Oakland Michigan Accounting Agreement — Self-Employed Independent Contractor The Oakland Michigan Accounting Agreement — Self-Employed Independent Contractor is a legally binding contract that outlines the responsibilities, rights, and obligations of a self-employed individual providing accounting services in Oakland, Michigan. This agreement is designed to protect both parties involved and ensure a smooth and mutually beneficial professional relationship. Keywords: Oakland Michigan, accounting agreement, self-employed, independent contractor This accounting agreement is specifically tailored for self-employed individuals in Oakland, Michigan, who offer accounting services to clients. It encompasses a range of crucial details to ensure the efficient operation of the contractor's accounting services and protect the interests of both parties. Key Elements of the Oakland Michigan Accounting Agreement: 1. Scope of Services: This section defines the specific accounting services to be provided by the independent contractor, such as bookkeeping, financial analysis, tax preparation, or auditing. It clarifies the expectations and goals of the engagement. 2. Compensation: This section outlines the payment terms, including the rate or fee structure for the accounting services rendered. It may detail the payment schedule, invoicing procedures, and any other financial arrangements agreed upon. 3. Independent Contractor Status: This clause establishes that the service provider is operating as a self-employed individual and not as an employee of the client. It clarifies that the contractor is solely responsible for paying their own taxes, obtaining necessary permits, and complying with all legal obligations. 4. Confidentiality and Non-Disclosure: This section ensures that the contractor will handle all client information and data with strict confidentiality. It prevents the contractor from disclosing any sensitive or proprietary information without prior consent. 5. Intellectual Property: If the contractor develops any intellectual property while performing accounting services, this clause specifies how ownership rights will be handled. It may address who retains the rights to any accounting software, templates, or other materials developed during the engagement. Different Types of Oakland Michigan Accounting Agreement — Self-Employed Independent Contractor: 1. Basic Accounting Agreement: This contract outlines the essential terms and conditions between the self-employed accountant and a client, covering the scope of services, payment details, and confidentiality requirements. 2. Comprehensive Accounting Agreement: A more detailed agreement that includes additional provisions, such as dispute resolution procedures, termination rights, liability limitations, and governing law clauses. This type of agreement provides more extensive legal protection for both parties. 3. Project-Specific Accounting Agreement: This type of agreement is used for self-employed accountants engaged in short-term or project-based assignments. It focuses on specific accounting tasks, timelines, and deliverables, tailoring the agreement to the unique requirements of the project. In conclusion, the Oakland Michigan Accounting Agreement — Self-Employed Independent Contractor is a crucial legal document that governs the terms of engagement between a self-employed accountant and clients in Oakland, Michigan. It establishes expectations, protects confidential information, and ensures fair compensation for accounting services provided.

Oakland Michigan Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Oakland Michigan Accounting Agreement - Self-Employed Independent Contractor?

Preparing paperwork for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Oakland Accounting Agreement - Self-Employed Independent Contractor without professional help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Oakland Accounting Agreement - Self-Employed Independent Contractor by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step instruction below to get the Oakland Accounting Agreement - Self-Employed Independent Contractor:

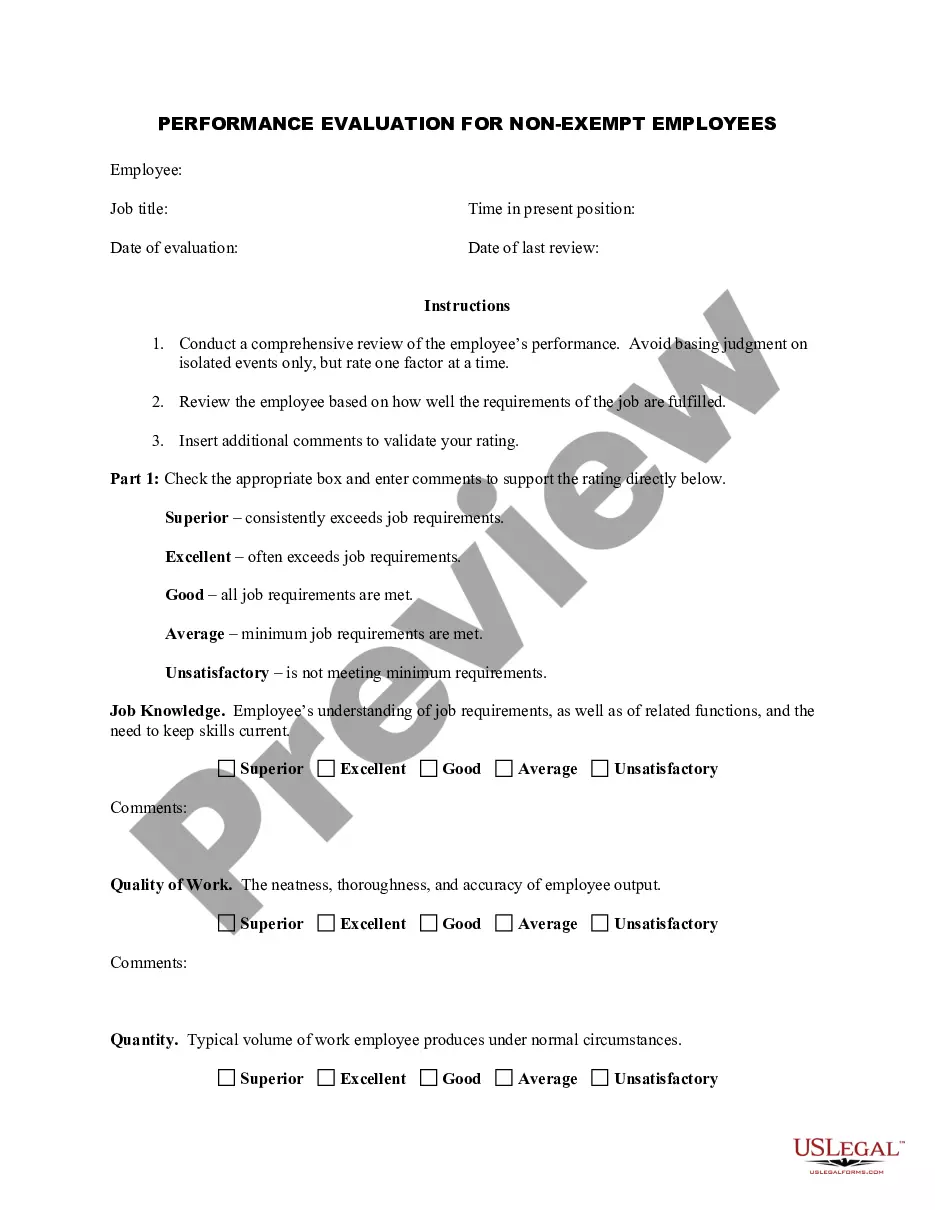

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!