San Diego California Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out San Diego California Self-Employed Independent Contractor Consideration For Hire Form?

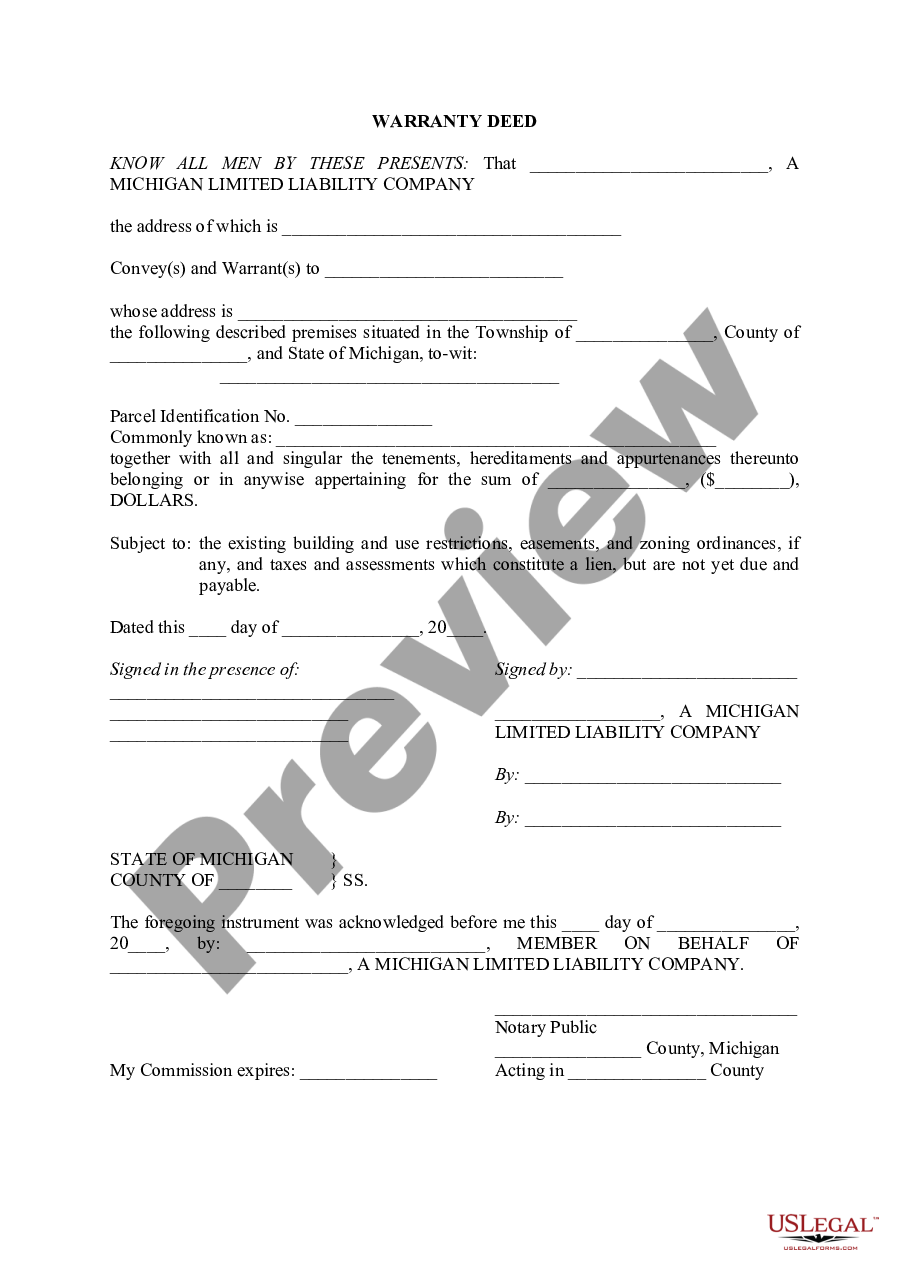

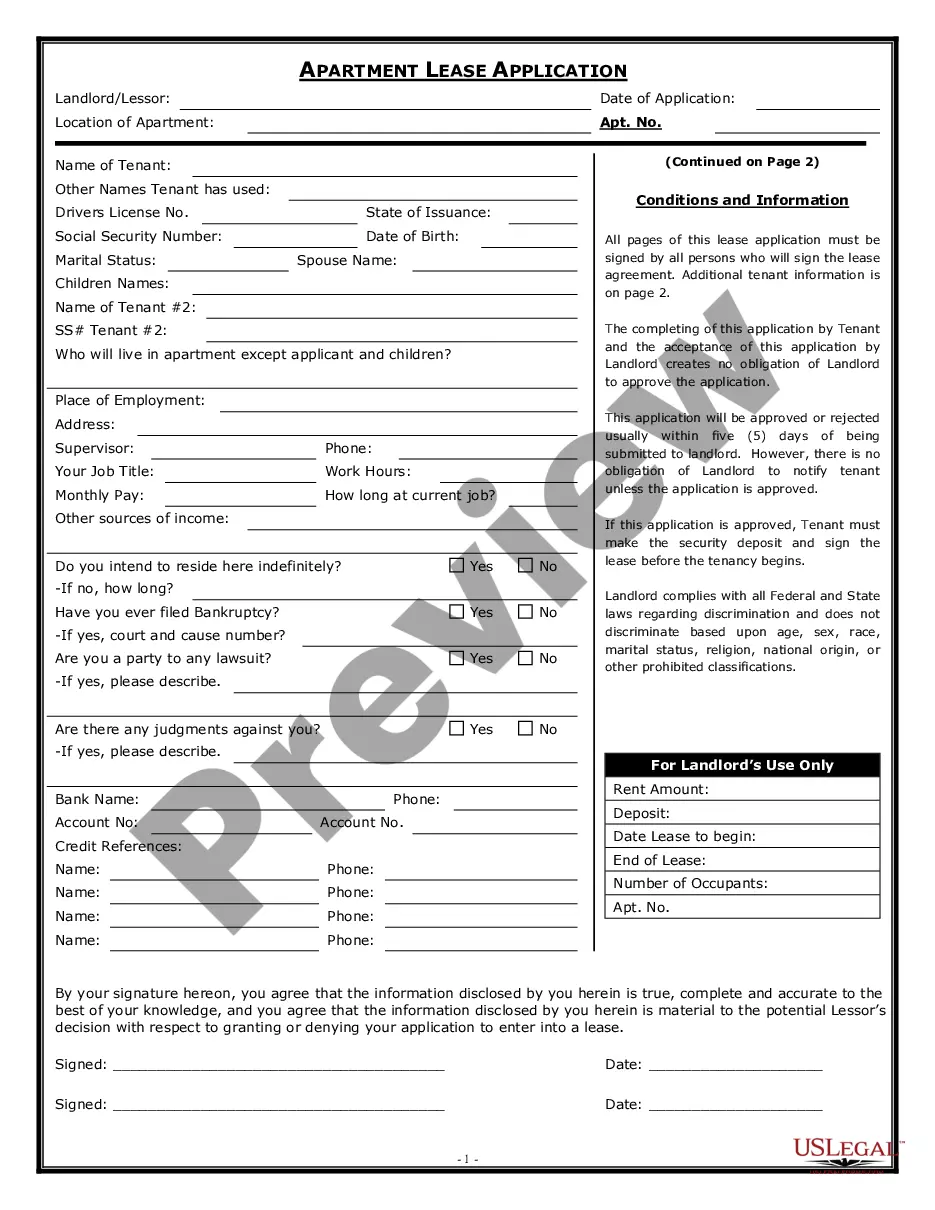

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the San Diego Self-Employed Independent Contractor Consideration For Hire Form, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Consequently, if you need the latest version of the San Diego Self-Employed Independent Contractor Consideration For Hire Form, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Self-Employed Independent Contractor Consideration For Hire Form:

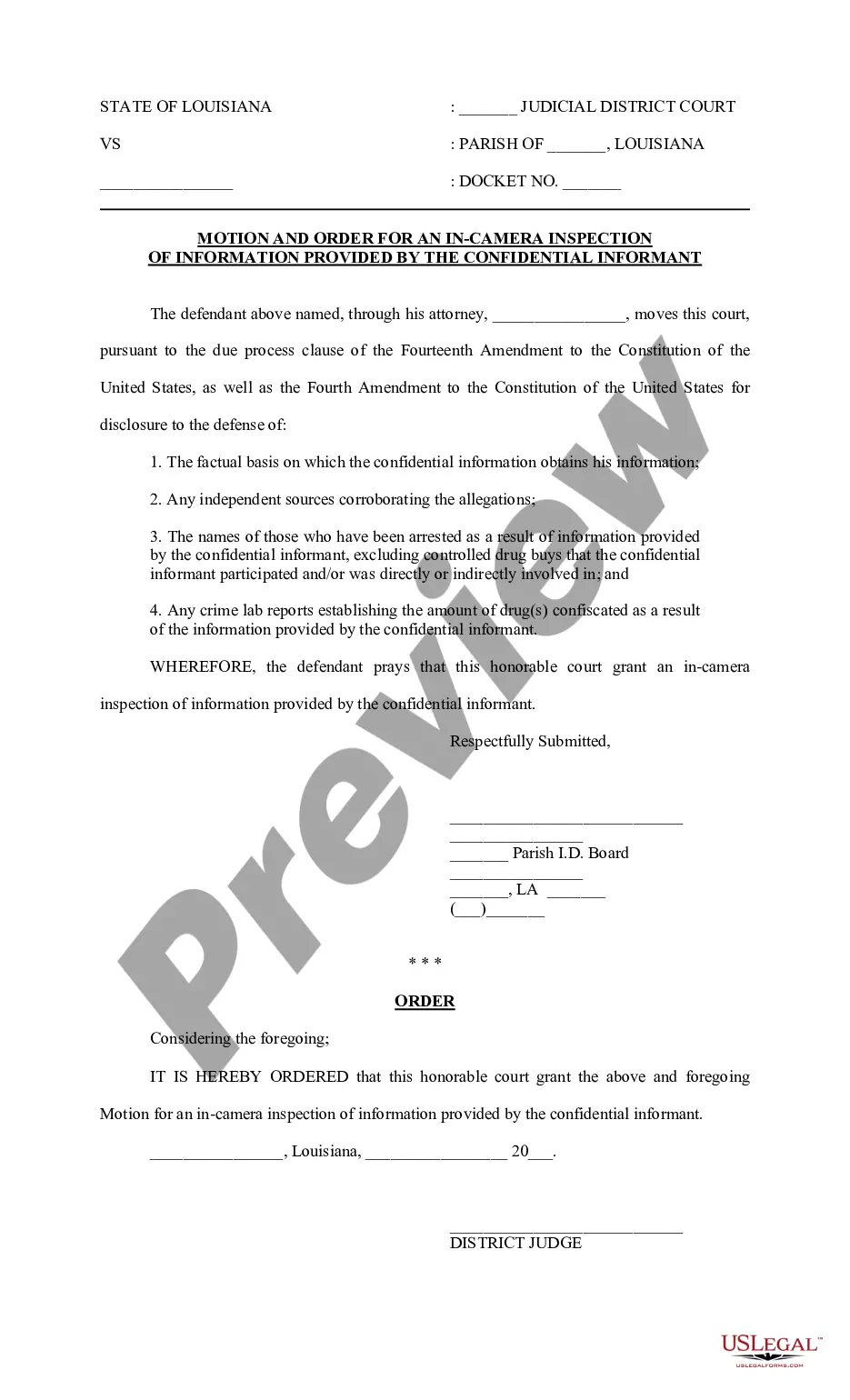

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your San Diego Self-Employed Independent Contractor Consideration For Hire Form and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

You cannot designate a worker, including yourself, as an employee or independent contractor solely by the issuance of Form W-2 or Form 1099-MISC. It does not matter whether the person works full time or part time. You use Form 1099-MISC, Miscellaneous IncomePDF to report payments to others who are not your employees.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

AB 5 requires the application of the ABC test to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code, and the Industrial Welfare Commission (IWC) wage orders.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

