Phoenix Arizona Self-Employed Independent Contractor Payment Schedule refers to the predetermined schedule or timeline that outlines when and how self-employed independent contractors in Phoenix, Arizona receive payment for their services. As independent contractors, these individuals work for themselves and are responsible for managing their own business operations, including invoicing clients and tracking their payments. There are various types of payment schedules that self-employed independent contractors in Phoenix, Arizona may adopt based on their contractual agreements and specific business needs. Here are some common types: 1. Fixed Payment Schedule: This type of schedule establishes predetermined payment dates and amounts, allowing contractors to receive regular, consistent payments. For example, a contractor might receive a fixed payment every two weeks or at the end of each month. 2. Milestone-Based Payment Schedule: In certain industries, contractors might have payment schedules tied to specific project milestones. These milestones could be significant stages in the project's completion, such as completing certain tasks, delivering specific outputs, or achieving specific goals. Contractors receive payment upon successfully reaching these milestones. 3. Percentage-Based Payment Schedule: Some contractors may base their payment schedules on a percentage of the project's overall cost or value. For instance, they might receive a percentage of the total contract price upfront, with subsequent payments tied to project progression or completion percentages. 4. Retainer Payment Schedule: In this type of arrangement, contractors receive an upfront payment or retainer fee from clients to secure their services. The retainer fee can be a fixed amount or a percentage of the total project cost. Contractors then bill against this retainer as they complete their work. Regardless of the payment schedule type, contractors often rely on clear and agreed-upon terms and payment terms to ensure timely and consistent payment. Having a documented contract that outlines payment details, including due dates and any potential penalties for late payment, can help promote fair business practices and protect both parties involved. In conclusion, the Phoenix Arizona Self-Employed Independent Contractor Payment Schedule refers to the agreed-upon timeline and method of payment for independent contractors in Phoenix, Arizona. Different types of payment schedules include fixed payment schedules, milestone-based schedules, percentage-based schedules, and retainer payment schedules. Having a well-defined payment schedule is crucial for contractors to manage their finances effectively and establish a mutually beneficial working relationship with their clients.

Phoenix Arizona Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Phoenix Arizona Self-Employed Independent Contractor Payment Schedule?

