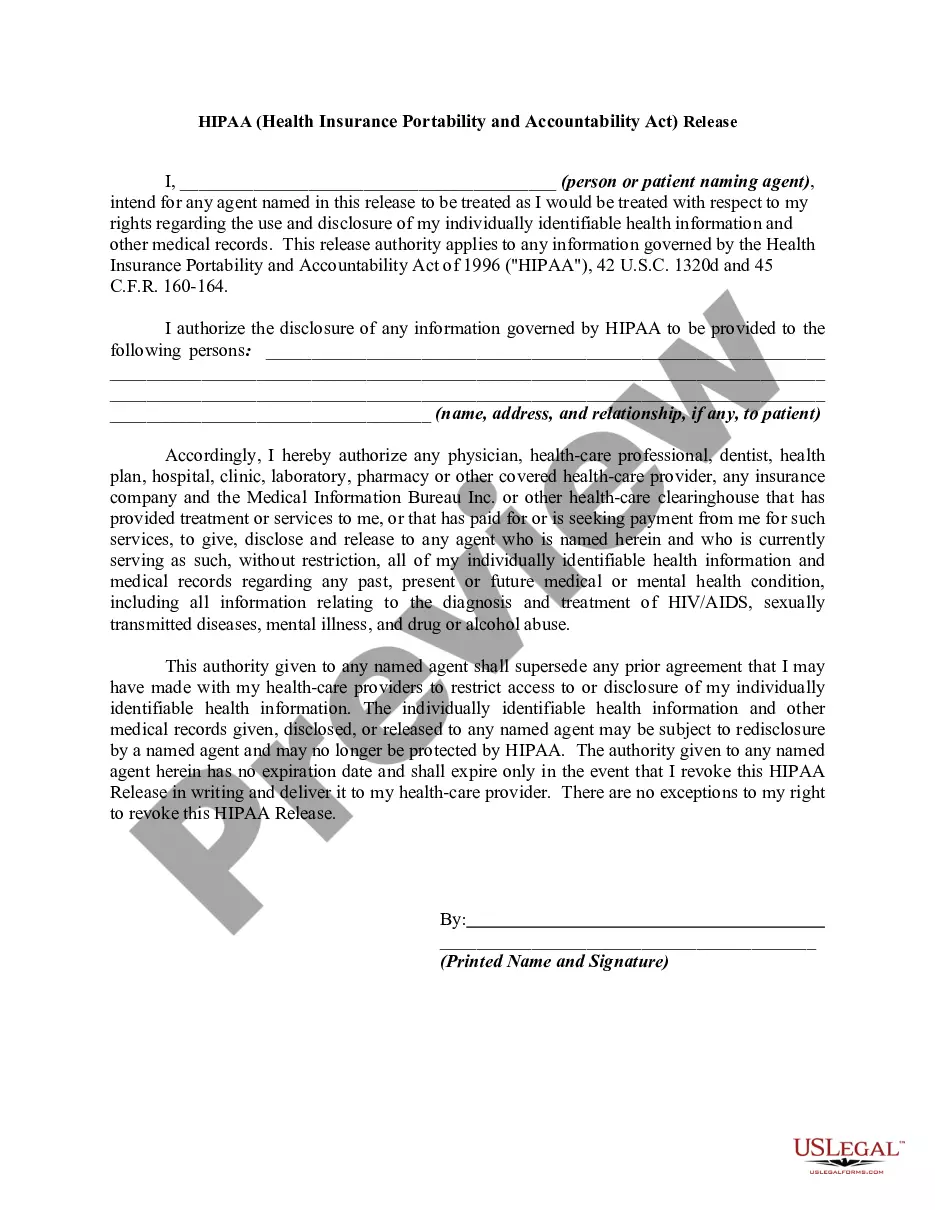

Allegheny Pennsylvania Accounting Agreement — Self-Employed Independent Contractor The Allegheny Pennsylvania Accounting Agreement is a legally binding contract designed to outline the terms and conditions between an accounting firm in Allegheny, Pennsylvania, and a self-employed independent contractor. This agreement is crucial for establishing a clear understanding of the rights, responsibilities, and expectations of both parties involved. The agreement includes various relevant keywords such as Allegheny Pennsylvania, accounting, agreement, self-employed, independent contractor, terms and conditions, rights, responsibilities, and expectations. The primary purpose of this agreement is to define the scope of services that the self-employed independent contractor will provide to the accounting firm. It typically includes services such as bookkeeping, financial analysis, tax preparation, and other accounting functions. Moreover, the agreement specifies the duration of the contract, payment terms, and conditions. The payment terms can vary depending on the specific agreement, but it often includes a detailed breakdown of the contractor's compensation structure, whether it is on an hourly, project-based, or commission basis. Furthermore, the Allegheny Pennsylvania Accounting Agreement may outline the ownership of any intellectual property produced during the contract, confidentiality requirements, and non-compete clauses to protect the accounting firm's interests. Different types of Allegheny Pennsylvania Accounting Agreements — Self-Employed Independent Contractor: 1. Basic Accounting Agreement: This type of agreement covers the basic terms and conditions between the accounting firm and the self-employed independent contractor, including services provided, payment terms, and duration. 2. Comprehensive Accounting Agreement: This agreement goes into more detail, outlining specific responsibilities, deadlines, and performance expectations. It may include additional clauses related to insurance, termination, and dispute resolution. 3. Project-Specific Accounting Agreement: This agreement is structured for self-employed independent contractors who are hired for a specific project or a limited duration rather than ongoing services. It focuses on the project deliverables, milestones, and payment structure related to that particular project. 4. Non-Disclosure Agreement (NDA): In some cases, the accounting firm may require a separate NDA to protect their sensitive financial information. This agreement ensures that the self-employed independent contractor maintains strict confidentiality and doesn't disclose any confidential information to third parties. Overall, the Allegheny Pennsylvania Accounting Agreement — Self-Employed Independent Contractor is a crucial document that clarifies the expectations, responsibilities, and payment terms for both parties. It serves as a foundation for a successful and mutually beneficial working relationship between the accounting firm and the self-employed contractor.

Allegheny Pennsylvania Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Allegheny Pennsylvania Accounting Agreement - Self-Employed Independent Contractor?

