The San Diego California Accounting Agreement — Self-Employed Independent Contractor is a crucial legal document that outlines the terms and conditions of engagement between a self-employed individual offering accounting services and a client or company based in San Diego, California. This contract serves to establish a mutually beneficial working relationship while ensuring both parties are protected and guided by agreed-upon rules and expectations. In general, the primary purpose of this agreement is to define the scope of the accounting services to be provided by the self-employed independent contractor and to establish the rights and responsibilities of both parties involved. It covers important aspects such as compensation, confidentiality, intellectual property, termination, dispute resolution, and legal compliance. By formalizing the engagement with an accurate and comprehensive contract, potential conflicts and misunderstandings can be minimized, fostering a professional and transparent working environment. Keywords: San Diego California, accounting agreement, self-employed, independent contractor, legal document, terms and conditions, engagement, client, services, mutually beneficial, working relationship, protection, rules, expectations, scope, compensation, confidentiality, intellectual property, termination, dispute resolution, legal compliance, contract, conflicts, misunderstandings, professional, transparent environment. While there may not be different types of San Diego California Accounting Agreement — Self-Employed Independent Contractor per se, it's worth mentioning that the specific terms and conditions within the agreement may vary based on the unique needs and preferences of the parties involved. Customizing the agreement to adequately address these specific requirements can be beneficial to both the self-employed accountant and the client, ensuring that the arrangement is tailored to their respective circumstances. Additionally, there might be variants of this agreement catered to different professions within the accounting field, such as tax professionals or forensic accountants, where additional terms specific to their expertise may be included. Variants or similar agreements: San Diego California Tax Accounting Agreement — Self-Employed Independent Contractor, San Diego California Forensic Accounting Agreement — Self-Employed Independent Contractor.

San Diego California Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out San Diego California Accounting Agreement - Self-Employed Independent Contractor?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including San Diego Accounting Agreement - Self-Employed Independent Contractor, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with paperwork execution simple.

Here's how to purchase and download San Diego Accounting Agreement - Self-Employed Independent Contractor.

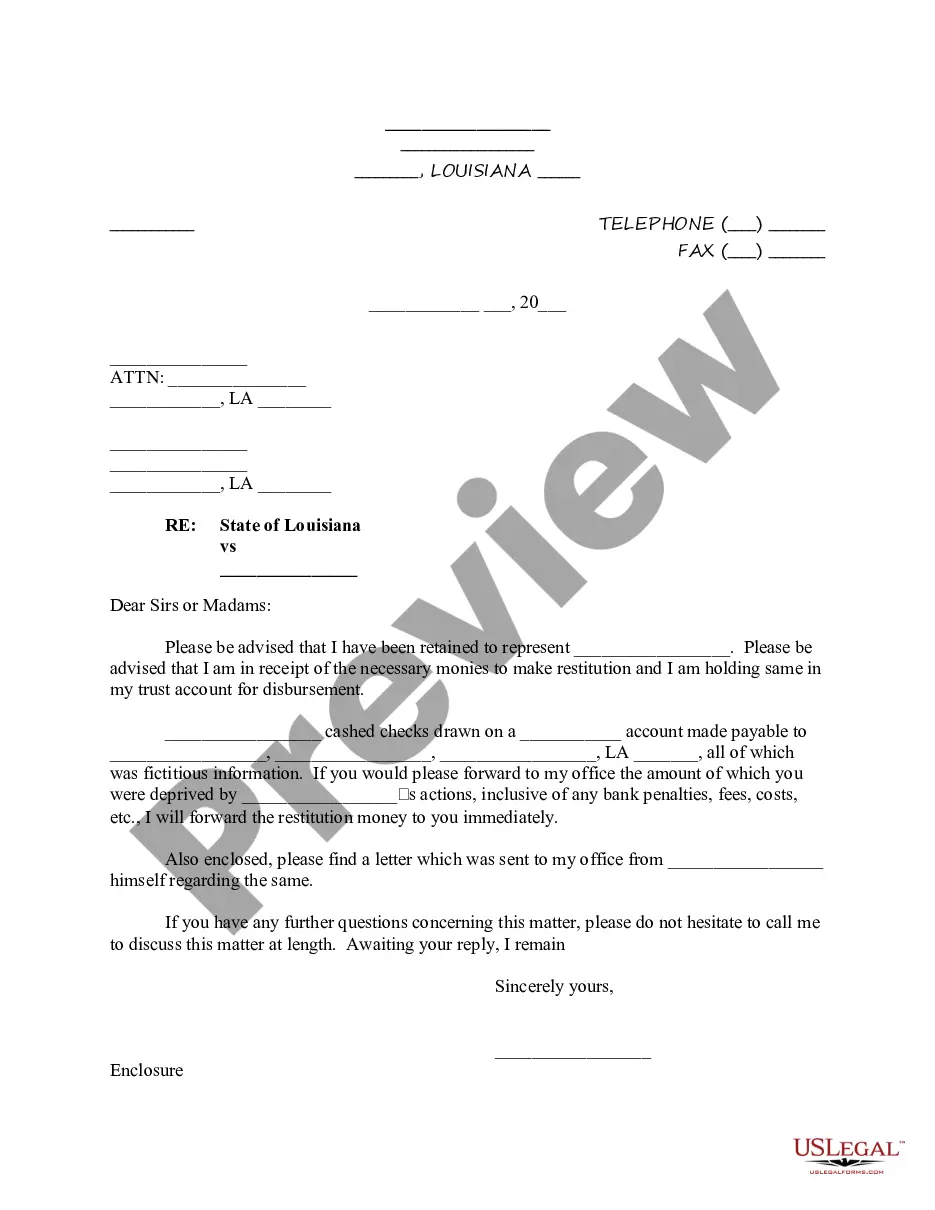

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the related forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and buy San Diego Accounting Agreement - Self-Employed Independent Contractor.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate San Diego Accounting Agreement - Self-Employed Independent Contractor, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you have to cope with an exceptionally difficult situation, we recommend getting a lawyer to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and get your state-compliant paperwork with ease!