The Alameda California Self-Employed Independent Contractor Payment Schedule refers to the specific guidelines and timelines that self-employed individuals and independent contractors in Alameda, California follow when receiving payment for their services. These schedules ensure that both parties involved are aware of when and how payments will be made, promoting transparency and accountability within the business relationship. As an independent contractor or self-employed individual in Alameda, it is essential to understand the payment schedule to plan your finances effectively. Different types of Alameda California Self-Employed Independent Contractor Payment Schedules may include: 1. Regular Payments: This type of payment schedule follows a consistent pattern, where payments are made on fixed dates, such as weekly, bi-weekly, or monthly. Contractors and clients mutually agree upon the payment frequency to streamline the financial flow and facilitate budgeting for both parties. For example, an independent contractor providing consulting services may receive payment every 15 days. 2. Milestone Payments: In some instances, contractors and clients may agree to a milestone-based payment schedule. This model involves breaking down the project into specific milestones or deliverables, with payments being made once each milestone is successfully completed. For instance, a freelance web developer might receive payments after completing design, coding, and testing stages. 3. Retainer Payments: A retainer payment schedule entails a prepared, fixed monthly or periodic payment made to the contractor in advance. In return, the contractor commits to being available for a set number of hours or to perform specific tasks during the designated period. This arrangement fosters a long-term working relationship and guarantees a minimum income for the contractor. 4. Percentage-Based Payments: In certain industries, payments are decided based on a predetermined percentage of the contract value or the total revenue generated. For instance, self-employed real estate agents in Alameda may receive a commission based on a percentage of the sale price. It's crucial to note that these are examples of possible Alameda California Self-Employed Independent Contractor Payment Schedules, and the actual payment terms may vary depending on the agreement between the contractor and the client. To ensure clarity and avoid disputes, it is recommended that contractors and clients establish a written contract clearly stating the payment schedule, rates, deliverables, and any additional terms related to compensation.