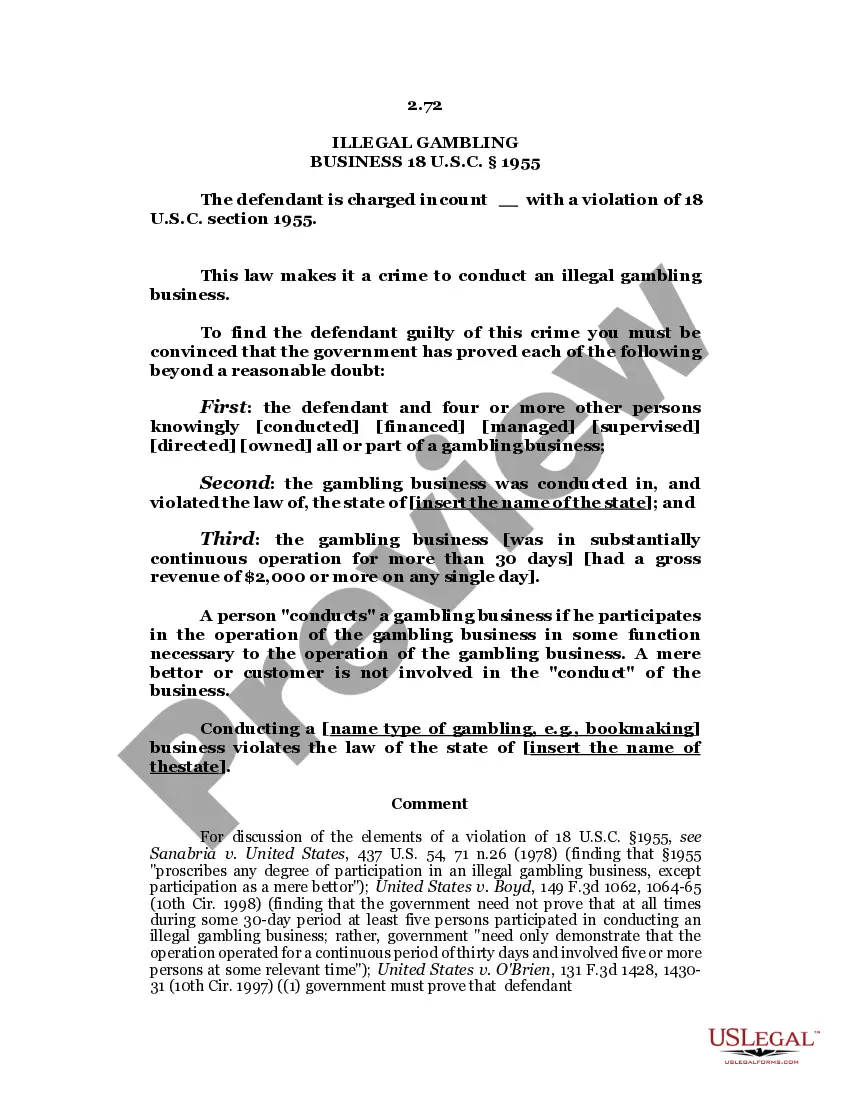

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Allegheny Accounting Agreement - Self-Employed Independent Contractor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Allegheny Accounting Agreement - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Allegheny Accounting Agreement - Self-Employed Independent Contractor:

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

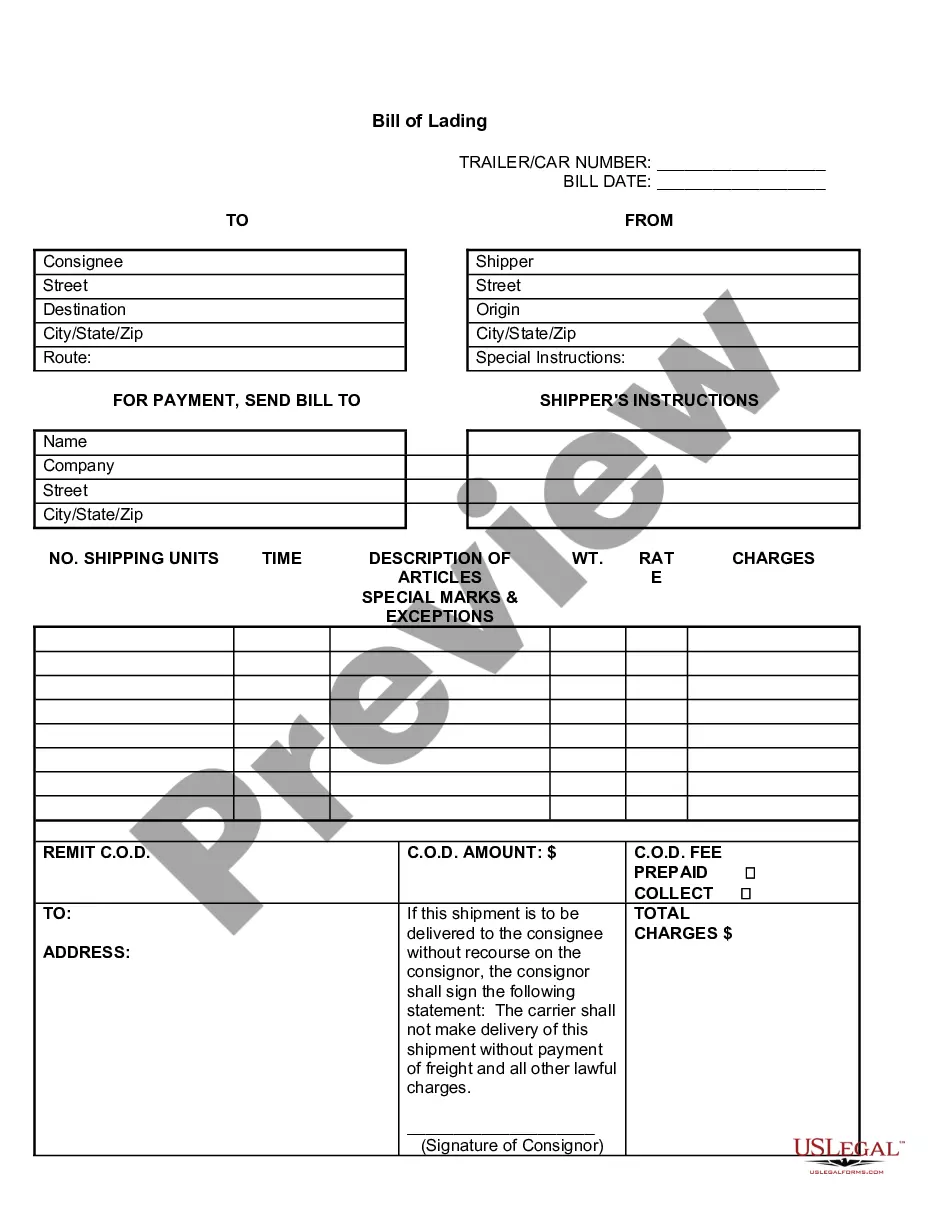

Elements of a Construction Contract Name of contractor and contact information.Name of homeowner and contact information.Describe property in legal terms.List attachments to the contract.The cost.Failure of homeowner to obtain financing.Description of the work and the completion date.Right to stop the project.

