Harris Texas Self-Employed Part Time Employee Contract refers to a legal agreement between an employer and a self-employed worker who works on a part-time basis in Harris County, Texas. This type of contract outlines the terms and conditions of the employment relationship, as well as the rights and responsibilities of both parties involved. A typical Harris Texas Self-Employed Part Time Employee Contract includes various clauses and provisions that are crucial to protect the interests of both the employer and the self-employed worker. These contracts are designed to establish a clear understanding of the working arrangement, compensation, hours of work, job duties, liabilities, confidentiality agreements, non-compete clauses, and other relevant aspects. In Harris County, Texas, there are several types of self-employed part-time employee contracts that can vary based on the nature of the work and the specific needs of the employer. Examples of these contracts may include: 1. Consulting Agreement: This type of contract is commonly used when a self-employed worker is hired to provide specialized expertise or advice on a specific project or task. It outlines the scope of work, deliverables, payment terms, and other details related to the consulting engagement. 2. Freelance Service Agreement: This contract is utilized when a self-employed worker is hired on a part-time basis to offer specific services, such as graphic design, writing, programming, or marketing. It specifies the type of services to be provided, rates, project deadlines, intellectual property rights, and other relevant details. 3. Independent Contractor Agreement: This type of contract is utilized when a self-employed worker is engaged to perform specific tasks or provide specialized services for the employer. It outlines the nature of the work relationship, payment terms, responsibilities, and obligations of both parties. 4. Part-Time Employment Agreement: This contract is employed when a self-employed worker is hired to work part-time for an employer on an ongoing basis. It typically includes provisions related to working hours, compensation, benefits, termination, and other relevant employment-related terms. It is important for both the employer and self-employed worker to ensure that the Harris Texas Self-Employed Part Time Employee Contract clearly reflects their respective intentions and protects their rights. Consulting legal professionals who specialize in employment law can be immensely beneficial in drafting and reviewing these contracts to ensure compliance with local laws and regulations.

Harris Texas Self-Employed Part Time Employee Contract

Description

How to fill out Harris Texas Self-Employed Part Time Employee Contract?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Harris Self-Employed Part Time Employee Contract, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different types varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any activities associated with document completion straightforward.

Here's how to purchase and download Harris Self-Employed Part Time Employee Contract.

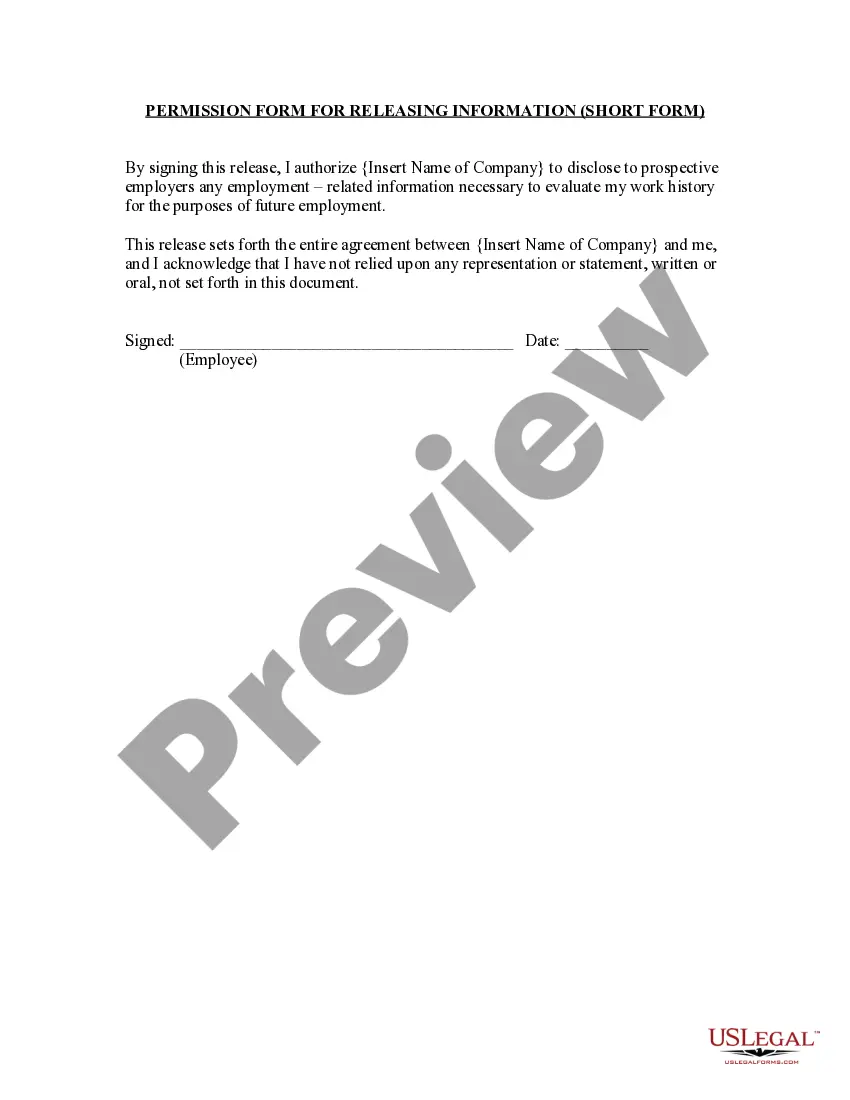

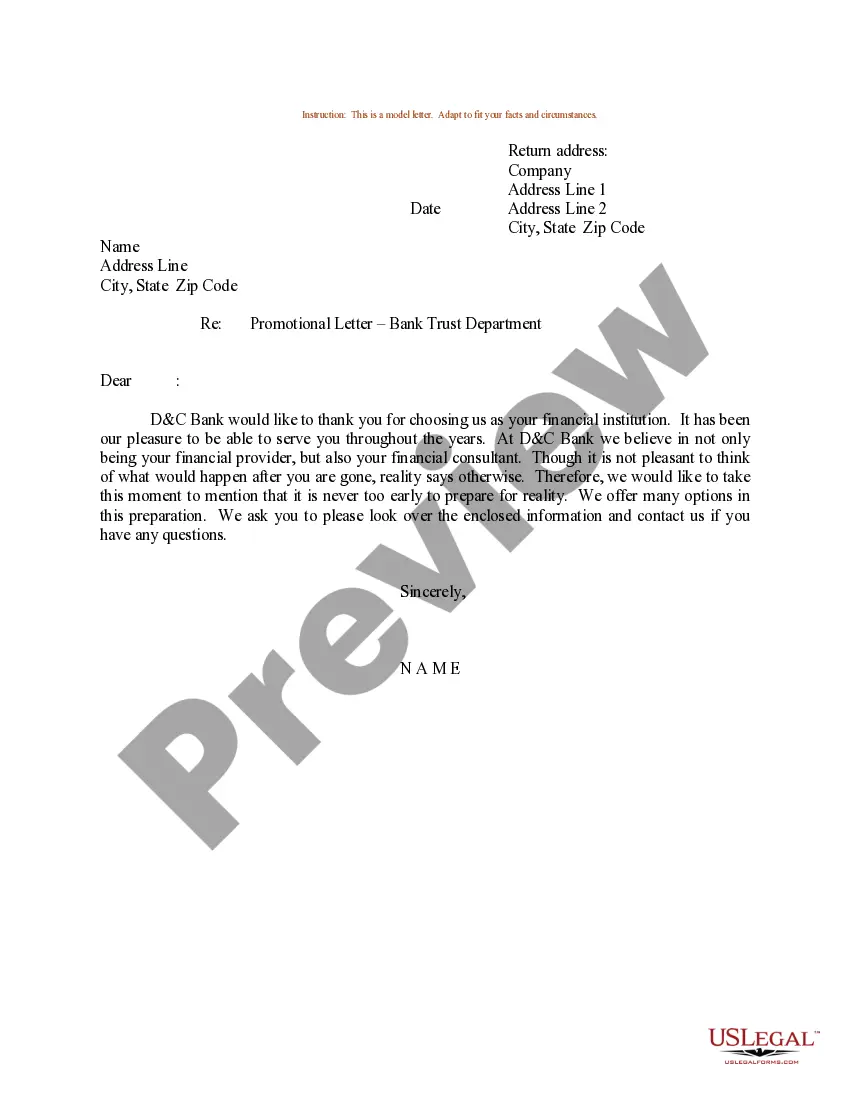

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the legality of some records.

- Check the similar document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Harris Self-Employed Part Time Employee Contract.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Harris Self-Employed Part Time Employee Contract, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you need to cope with an extremely complicated case, we advise getting a lawyer to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!