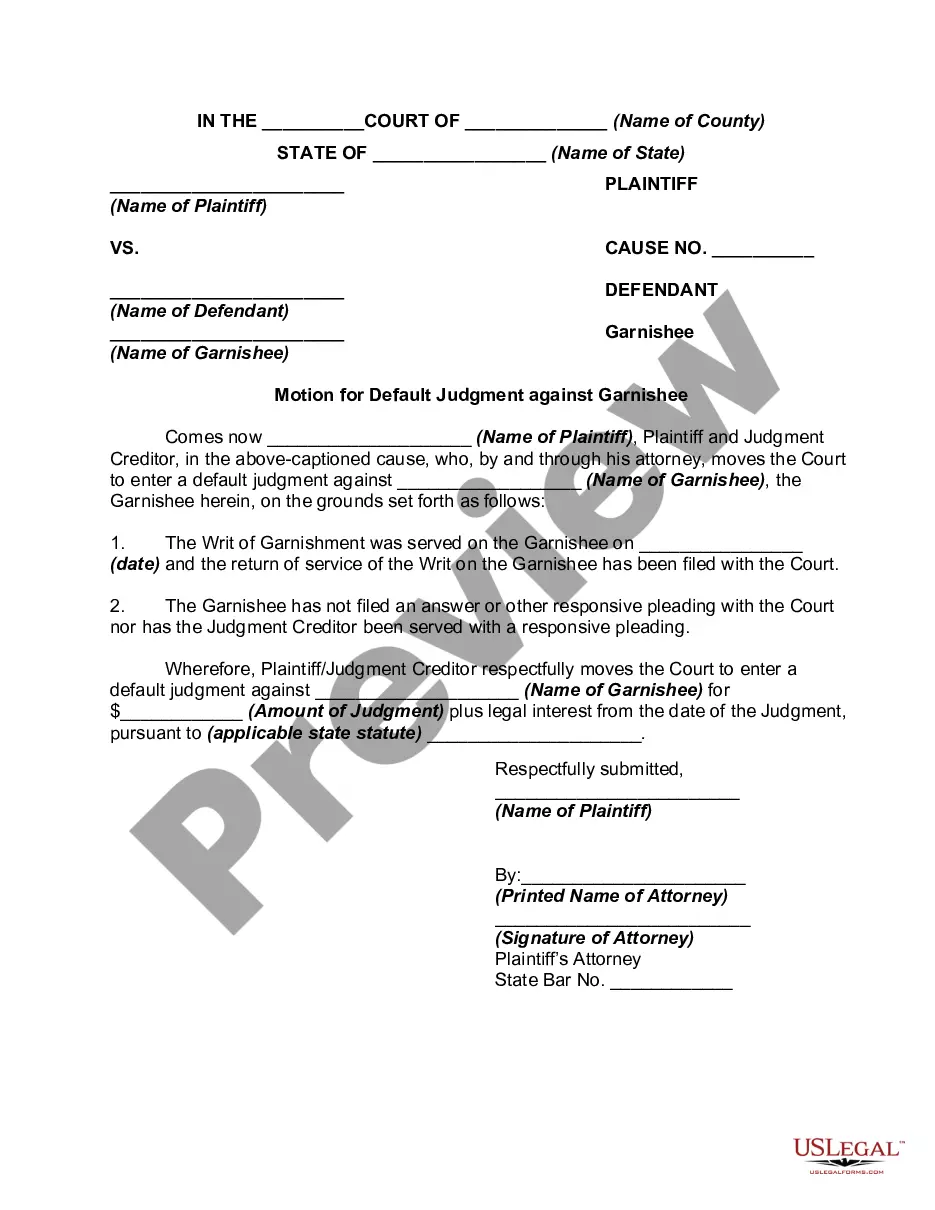

- Utilize the Preview mode (if provided) and review the template.

- Examine the description (if applicable) to confirm the template meets your requirements.

- Search for an alternative document using the search tab if the sample does not meet your criteria.

- Click Buy Now once you find the desired template.

- Select the appropriate subscription plan, then Log In or create a new account.

Form popularity

FAQ

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

How to hire a 1099 employee Correctly classify the individual.Check credentials and employment history.Create a contract.Have them fill out the proper forms.Integrate into company.

What tax forms are needed for an independent contractor to be hired? IRS Tax Form W-9. A W-9 form is used by a company to request a contractor's taxpayer identification number (TIN).IRS Tax Form 1099-NEC.IRS Tax Form 1096.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Pursuant to California labor law, the basic test for determining whether a worker is an independent contractor versus an employee is whether the employer has the right to direct and control the manner and means by which the work is performed.

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.