A Nassau New York Employment Services Agreement — Self-Employed Independent Contractor is a detailed legal contract that outlines the terms and conditions between an individual (the independent contractor) and a hiring entity (the employer) in Nassau County, New York. This agreement establishes a working relationship where an individual provides specific services to the employer as an independent contractor, rather than as an employee. Keywords: Nassau New York, Employment Services Agreement, Self-Employed Independent Contractor. There can be different types of Nassau New York Employment Services Agreements — Self-Employed Independent Contractor, depending on the nature of the services provided. Some common types include: 1. Professional Services Agreement: This type of agreement is suitable for professionals such as doctors, lawyers, consultants, or any other specialized service providers who work independently and are hired on a project basis. 2. Freelance Services Agreement: This agreement is often used for creative professionals, such as graphic designers, writers, photographers, or web developers, who offer their services on a freelance or contract basis. 3. Trade Services Agreement: This type of agreement applies to skilled trade workers, such as plumbers, electricians, carpenters, or construction workers, who operate as self-employed independent contractors and provide their services to clients or businesses. 4. Business Consulting Agreement: This agreement is designed for independent consultants who provide strategic advice, management consulting, or other professional services to businesses. The Nassau New York Employment Services Agreement — Self-Employed Independent Contractor typically includes the following key elements: 1. Identification of Parties: The agreement should clearly state the names and addresses of both the independent contractor and the hiring entity. 2. Service Description: A detailed description of the services to be performed by the independent contractor should be provided. This section should outline the scope, deliverables, and timeframe of the work. 3. Compensation: The agreement should specify the payment terms, including the agreed-upon fee structure, timing of payments, and any additional expenses or reimbursements. 4. Independent Contractor Status: It is important to explicitly state that the independent contractor is not an employee of the hiring entity, but rather an independent business entity responsible for their own taxes, insurance, and liability. 5. Confidentiality and Non-Disclosure: This section outlines the obligations of both parties to keep any confidential information or trade secrets confidential during and after the term of the agreement. 6. Intellectual Property: In cases where the independent contractor creates intellectual property during the course of their work, this section will specify who retains ownership rights. 7. Termination: The agreement should outline the conditions under which either party can terminate the contract, including notice requirements and any applicable penalties. 8. Governing Law and Jurisdiction: This section establishes which laws govern the agreement and in which jurisdiction any legal disputes will be resolved. It is critical for both parties to thoroughly review and understand the terms and conditions stated in the Nassau New York Employment Services Agreement — Self-Employed Independent Contractor before signing. Consulting with legal professionals familiar with local laws and regulations can ensure the agreement aligns with the specific needs and interests of both the independent contractor and the hiring entity.

Nassau New York Employment Services Agreement - Self-Employed Independent Contractor

Description

How to fill out Nassau New York Employment Services Agreement - Self-Employed Independent Contractor?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Nassau Employment Services Agreement - Self-Employed Independent Contractor without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Nassau Employment Services Agreement - Self-Employed Independent Contractor on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Nassau Employment Services Agreement - Self-Employed Independent Contractor:

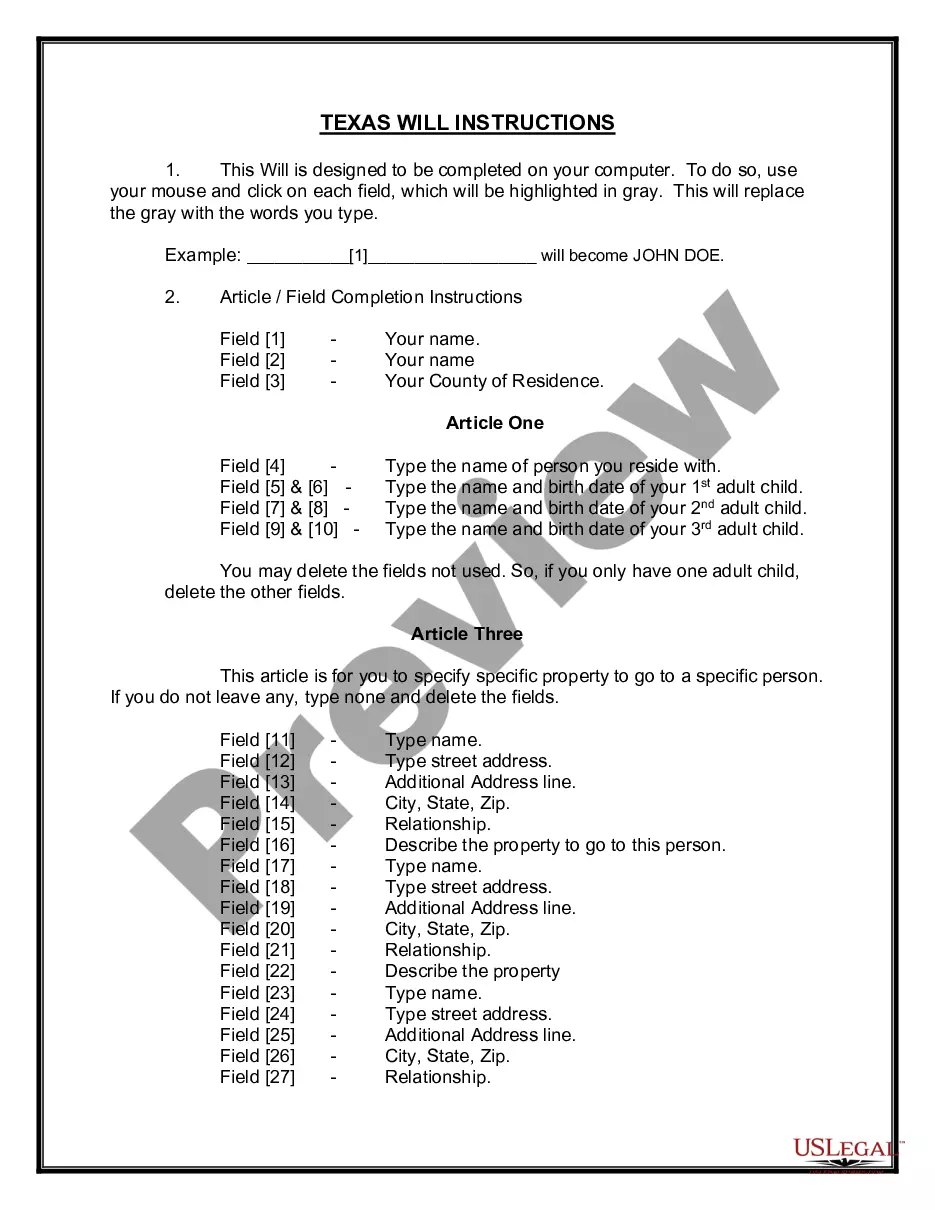

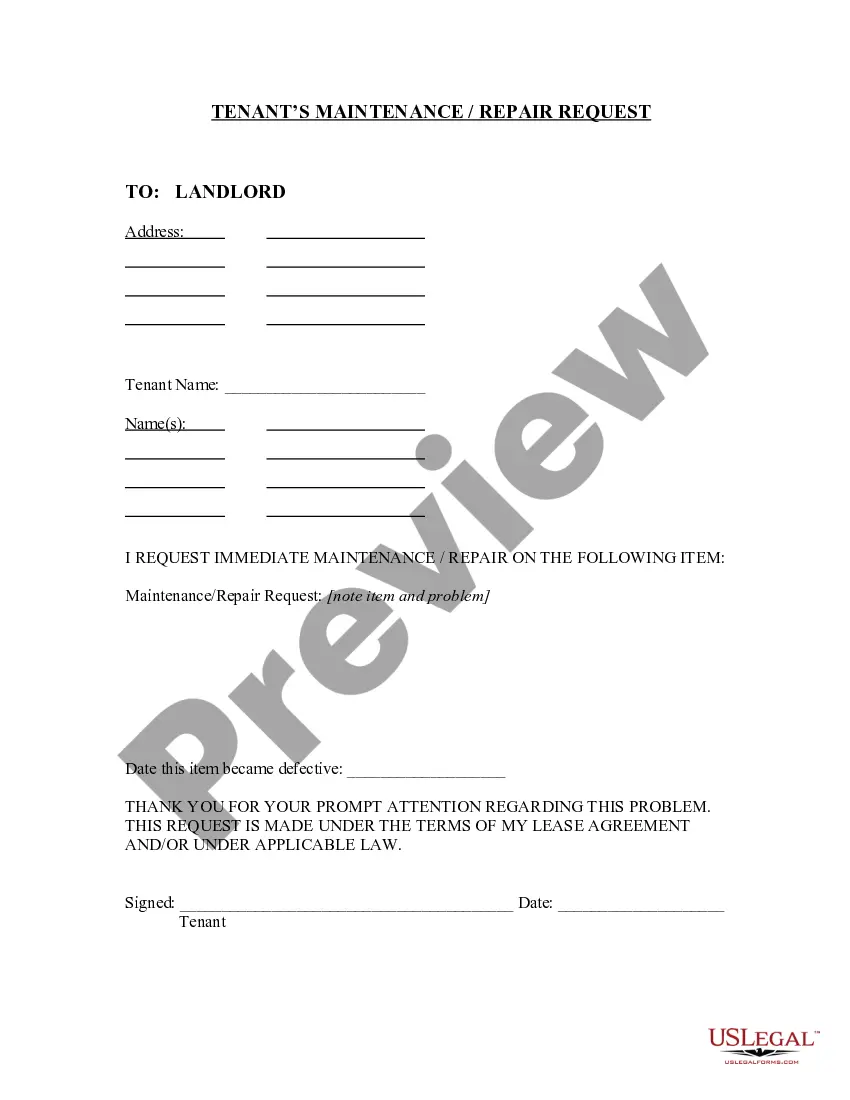

