Wayne Michigan Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Wayne Michigan Design Agreement - Self-Employed Independent Contractor?

Preparing paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Wayne Design Agreement - Self-Employed Independent Contractor without professional assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Wayne Design Agreement - Self-Employed Independent Contractor by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Wayne Design Agreement - Self-Employed Independent Contractor:

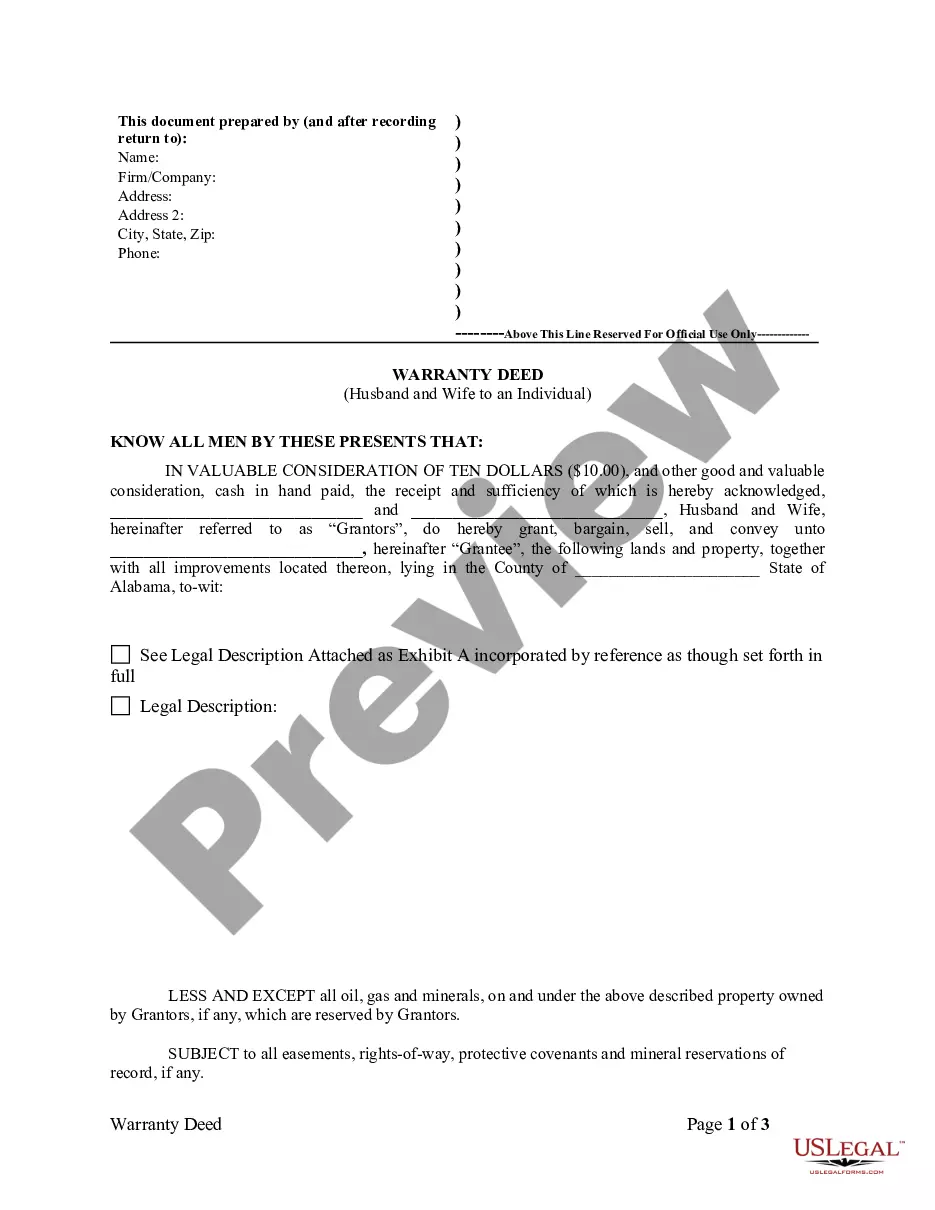

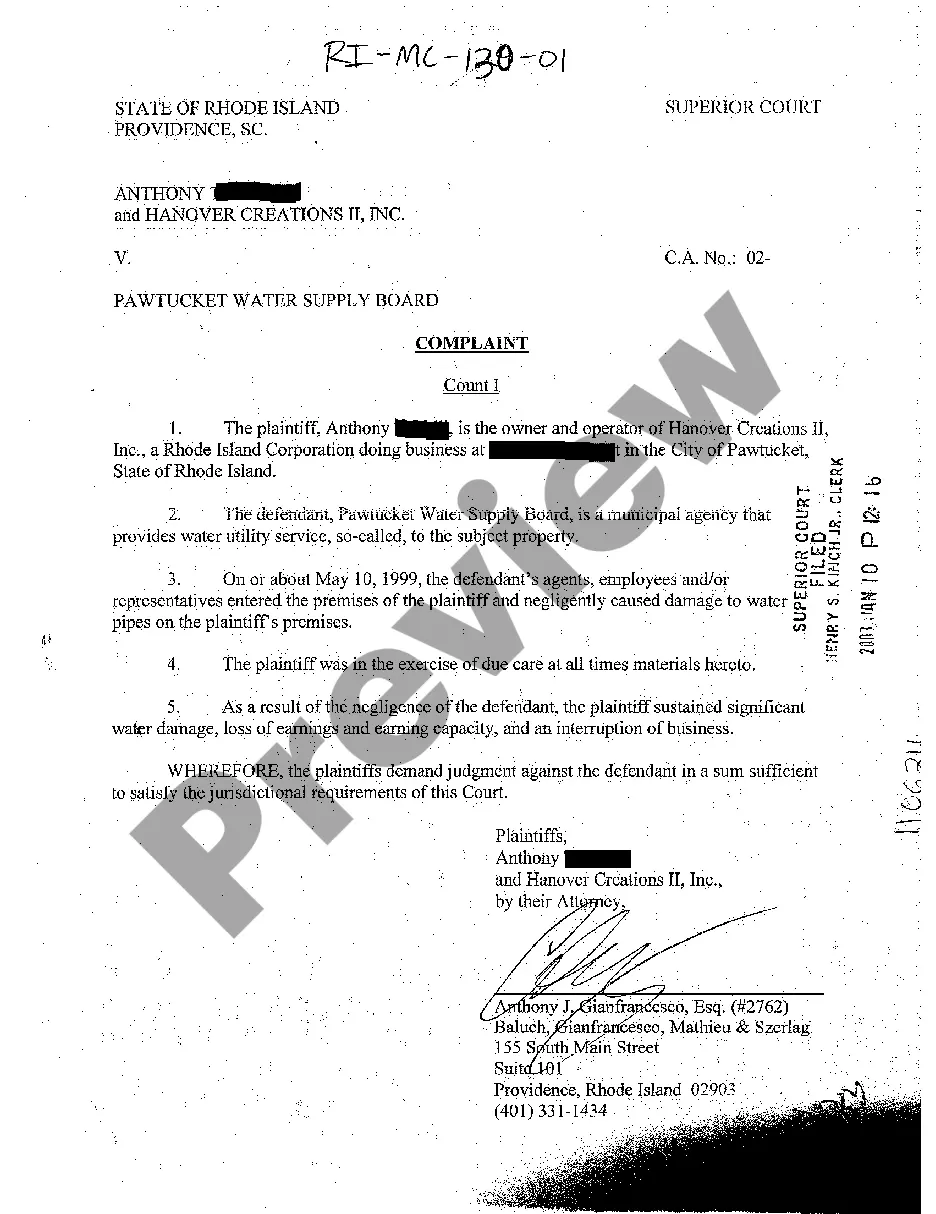

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Many designers work as independent contractors. This guide provides an overview of the legal and tax basics that independent contractor designers need to know.

Graphic Designer (Freelance) Must be set up as an independent contractor (1099 employee).

A contract graphic designer works on design projects on a freelance basis. As an independent contractor, your duties include communicating with clients to define their needs for each project. You create the visual elements for websites, advertisements, marketing materials, or any visual asset required by the client.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

4 answers. Artists/event hosts are called and hired as independent contractors, but by legal definition they are not. An independent contractor makes their own schedule and sets the pay for the job.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Fashion models are generally regarded in the United States as independent contractors.