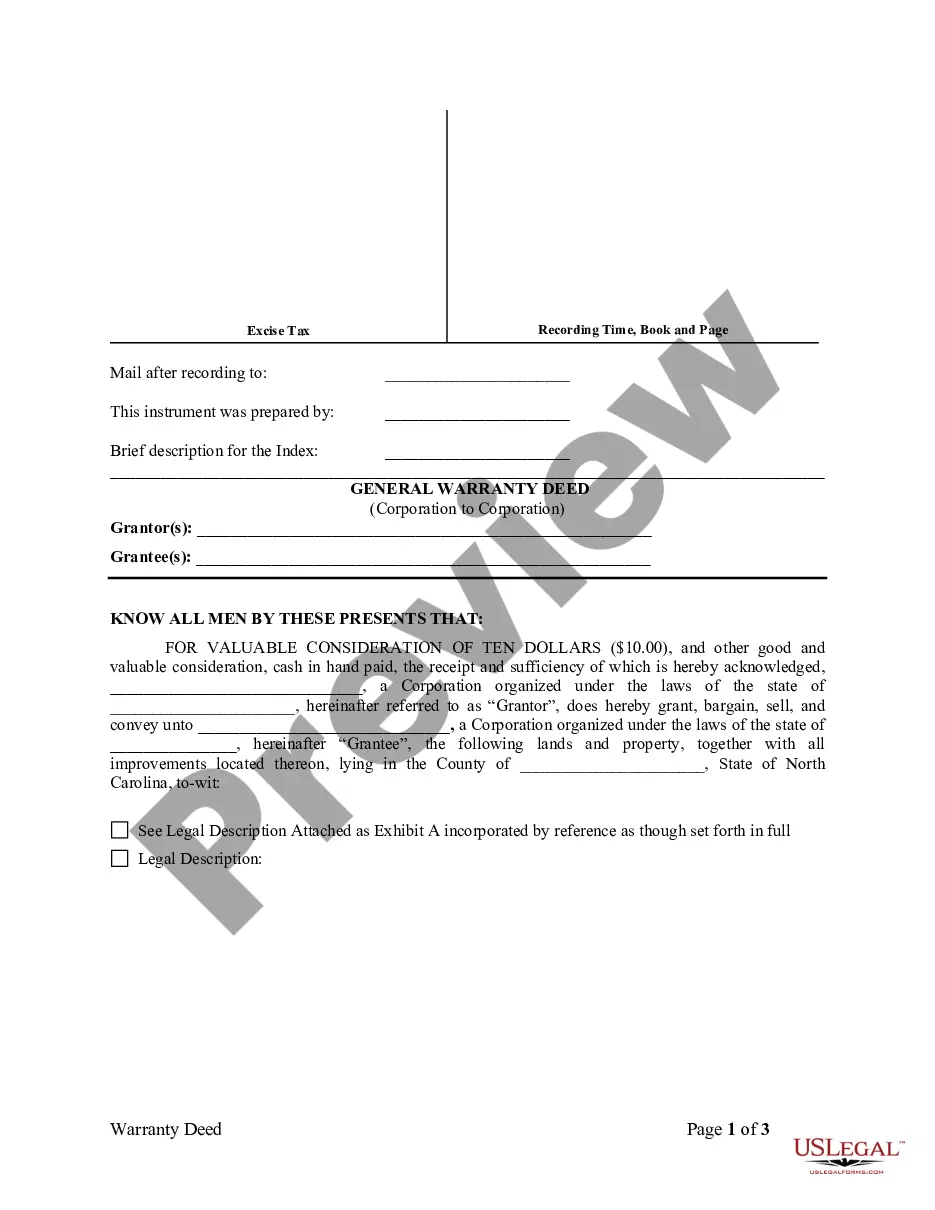

How to Hire a Contractor in California Review Nature of Proposed Project for Consultant.Collect W-9 From Independent Contractor.Execute Independent Contracting Agreement.Optional Items you May Want/Need to do for Your Independent Contractor.Report use of Independent Contractor With California.

An individual is an independent contractor in California only if they meet all three (3) requirements of the test: The worker remains free from managerial direction and control related to the worker's performance. The worker performs duties outside the scope of the company's course of business.

In essence, the state of California is requiring companies that operate in the state to make their 1099 employees hourly staff. According to FUNDERA, 1099 employees are self-employed independent contractors.