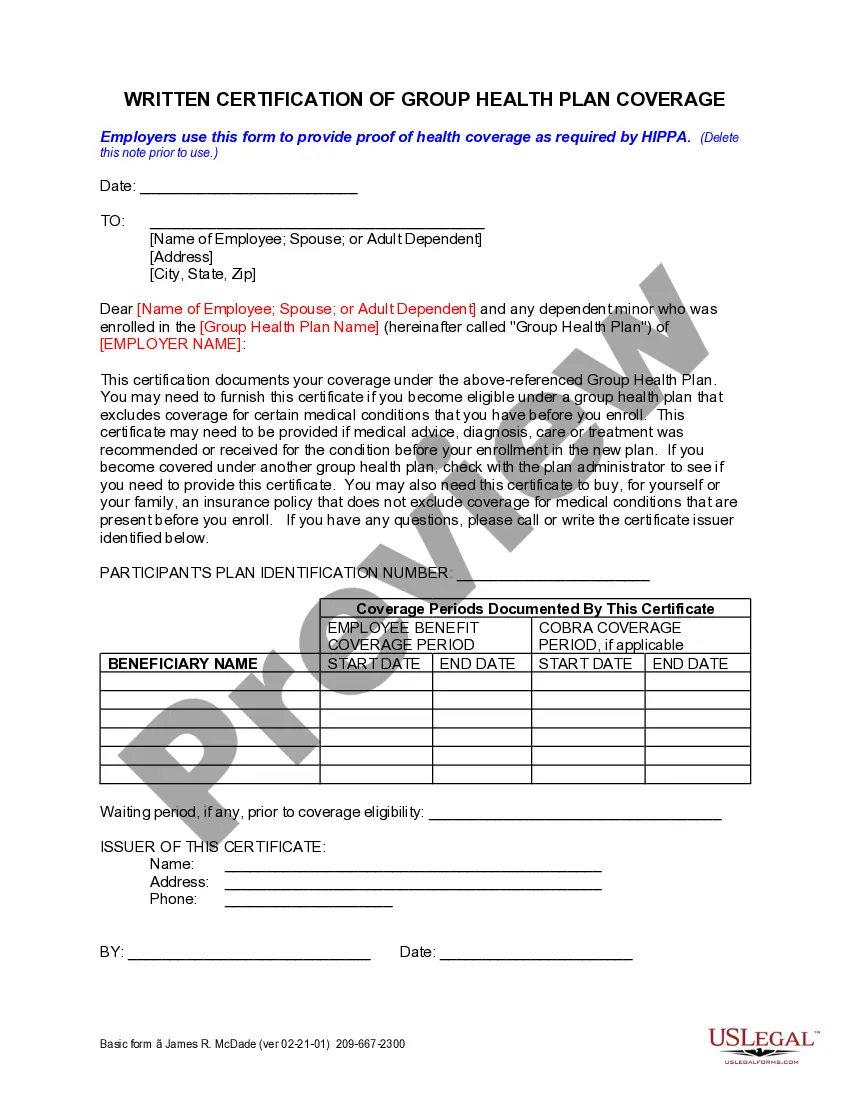

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!