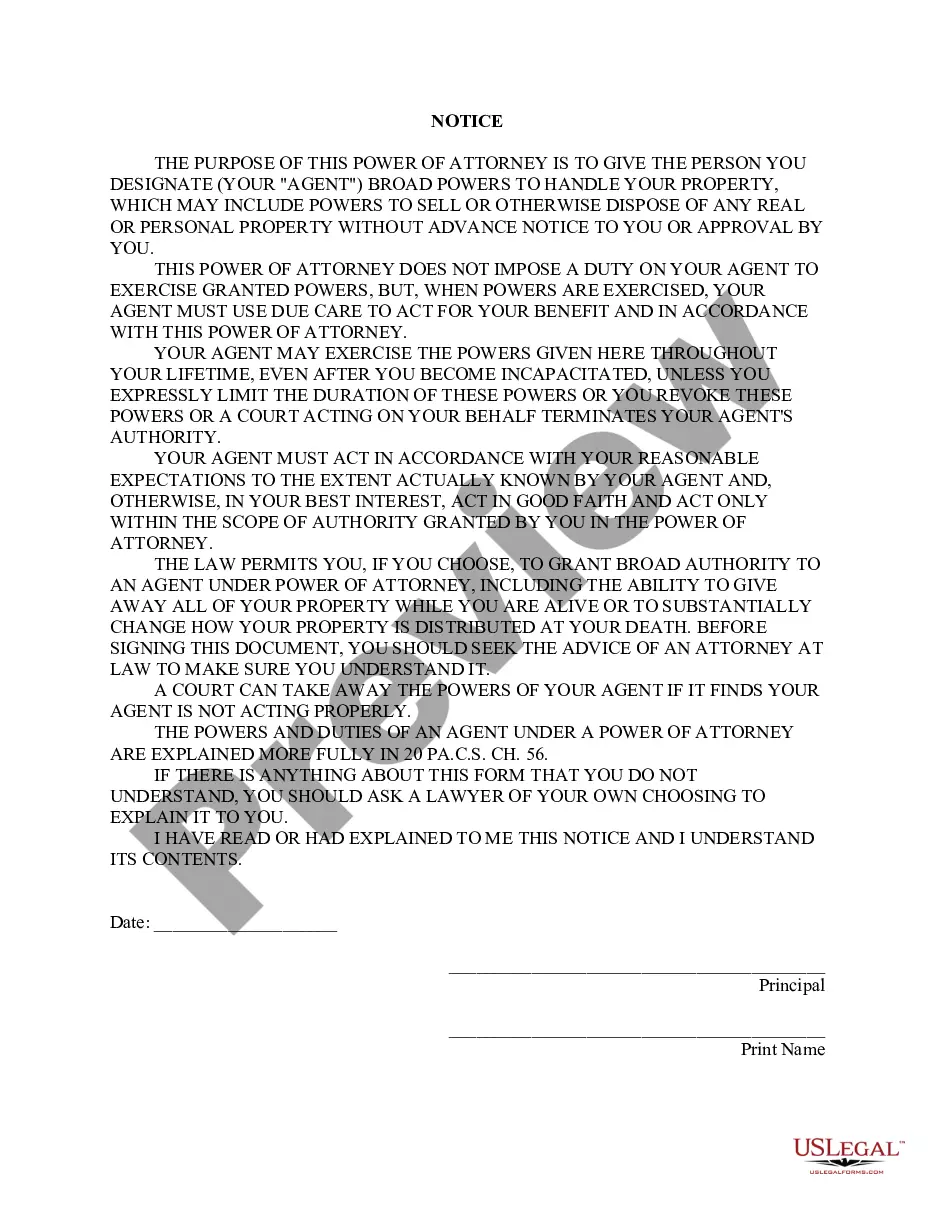

Do you need to quickly create a legally-binding Phoenix Self-Employed Independent Contractor Payment Schedule or maybe any other document to take control of your personal or business matters? You can select one of the two options: hire a legal advisor to draft a legal document for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific document templates, including Phoenix Self-Employed Independent Contractor Payment Schedule and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, double-check if the Phoenix Self-Employed Independent Contractor Payment Schedule is adapted to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Phoenix Self-Employed Independent Contractor Payment Schedule template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Whether self-employed or traditionally employed, you can claim a tax refund from the IRS.

What to include in your invoice for contract work. Your name (or company name) and contact details. Your client's name and contact details. Date of invoice. Invoice number. Itemized list and description of services. Date or duration of service. Pricing breakdowns, such as hourly or flat rates. Applicable taxes.

If you make cash payments to independent contractors, the first thing you should know is that there is nothing inherently illegal about doing so. Cash is still a perfectly good form of payment. If you have cash on hand and want to use it to pay your contractors, then you can absolutely do so.

The IRS typically requires independent contractors and sole proprietors to pay estimated taxes quarterly using Form 1040-ES, Estimated Tax for Individuals. This ?pay-as-you-go? approach helps them avoid a large tax bill at the end of the year.

1. You set your own schedule. One of the best parts of being an independent contractor is that you can choose your own work hours. Most employees get schedules telling them when and how long they have to work.

Step 1: Determine How to Pay Contractors. Paying independent contractors isn't difficult, but it is different from paying employees.Step 2: Collect W-9 Forms.Step 3: Set Up Contractors in Your Payroll System.Step 4: Process Payments to Independent Contractors.Step 5: Send 1099-NEC Forms.

Nevertheless, independent contractors are usually responsible for paying the Self-Employment Tax and income tax. With that in mind, it's best practice to save about 25?30% of your self-employed income to pay for taxes. (If you're looking to automate this, check out Tax Vault!)

Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

You are required to file a federal Nonemployee Compensation (Form 1099-NEC) or a Miscellaneous Information (Form 1099-MISC) for the services performed by the independent contractor. You pay the independent contractor $600 or more or enter into a contract for $600 or more.

Paying through a credit card is usually the safest and the most effective way of paying your contractor. You can organize your credit card payments into convenient installments through direct deposit. It also provides more substantial proof that you've paid your contractor how much and when.