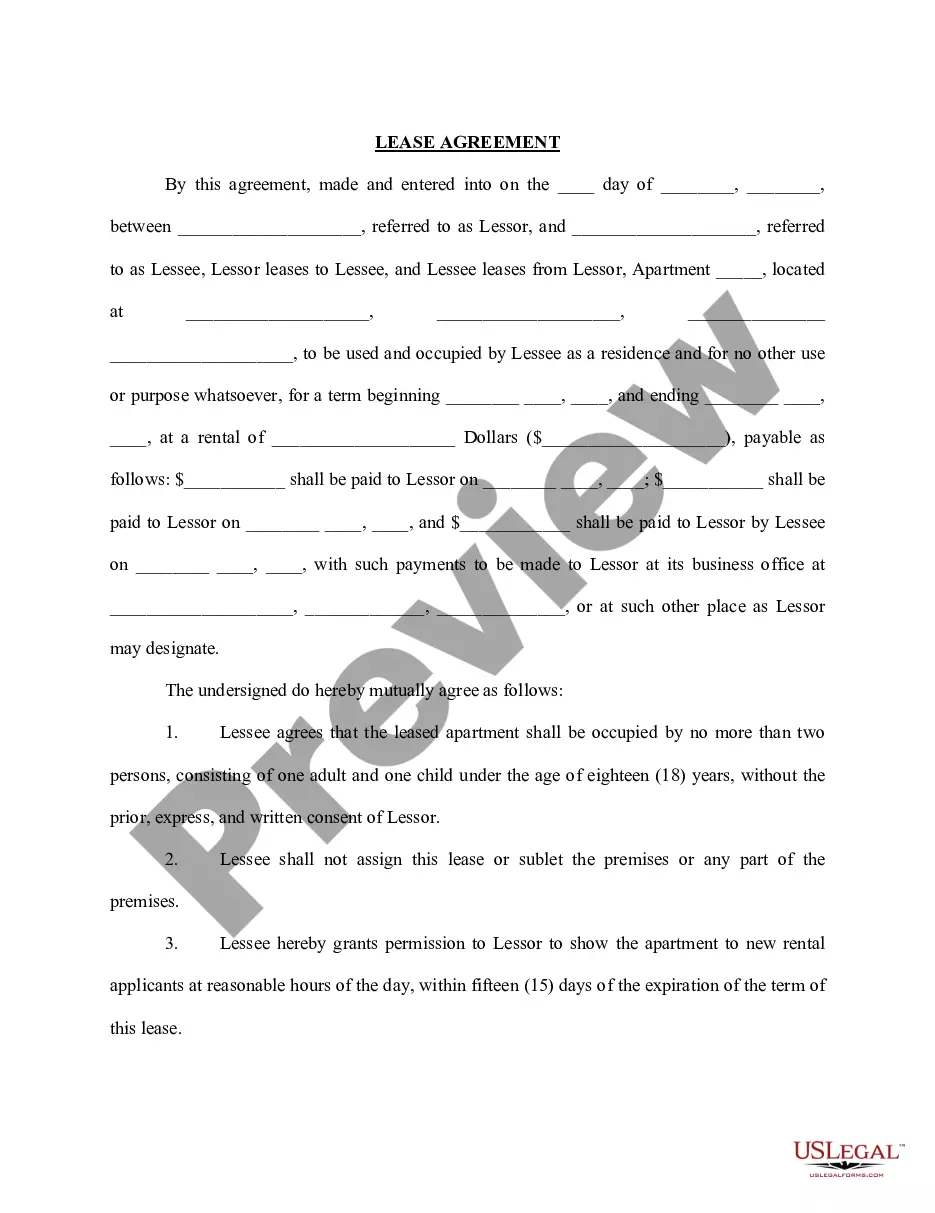

Collin Texas Self-Employed Independent Sales Contractor Agreement is a legally binding contract between a self-employed individual residing in Collin, Texas, and a company or business entity that hires them as an independent sales contractor. This agreement outlines the terms and conditions under which the contractor will work, perform sales-related tasks, and be compensated for their services. The agreement encompasses various key aspects such as the parties involved, the scope of work, and the payment structure. It typically outlines the specific products or services the contractor will be selling, the territories they will cover, and any sales goals or targets they must achieve. The agreement also clarifies that the contractor is not an employee but an independent contractor, meaning they are responsible for their own taxes, insurance, and expenses. Key points covered in the Collin Texas Self-Employed Independent Sales Contractor Agreement include: 1. Duration: The agreement specifies the duration of the contract, whether it is for a fixed term or an ongoing contractual relationship until either party terminates it. 2. Confidentiality: The contractor agrees to maintain the confidentiality of any proprietary or sensitive information they may come across during their engagement with the company. 3. Non-compete clause: Some agreements include a non-compete clause that limits the contractor from engaging in similar sales activities with competitors during or after the contract period. 4. Compensation: The agreement clearly defines how the contractor will be compensated for their services. It may include a commission-based structure, a fixed fee, or a combination of both. The payment terms, frequency, and any applicable deductions or allowances are also detailed. 5. Ownership of intellectual property: If the contractor creates any intellectual property during their engagement, the agreement outlines the ownership rights and usage permissions. Types of Collin Texas Self-Employed Independent Sales Contractor Agreements may vary depending on the specific industry or nature of the sales activities. For example: 1. Product Sales Agreement: This type of agreement focuses on the sale of tangible goods, outlining the specific products the contractor will sell, sales targets, and commission rates. 2. Service Sales Agreement: Service-based agreements are tailored to contractors who sell intangible services. They cover areas such as service deliverables, milestones, and payment terms. 3. Distributorship Agreement: If the contractor acts as a distributor for a company's products, a separate agreement can lay out the terms and conditions related to distribution rights, marketing support, and territory exclusivity. 4. Independent Sales Representative Agreement: This agreement may include provisions specifically addressing the relationship between the independent sales contractor and the company as a representative, outlining their role in promoting and selling the company's products or services. In conclusion, a Collin Texas Self-Employed Independent Sales Contractor Agreement is a vital legal document that ensures clarity and protects the interests of both parties involved. It establishes the framework for a successful working relationship and provides a clear understanding of the rights, responsibilities, and obligations associated with being a self-employed sales contractor in Collin, Texas.

Collin Texas Self-Employed Independent Sales Contractor Agreement

Description

How to fill out Collin Texas Self-Employed Independent Sales Contractor Agreement?

If you need to get a trustworthy legal paperwork provider to obtain the Collin Self-Employed Independent Sales Contractor Agreement, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support team make it simple to locate and complete different papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Collin Self-Employed Independent Sales Contractor Agreement, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Collin Self-Employed Independent Sales Contractor Agreement template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less pricey and more reasonably priced. Create your first company, organize your advance care planning, create a real estate agreement, or complete the Collin Self-Employed Independent Sales Contractor Agreement - all from the convenience of your home.

Join US Legal Forms now!