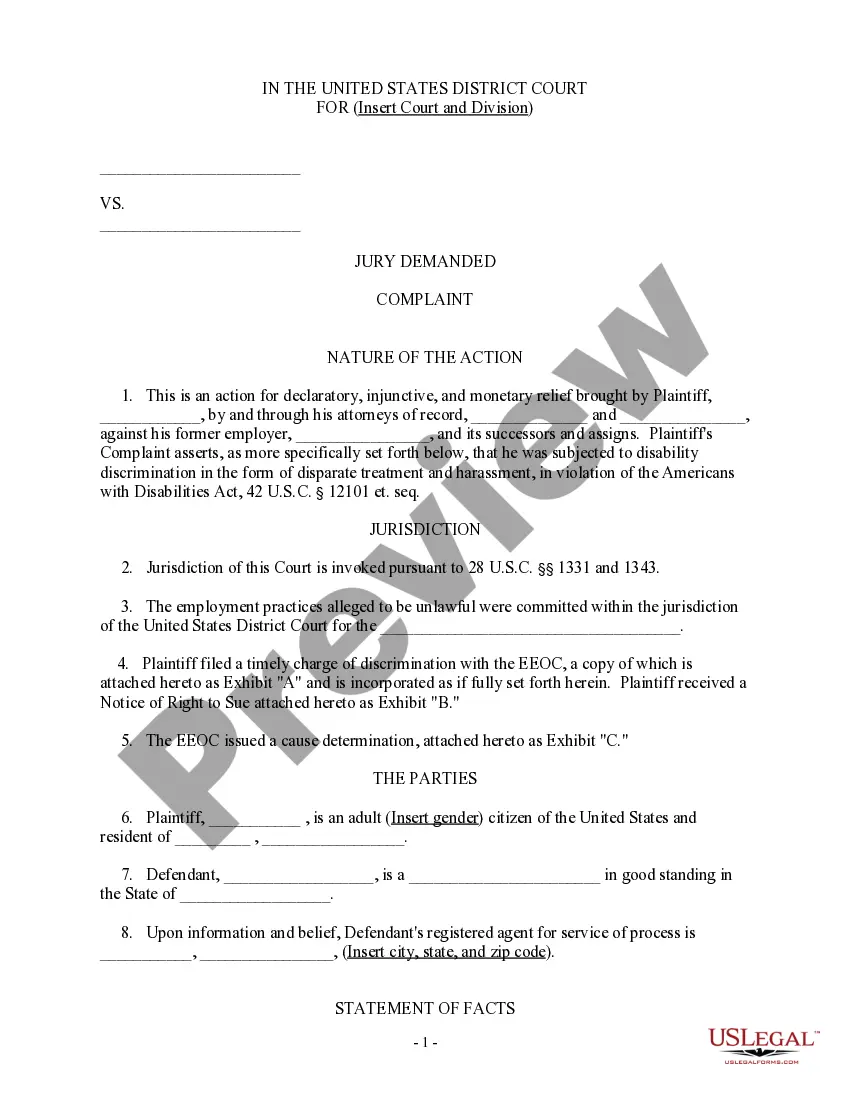

Contractor Agreement Contractor Agreement. Wyoming California Create Document. Updated June 21, 2022. An independent contractor agreement is between a contractor that performs a service for a client in exchange for payment. The contractor is not an employee of the client.

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.

INDEPENDENT CONTRACTOR AGREEMENT (ICA)

4 Types of Construction Contracts Lump-Sum Contracts. Cost-Plus-Fee Contracts. Guaranteed Maximum Price Contracts. Unit-Price Contracts.

Five Essential Elements of a Construction Contract Full Name, Address, and Signatures of Both Parties. Though this may sound obvious, this commonly overlooked element of construction contracts is required to make the contract legally binding.Scope of Work.Project Cost and Payment Terms.Schedule of Work.Authority.

drafted construction contract clearly sets out the work to be done, the price to be paid for the work, and the terms and conditions of payment. The contract should also allocate various foreseeable risks that may arise between the parties.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.

Construction contracts do not necessarily have to be in writing. All states in the U.S. have a law generally known as a statute of frauds that requires certain types of contracts to be in writing in order to be a legally enforceable agreement.