Franklin Ohio Self-Employed Independent Contractor Payment Schedule: An In-Depth Overview As a self-employed independent contractor in Franklin, Ohio, it is crucial to understand the payment schedule that governs your earnings. This detailed description will provide insight into the various types of payment schedules available and highlight the key considerations for contractors in this region. Payment Schedule Types for Franklin Ohio Self-Employed Independent Contractors: 1. Weekly Payment Schedule: Some businesses in Franklin, Ohio, offer independent contractors the option of receiving weekly payment. This payment schedule ensures contractors receive timely compensation for their services within a seven-day interval. It provides a consistent cash flow, especially for contractors with ongoing projects or regular gigs. 2. Bi-Weekly Payment Schedule: Another commonly used payment schedule for self-employed independent contractors in Franklin, Ohio, is bi-weekly payment. Contractors under this schedule receive their earnings every two weeks, typically on predetermined dates such as the 15th and 30th of each month. This schedule provides contractors with a structured payment system, allowing better financial planning. 3. Monthly Payment Schedule: Certain industries or clients may opt for a monthly payment schedule, wherein contractors receive their earnings once a month. This payment structure is typically used for higher-value projects or long-term contracts. Contractors receiving monthly payments are advised to budget effectively since they may experience fluctuations in income throughout the month. Key Considerations for Franklin Ohio Self-Employed Independent Contractor Payment Schedule: 1. Contractual Agreement: Before commencing any work, it is crucial for self-employed independent contractors in Franklin, Ohio, to establish a contractual agreement with their clients. This agreement should outline the payment schedule, including the frequency and method of payment, to avoid any confusion or disputes. 2. Invoice Preparation: Contractors should ensure they have a professional invoice template and a streamlined invoicing system in place to submit their payment requests. This process aids in prompt payment processing and helps track the payment schedule. 3. Account for Tax Obligations: As an independent contractor, it is essential to allocate a portion of the income for taxes. Contractors in Franklin, Ohio, should consult with an accountant or tax professional to grasp their tax obligations and incorporate these into their financial planning. 4. Cash Flow Management: Understanding the payment schedule allows contractors to manage their cash flow effectively. It is crucial for contractors to plan their personal finances, savings, and expenses accordingly, especially if there are gaps between payment intervals. 5. Open Communication: Maintaining open and regular communication with clients is key to ensuring a smooth payment schedule. Contractors should clarify any uncertainties regarding payments, address potential delays promptly, and adhere to any agreed-upon payment terms to foster positive client relationships. In conclusion, Franklin Ohio Self-Employed Independent Contractor Payment Schedule encompasses various payment schedule types tailored to the needs of different contractors. By establishing a clear payment schedule, adhering to contractual agreements, and effectively managing cash flow, self-employed independent contractors in Franklin, Ohio, can navigate the financial aspect of their business successfully.

Franklin Ohio Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Franklin Ohio Self-Employed Independent Contractor Payment Schedule?

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Franklin Self-Employed Independent Contractor Payment Schedule, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Franklin Self-Employed Independent Contractor Payment Schedule, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Franklin Self-Employed Independent Contractor Payment Schedule:

- Glance through the page and verify there is a sample for your area.

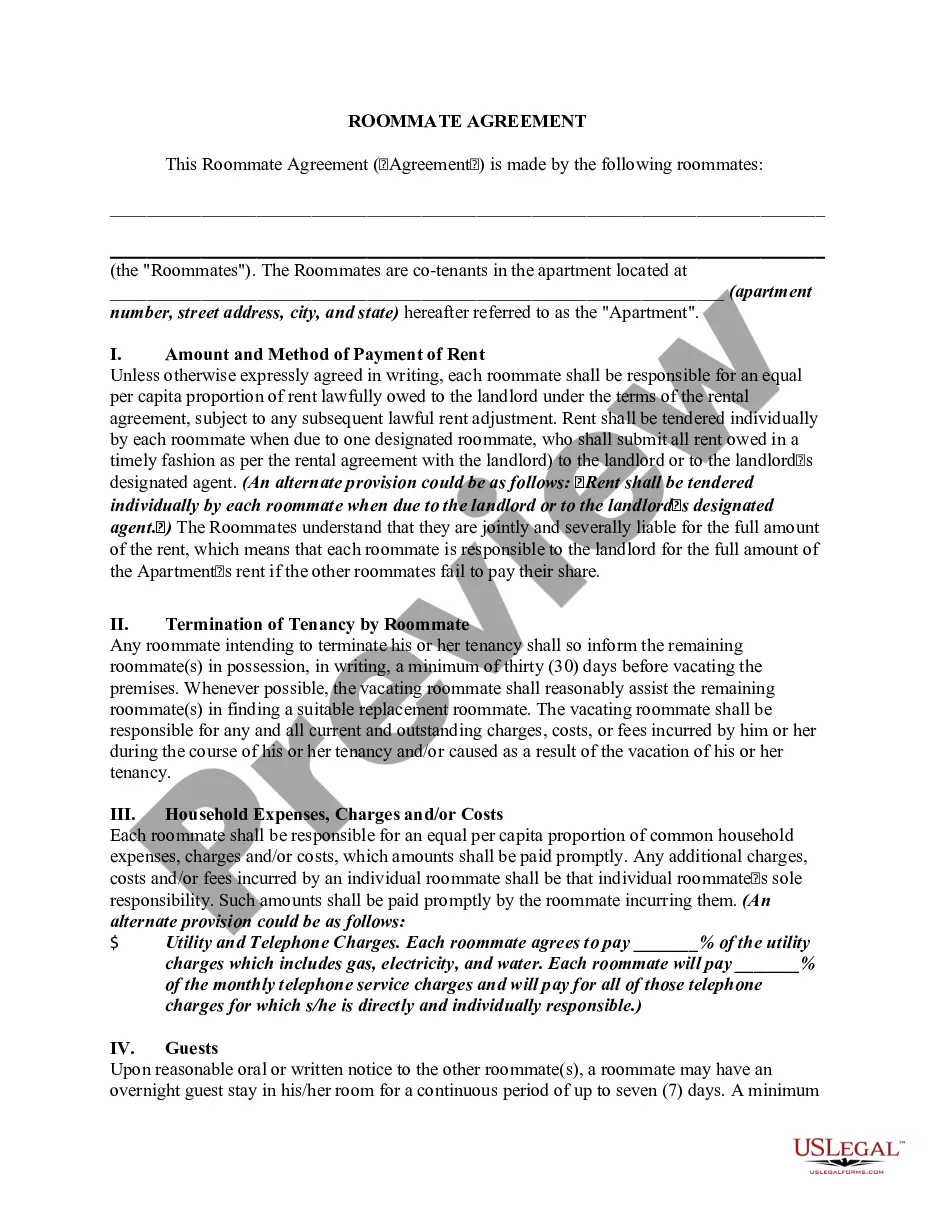

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Franklin Self-Employed Independent Contractor Payment Schedule and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!