San Jose, California, is a vibrant city located in the heart of Silicon Valley. As one of the largest cities in the Bay Area, San Jose offers a plethora of opportunities for self-employed independent contractors. Whether you are a freelancer, consultant, gig worker, or any other type of self-employed professional, understanding the payment schedule specific to San Jose is crucial for managing your finances effectively. The San Jose California Self-Employed Independent Contractor Payment Schedule refers to the timeline and frequency at which self-employed individuals or independent contractors receive payments for their services rendered. As each person's arrangement may vary, it is essential to be aware of different payment schedules, which can be categorized into three main types: 1. Hourly Payment Schedule: Many self-employed contractors in San Jose are compensated on an hourly basis. Under this payment structure, contractors submit timesheets or maintain records of the hours worked, and payments are made based on the agreed-upon hourly rate. This payment method often requires contractors to invoice regularly—usually on a monthly or bi-monthly basis—to ensure timely payments. 2. Project-Based Payment Schedule: For individuals working on specific projects, such as web development, graphic design, or consulting, a project-based payment schedule is customary. Contractors agree on a fixed fee or an installment-based payment structure, where payments are released at different milestones or completion stages of the project. The frequency of payments can vary, with some project-based contracts offering weekly, bi-weekly, or monthly payments. 3. Recurring or Retainer Payment Schedule: Certain self-employed professionals in San Jose, particularly those providing ongoing services like virtual assistance, marketing, or accounting, operate on a recurring or retainer payment schedule. With this payment arrangement, contractors receive regular monthly or quarterly payments in exchange for their continuous availability and periodic deliverables, such as reports or consultations. It provides stability and consistent income for both parties involved. Regardless of the type of payment schedule, it is crucial for self-employed contractors in San Jose to maintain accurate records of invoices, hours worked, and any necessary documentation to ensure seamless payment processing. Adhering to deadlines and promptly addressing payment-related queries or concerns is vital for maintaining healthy working relationships with clients. In summary, San Jose California's Self-Employed Independent Contractor Payment Schedule encompasses various payment structures such as hourly, project-based, and recurring or retainer arrangements. Understanding the specific payment terms outlined in your contract and effectively managing your invoicing and financial records can contribute to a smooth and successful self-employment experience in the vibrant city of San Jose.

San Jose California Self-Employed Independent Contractor Payment Schedule

Description

How to fill out San Jose California Self-Employed Independent Contractor Payment Schedule?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the San Jose Self-Employed Independent Contractor Payment Schedule, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Jose Self-Employed Independent Contractor Payment Schedule from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Jose Self-Employed Independent Contractor Payment Schedule:

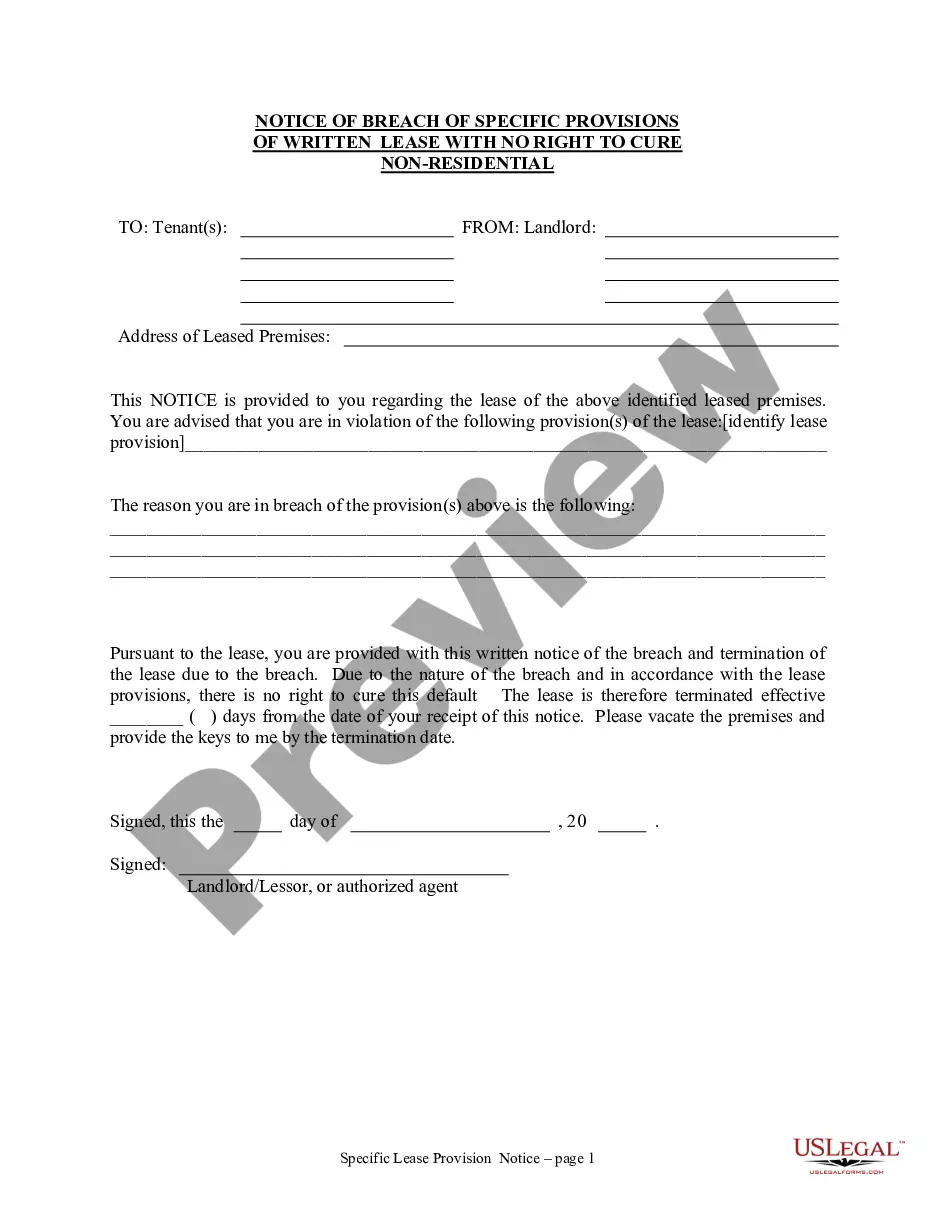

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!