Cook Illinois's Self-Employed Part Time Employee Contract is a legally binding agreement between Cook Illinois, a transportation company, and a self-employed individual who will be working part-time for the company. This contract outlines the specific terms and conditions governing the working relationship between the company and the employee. The Cook Illinois Self-Employed Part Time Employee Contract ensures that both parties have a clear understanding of their rights and responsibilities. It covers various aspects such as compensation, working hours, duties and job responsibilities, confidentiality, termination conditions, and dispute resolution mechanisms. This type of contract is designed for individuals who are considered self-employed but wish to work part-time for Cook Illinois. It is particularly suitable for those who may have other business or freelance commitments but want to utilize their skills and services within the company's framework. The key features of the Cook Illinois Self-Employed Part Time Employee Contract include: 1. Compensation: The contract specifies the agreed-upon payment structure, hourly rates, or project-based fees for the services rendered by the employee. It may also include other financial considerations such as reimbursement for travel expenses. 2. Working hours: The contract outlines the specific part-time working schedule agreed upon by both parties. This includes the number of hours the employee will work per day or week and any flexibility or changes that may be needed based on mutual agreement. 3. Duties and responsibilities: The contract provides a detailed description of the tasks and responsibilities that the part-time employee is expected to perform for Cook Illinois. It also clarifies any limitations or exclusions, ensuring both parties are on the same page regarding the scope of work. 4. Confidentiality: A crucial aspect of the contract is the inclusion of provisions that protect the confidentiality of any sensitive information the employee might come across while working for Cook Illinois. This includes customer data, trade secrets, or any other proprietary information that should not be disclosed to third parties. 5. Termination conditions: This section outlines the conditions under which either party may terminate the contract. It typically includes details about notice periods, reasons for termination, and any associated consequences or obligations. 6. Dispute resolution: The contract may include provisions for resolving any disputes or disagreements that may arise. This could involve going through mediation, arbitration, or other agreed-upon alternative dispute resolution mechanisms. Different types of Cook Illinois Self-Employed Part Time Employee Contracts may exist based on the nature of the services provided or specific contractual arrangements. Some examples could include contracts for self-employed part-time drivers, IT consultants, marketing specialists, or administrative support personnel. Overall, the Cook Illinois Self-Employed Part Time Employee Contract ensures a transparent and mutually beneficial working relationship between the company and its self-employed part-time workforce.

Cook Illinois Self-Employed Part Time Employee Contract

Description

How to fill out Cook Illinois Self-Employed Part Time Employee Contract?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Cook Self-Employed Part Time Employee Contract, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Cook Self-Employed Part Time Employee Contract from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Cook Self-Employed Part Time Employee Contract:

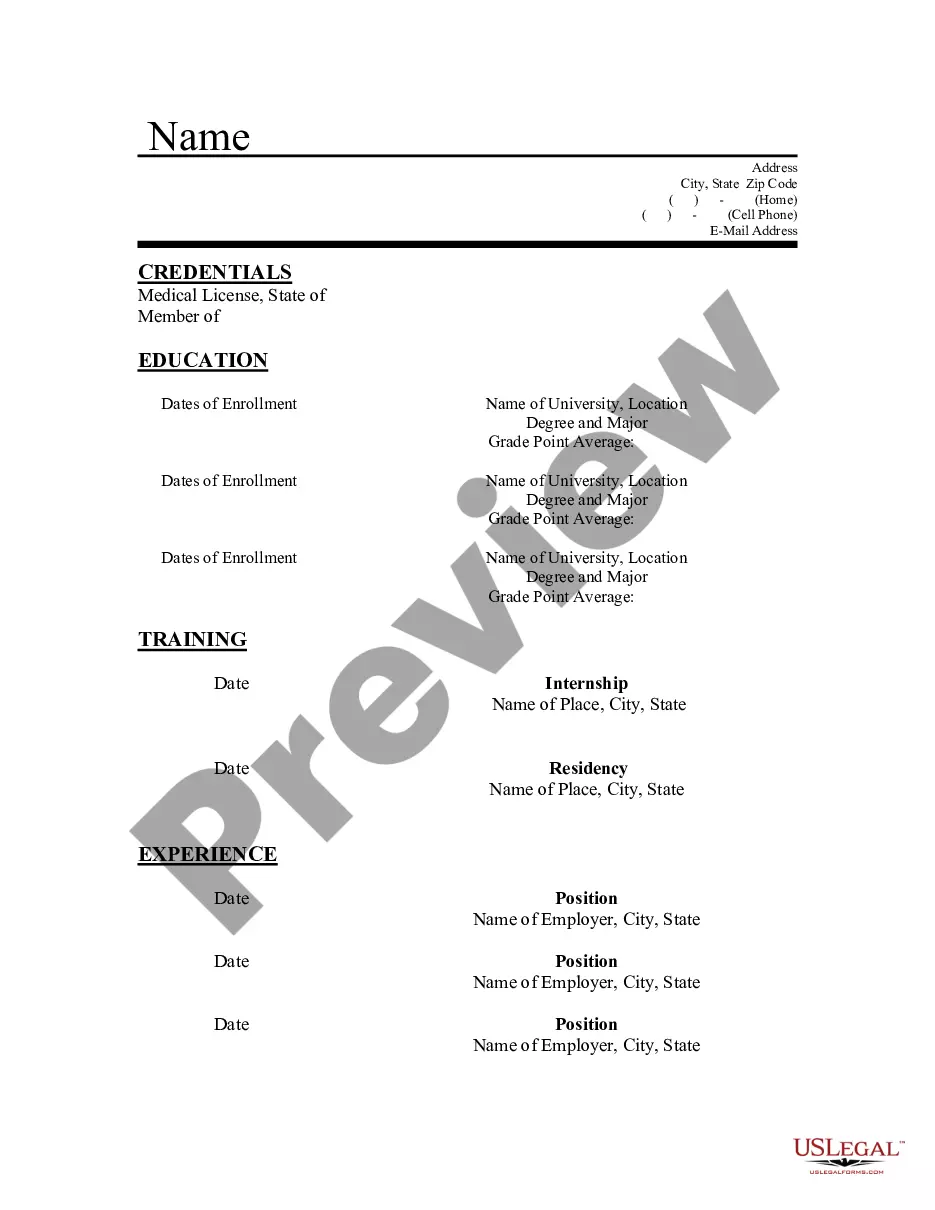

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!