Queens New York Self-Employed Independent Contractor Consideration For Hire Form: Explained If you are a self-employed individual residing in Queens, New York, seeking to collaborate with businesses or clients, it is crucial to have a comprehensive understanding of the Self-Employed Independent Contractor Consideration For Hire Form. This legal document serves as a contract between two parties, outlining the terms and conditions of the working relationship. The Queens New York Self-Employed Independent Contractor Consideration For Hire Form establishes the rights and responsibilities of both the contractor and the hiring entity. It ensures that both parties are aware of their obligations, protecting the interests of all involved. Whether you are a freelance writer, graphic designer, consultant, or any other self-employed professional, this form is essential for a smooth working arrangement. Different Types of Queens New York Self-Employed Independent Contractor Consideration For Hire Forms 1. General Queens New York Self-Employed Independent Contractor Consideration For Hire Form: This is the standard form used by self-employed individuals in Queens, New York, when entering into a contractual agreement with a hiring entity. It includes sections such as scope of work, payment terms, project duration, confidentiality, termination clauses, and dispute resolution procedures. 2. Queens New York Self-Employed Independent Contractor Consideration For Hire Form for Creative Professionals: Tailored specifically for artists, writers, photographers, and other creative professionals, this form includes additional clauses related to intellectual property rights, usage rights of created works, and licensing terms. 3. Queens New York Self-Employed Independent Contractor Consideration For Hire Form for Construction Contractors: Created specifically for those in the construction industry, this form includes sections that address safety protocols, insurance requirements, project specifications, permits, and compliance with local regulations. 4. Queens New York Self-Employed Independent Contractor Consideration For Hire Form for Professional Services: Geared towards self-employed individuals offering professional services such as accounting, legal assistance, marketing consultation, or IT support, this form emphasizes confidentiality, non-compete agreements, and liability clauses. Regardless of the specific type of Self-Employed Independent Contractor Consideration For Hire Form used in Queens, New York, it is essential to consult an attorney to ensure the document complies with local laws and adequately protects both parties involved. The form should be carefully reviewed and signed by all parties before commencing work to establish clear expectations, avoid misunderstandings, and maintain a professional working relationship.

Queens New York Self-Employed Independent Contractor Consideration For Hire Form

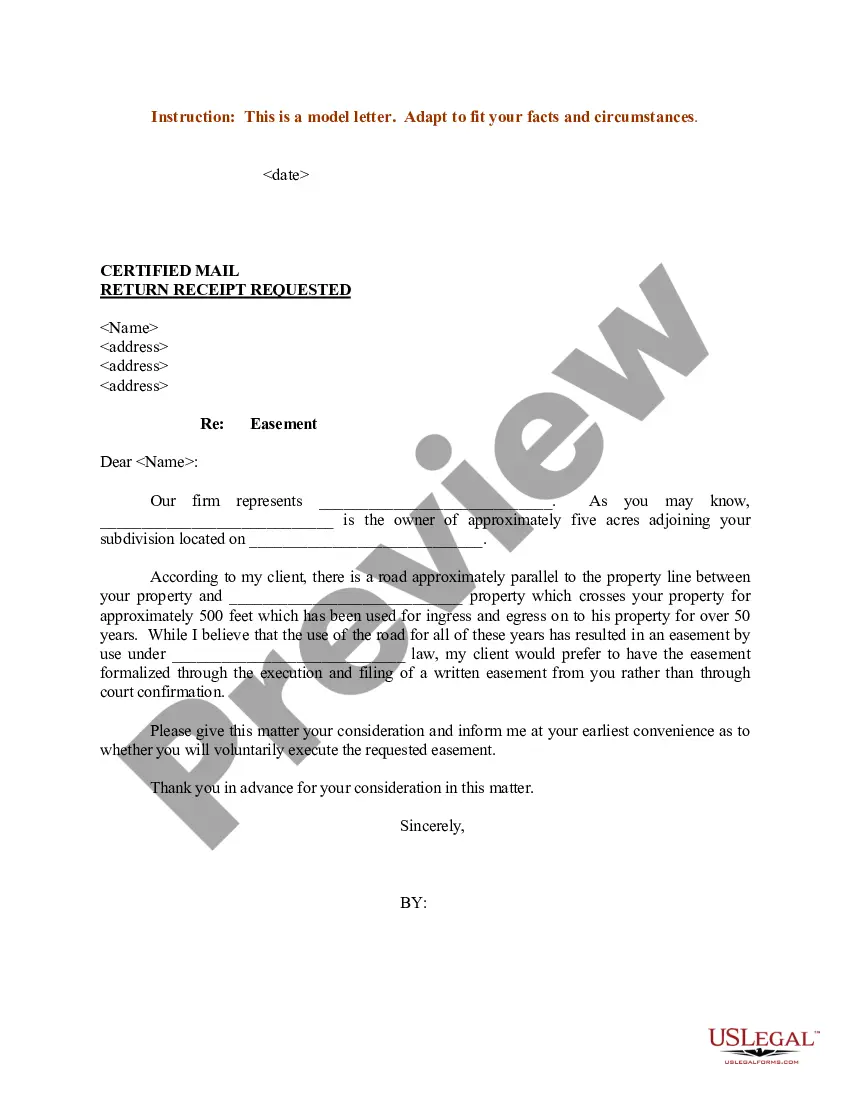

Description

How to fill out Queens New York Self-Employed Independent Contractor Consideration For Hire Form?

Are you looking to quickly create a legally-binding Queens Self-Employed Independent Contractor Consideration For Hire Form or maybe any other form to handle your personal or corporate affairs? You can go with two options: contact a legal advisor to write a legal paper for you or create it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you receive neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant form templates, including Queens Self-Employed Independent Contractor Consideration For Hire Form and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, double-check if the Queens Self-Employed Independent Contractor Consideration For Hire Form is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Queens Self-Employed Independent Contractor Consideration For Hire Form template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the templates we offer are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!