Alameda California Self-Employed Independent Contractor Payment Schedule

Description

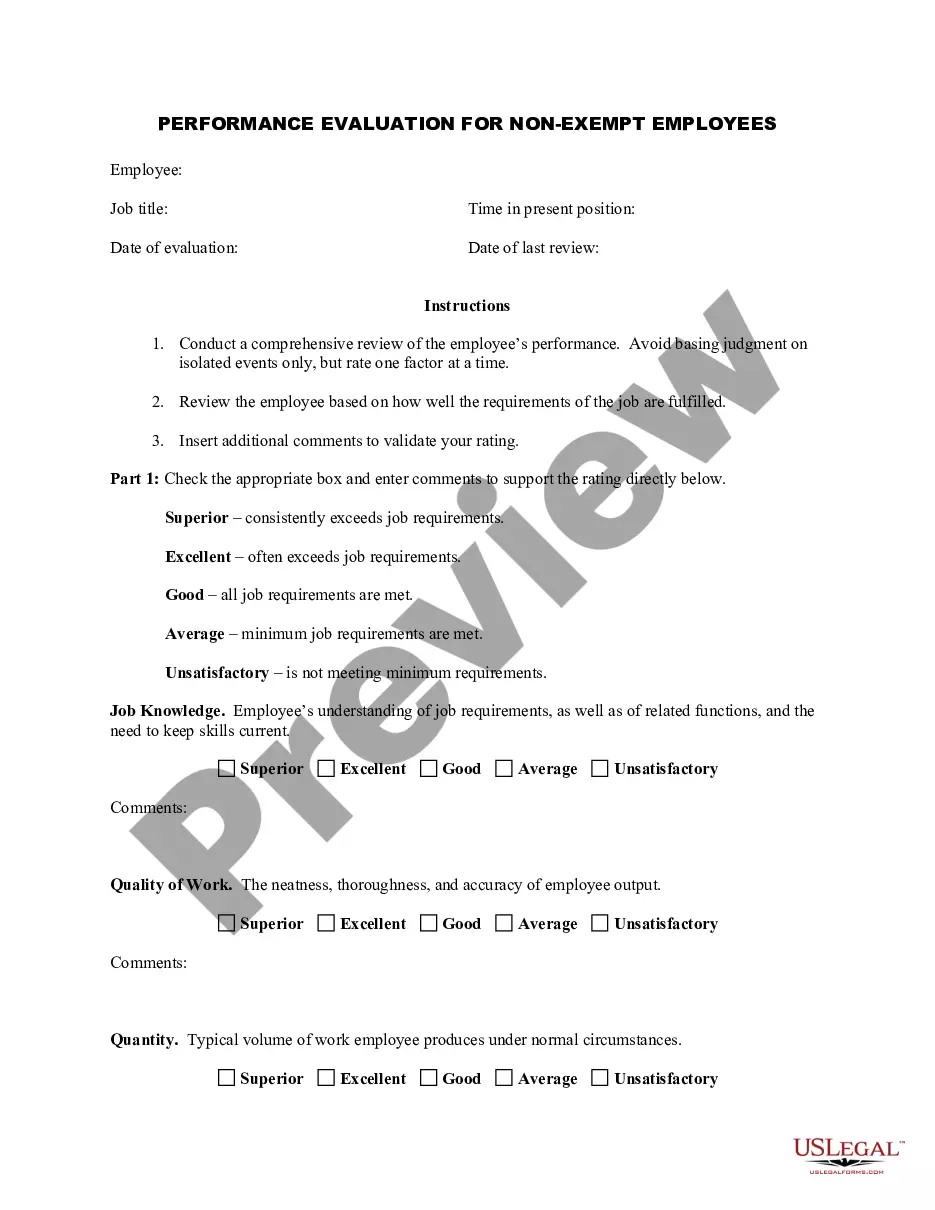

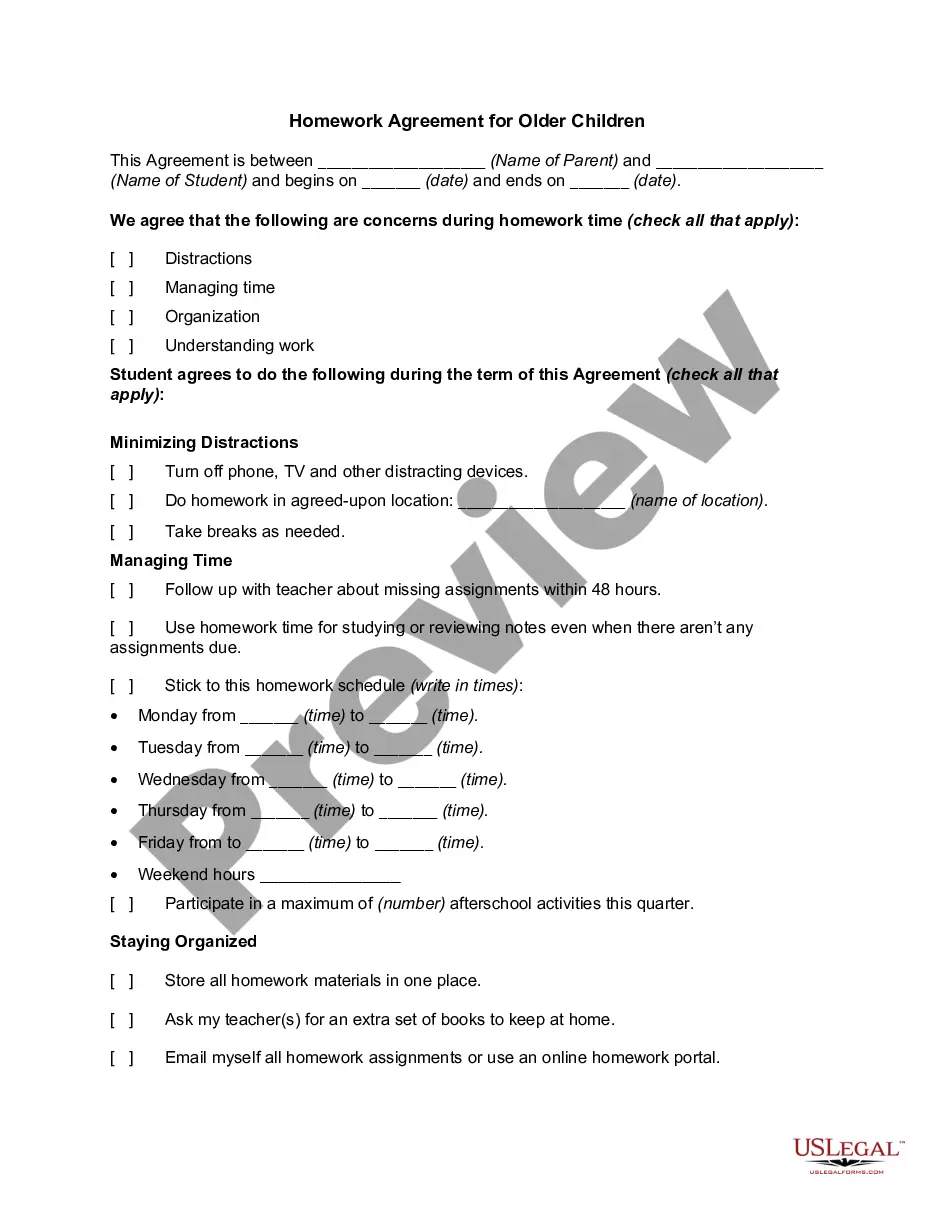

How to fill out Alameda California Self-Employed Independent Contractor Payment Schedule?

