Orange California Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Orange California Design Agreement - Self-Employed Independent Contractor?

Preparing papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Orange Design Agreement - Self-Employed Independent Contractor without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Orange Design Agreement - Self-Employed Independent Contractor by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Orange Design Agreement - Self-Employed Independent Contractor:

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Independent contractors are not covered by California's overtime and other wage and hour laws. However, employers cannot get around California wage and hour laws by simply declaring that an employee is an independent contractor, or by making the employee sign an agreement stating that s/he is an independent contractor.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

An individual is an independent contractor in California only if they meet all three (3) requirements of the test: The worker remains free from managerial direction and control related to the worker's performance. The worker performs duties outside the scope of the company's course of business.

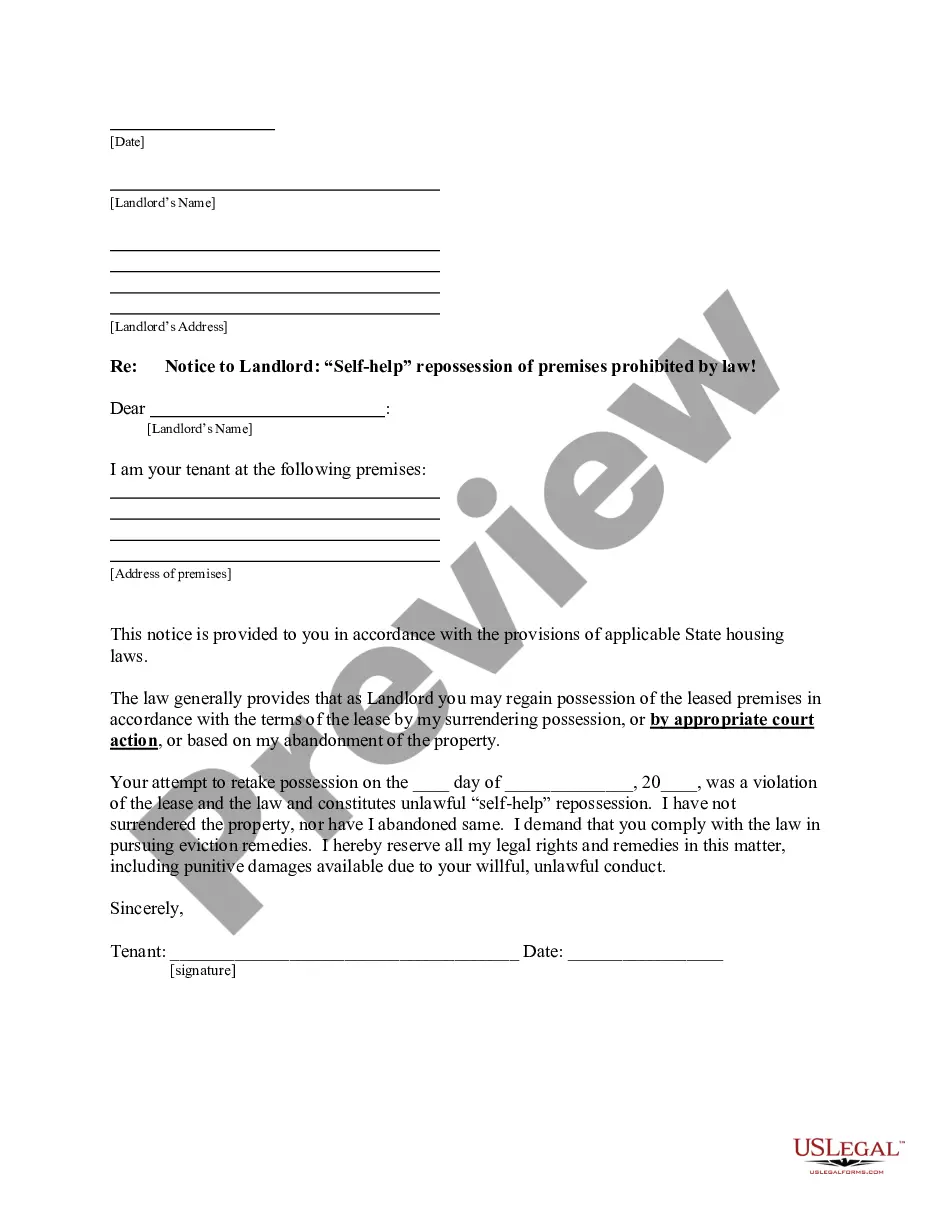

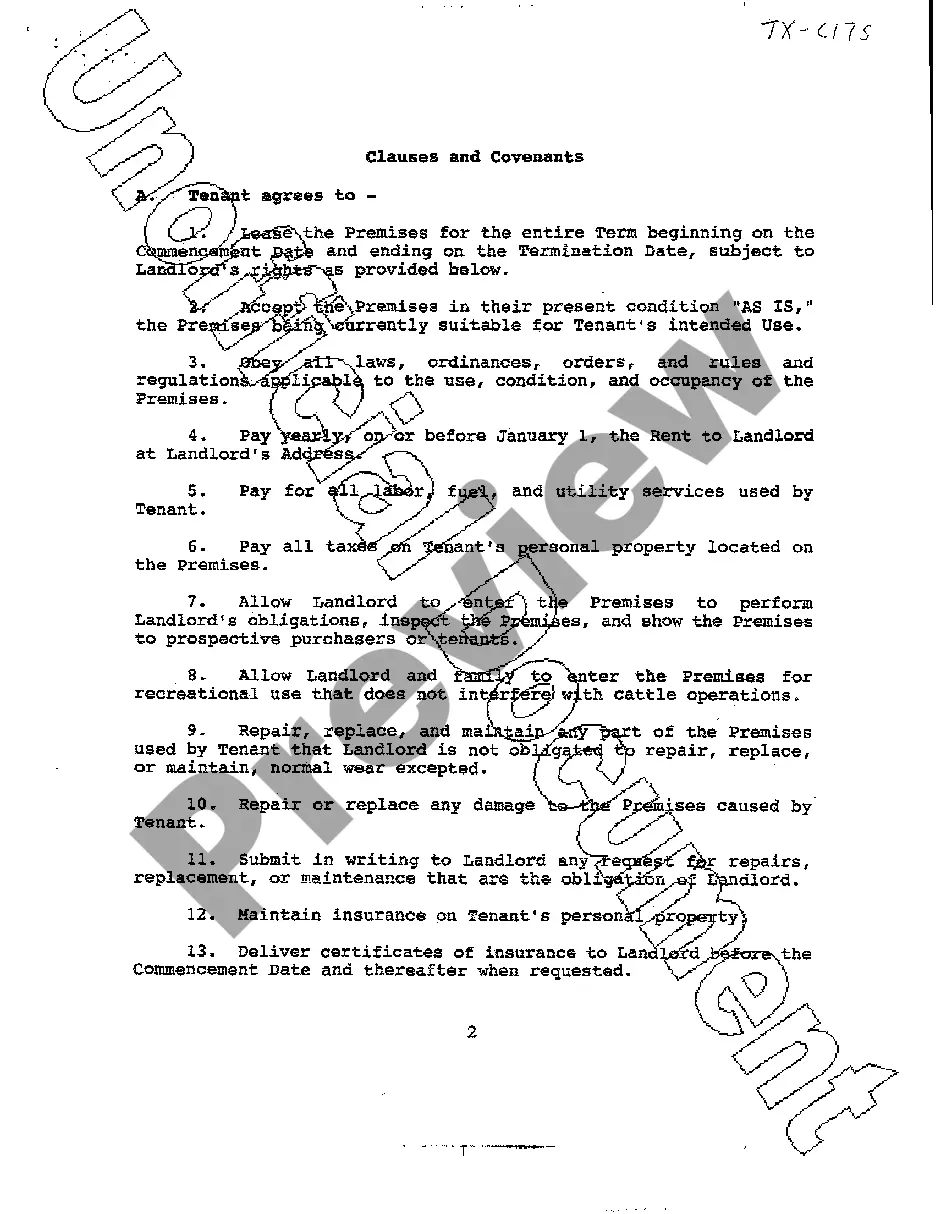

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

A contract should contain everything agreed upon by you and your licensed contractor. It should detail the work, price, when payments will be made, who gets the necessary building permits, and when the job will be finished. The contract also must identify the contractor, and give his/her address and license number.

Independent contractors are not entitled to overtime pay and may often work long hours without extra compensation. All employees in California are entitled to earn at least minimum wage. As of 2020, California's statewide minimum wage is $12.00 per hour for employers with 25 or fewer employees.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractors are thus specifically excluded from the application of the employment legislation in question. However, there is no statutory definition of the term 'independent contractor'.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

By Lisa Guerin, J.D. For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding.