Hillsborough Florida Self-Employed Seasonal Picker Services Contract: A Comprehensive Overview The Hillsborough Florida Self-Employed Seasonal Picker Services Contract is a legally binding agreement between a self-employed individual and an agricultural business or farm in Hillsborough County, Florida. This contract outlines the terms and conditions under which the self-employed picker will provide their services during the seasonal harvesting period. Key Terms and Provisions: 1. Parties involved: This contract identifies the self-employed picker (referred to as the contractor) and the agricultural business or farm (referred to as the client). 2. Scope of services: The contract clearly defines the specific tasks and duties the contractor will perform as a picker. This may include harvesting fruits, vegetables, or crops, sorting and packing produce, and adhering to quality control standards. 3. Compensation: The contract stipulates the payment terms and rates for the contractor's services. It may outline hourly wages, piece-rate compensation, bonuses, or other agreed-upon payment structures. The contractor's compensation is typically dependent on factors such as productivity, quality of work, and adherence to deadlines. 4. Duration: The contract establishes the start and end dates of the seasonal work period. It may also include provisions for early termination or extension of the contract due to unforeseen circumstances such as inclement weather or changes in crop yield. 5. Working hours and schedule: The contract specifies the expected working hours, breaks, and rest periods. It also outlines any overtime provisions and how these will be compensated according to local labor laws. 6. Health and safety: This section addresses the responsibilities of both the contractor and the client in ensuring a safe working environment. It may cover topics such as appropriate safety equipment, pesticide handling procedures, emergency protocols, and workers' compensation insurance. 7. Confidentiality and non-disclosure: If necessary, this contract may include confidentiality clauses to protect the client's sensitive business information or trade secrets that the contractor may come across during their engagement. Types of Hillsborough Florida Self-Employed Seasonal Picker Services Contracts: 1. Individual Contractor Agreement: This is a standard contract between a single self-employed picker and a specific agricultural business or farm. It outlines the terms of their working relationship for the designated seasonal period. 2. Group Contractor Agreement: In some cases, multiple self-employed pickers may collaborate or form a crew to effectively fulfill larger-scale harvesting contracts. A group contractor agreement clarifies the collective responsibilities, compensation, and liabilities of the participating pickers. 3. Contractor Services Agreement Extension: When both parties agree to extend the existing contract for an additional seasonal period or beyond, an extension agreement can be executed to formalize the revised terms and conditions. In conclusion, the Hillsborough Florida Self-Employed Seasonal Picker Services Contract serves as a vital tool for establishing a clear understanding between self-employed pickers and agricultural businesses or farms. It ensures that the parties involved are aware of their rights, obligations, and compensation for a successful and mutually beneficial working relationship during the harvesting season.

Hillsborough Florida Self-Employed Seasonal Picker Services Contract

Description

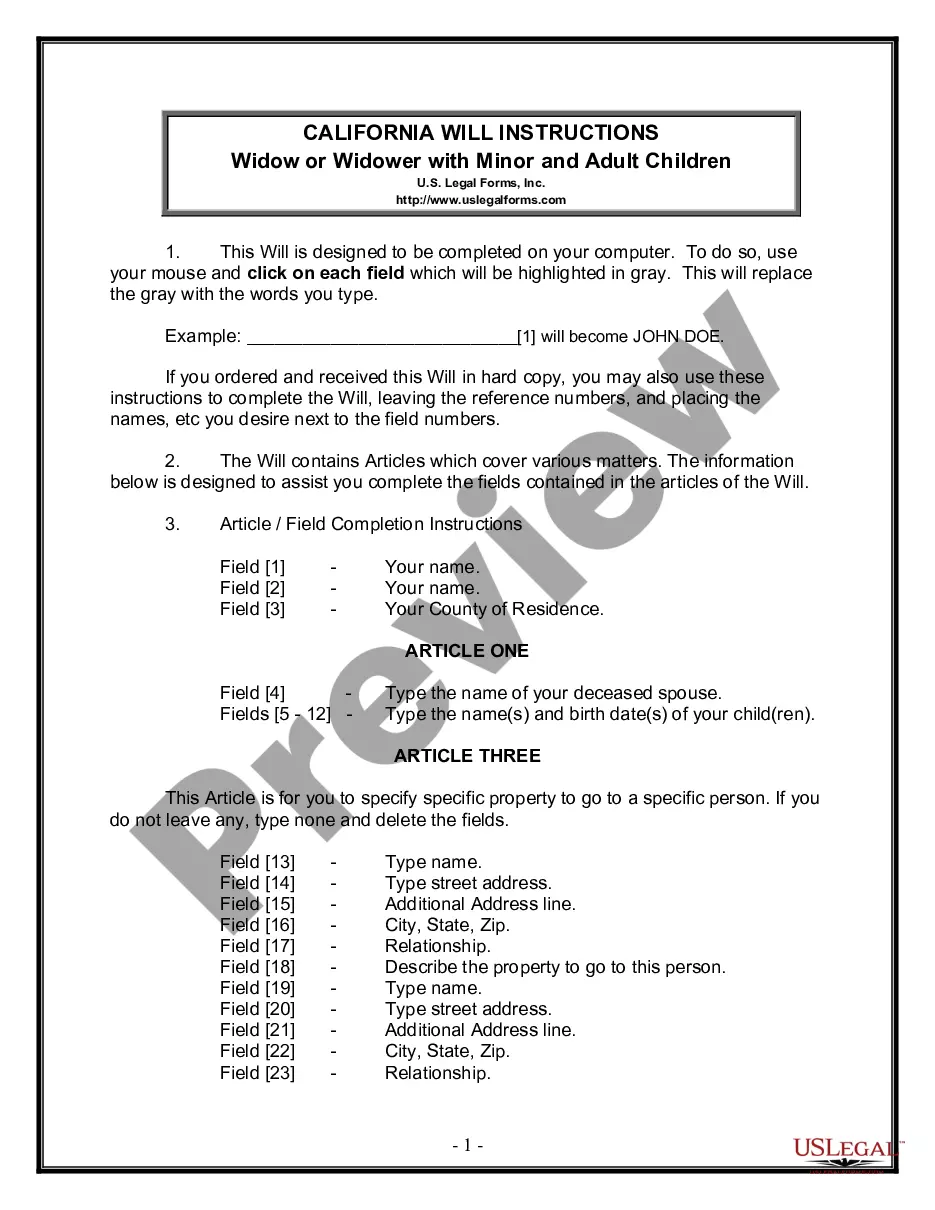

How to fill out Hillsborough Florida Self-Employed Seasonal Picker Services Contract?

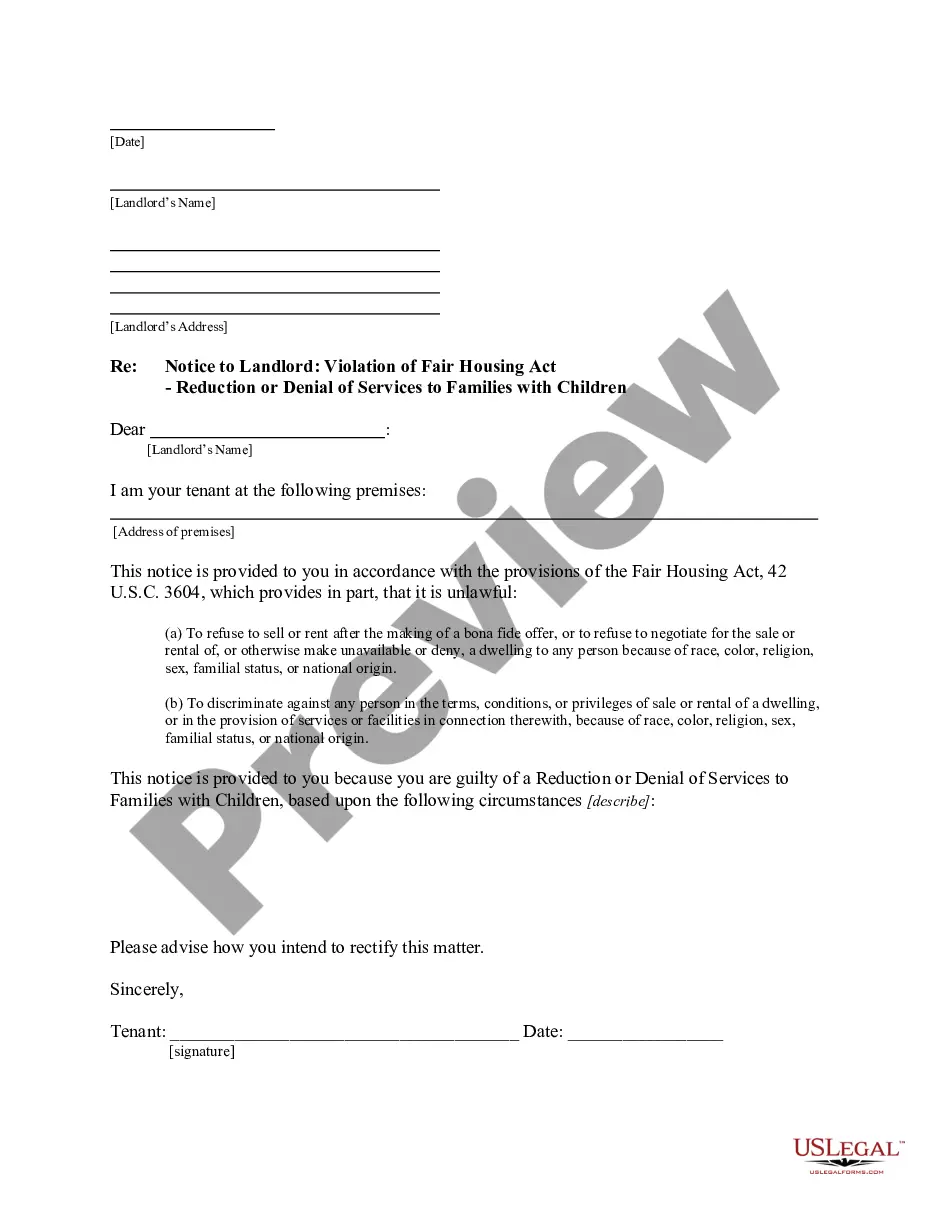

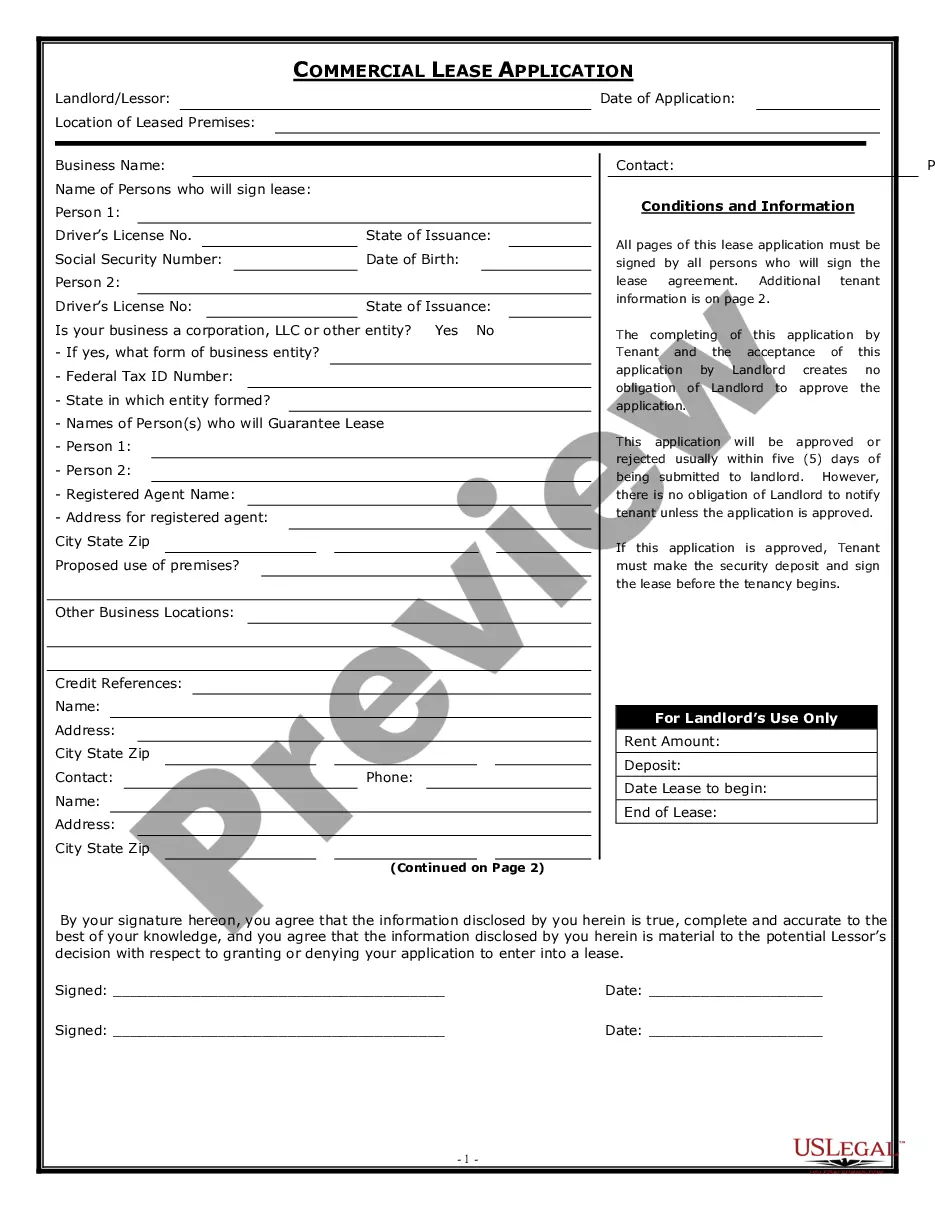

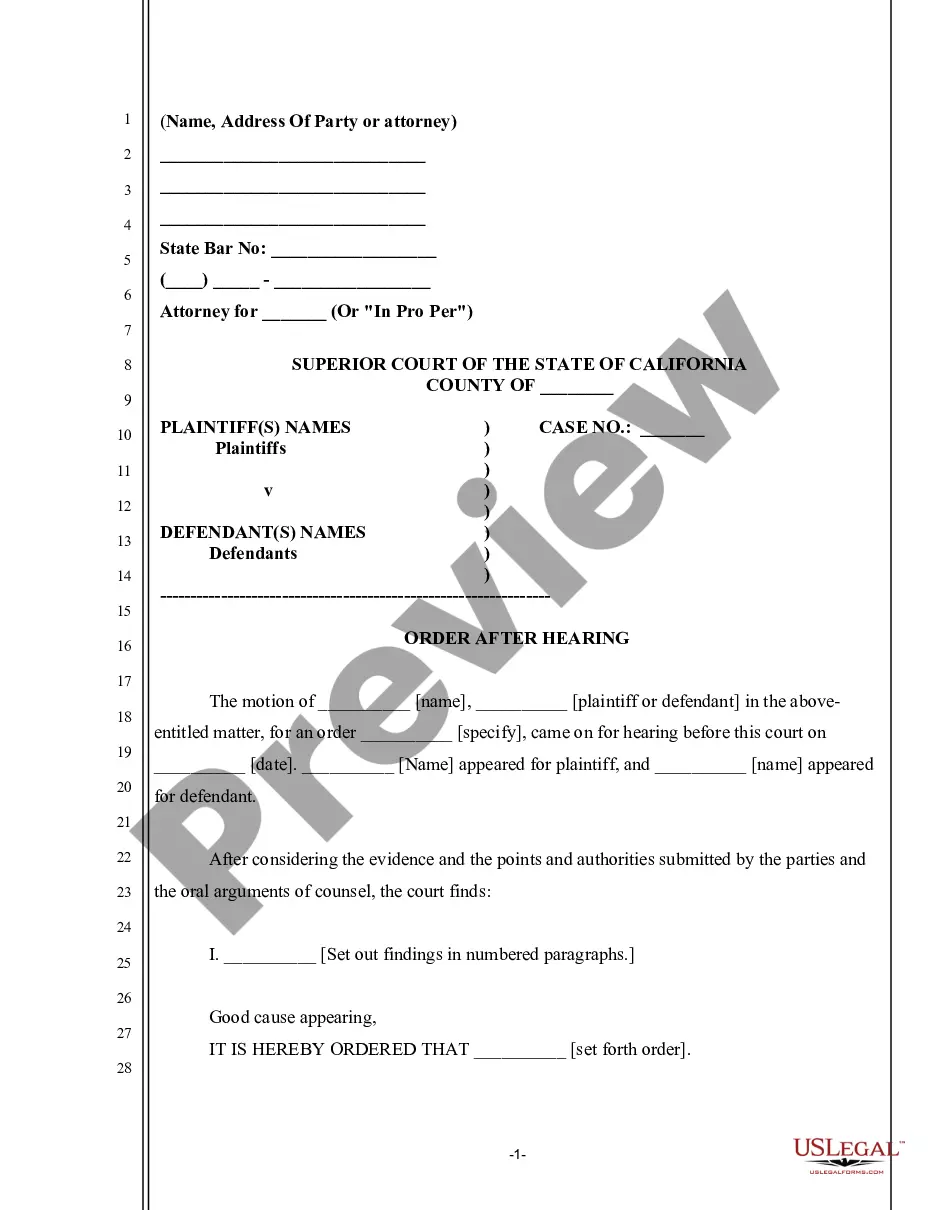

If you need to find a reliable legal paperwork provider to find the Hillsborough Self-Employed Seasonal Picker Services Contract, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of supporting materials, and dedicated support make it simple to get and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to look for or browse Hillsborough Self-Employed Seasonal Picker Services Contract, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Hillsborough Self-Employed Seasonal Picker Services Contract template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less costly and more affordable. Set up your first company, arrange your advance care planning, draft a real estate agreement, or execute the Hillsborough Self-Employed Seasonal Picker Services Contract - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

An employee usually works as the employer directs them. A contractor runs their own business and provides a service, usually works the hours required to do a task, and has a high level of control over the way they work.

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

A sham contracting arrangement is when an employer attempts to disguise an employment relationship as a contractor relationship. They may do this to avoid certain taxes and their responsibility for employee entitlements like: minimum wages. superannuation. leave.

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)

You must issue an ABN: When a Medicare item or service isn't reasonable and necessary under Program standards, including care that's: Not indicated for the diagnosis, treatment of illness, injury, or to improve the functioning of a malformed body member. Experimental and investigational or considered research only.

A sham contracting arrangement is when an employer attempts to disguise an employment relationship as a contractor relationship. They may do this to avoid certain taxes and their responsibility for employee entitlements like: minimum wages. superannuation. leave.

Sham contracting is an attempt by an employer to misrepresent or disguise an employment relationship as an independent contracting arrangement. Employers may do this to avoid having to give an employee their proper work entitlements, such as minimum rates of pay and leave entitlements.

To avoid sham contracting, ensure you undertake a due diligence process. Confirm that both you and your prospective workers understand the nature of their work status and draft your contracts to reflect this.

Generally: If you work for a labour hire company that pays you directly, then you cannot work under an ABN as you are an employee. If you have no independence in how you go about your work, you are an employee. Most casual labourers are employees.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.