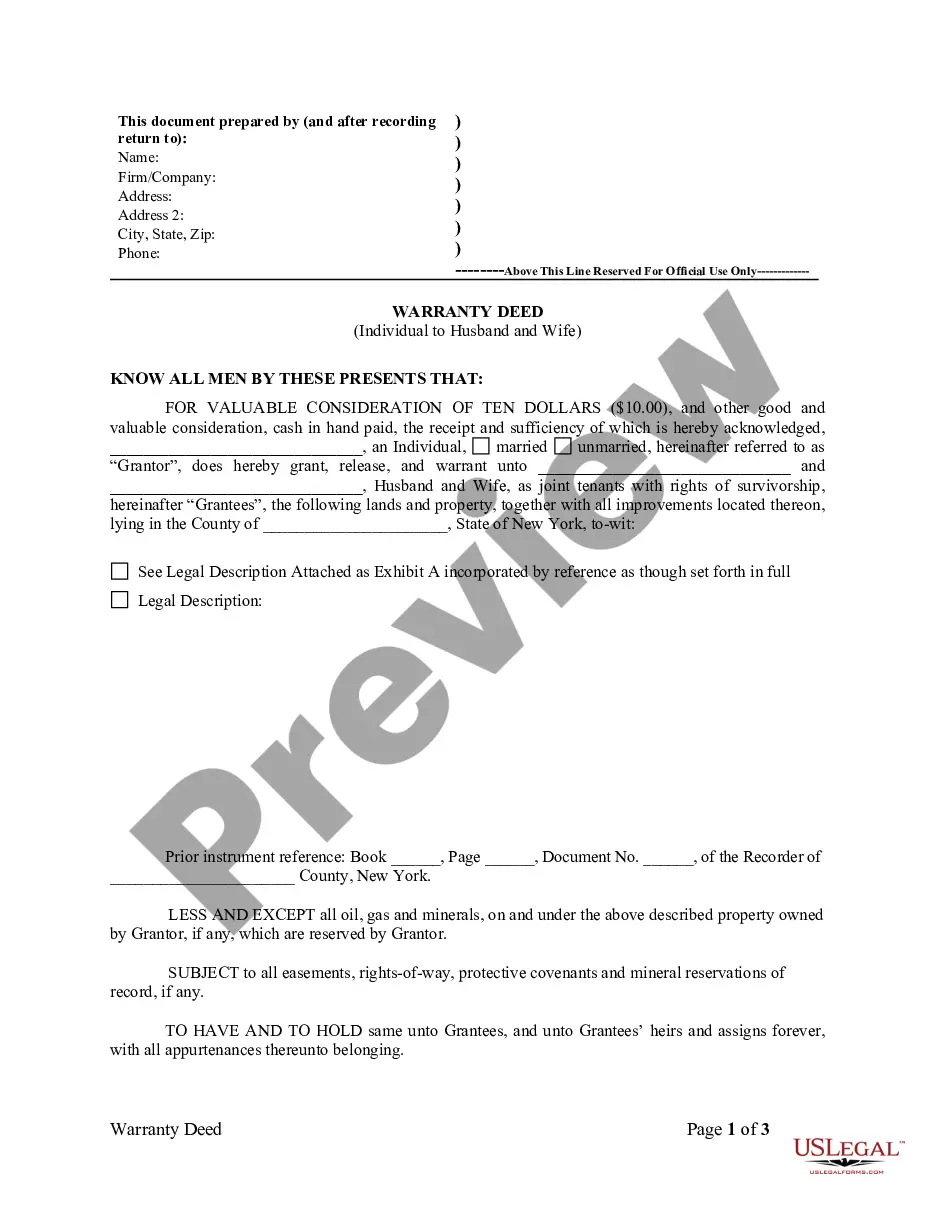

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life situation, locating a Alameda Self-Employed Independent Contractor Payment Schedule suiting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. In addition to the Alameda Self-Employed Independent Contractor Payment Schedule, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Alameda Self-Employed Independent Contractor Payment Schedule:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Alameda Self-Employed Independent Contractor Payment Schedule.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

If you are self-employed, you have to pay income tax. You operate as an individual for tax purposes. You may also be required to pay estimated taxes quarterly . This requires the individual to report all business income or losses on their individual income tax return (Form 540 ).

You'll need to file a tax return with the IRS if your net earnings from self-employment are $400 or more. Along with your Form 1040, you'll file a Schedule C to calculate your net income or loss for your business. You can file a Schedule C-EZ form if you have less than $5,000 in business expenses.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Here are five of them. Keep your business and personal accounts separate. Let your business checking account pay your personal account; transfer income over when needed.Don't cheat yourself when you're pitching jobs.Create dual budgets.Never have a low balance in your business savings account.Let an expert step in.

The government requires that you include on your return any personal income you make from your business, along with business tax deductions. Most independent contractors are sole proprietors or single-member LLCs who report their federal income taxes on Schedule C as part of Form 1040.

What taxes do independent contractors have to pay? Independent contractors generally must pay income tax and self-employment tax, which is a combination of Medicare and Social Security taxes. Specific tax obligations will depend on whether the business resulted in a net profit or a net loss.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

As an independent contractor, you're required to file Schedule C along with your personal tax return. Schedule C details your profit and loss from business. Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business.