Wake North Carolina Self-Employed Animal Exercise Services Contract

Description

How to fill out Wake North Carolina Self-Employed Animal Exercise Services Contract?

If you need to find a trustworthy legal paperwork supplier to find the Wake Self-Employed Animal Exercise Services Contract, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to find and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to search or browse Wake Self-Employed Animal Exercise Services Contract, either by a keyword or by the state/county the document is intended for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

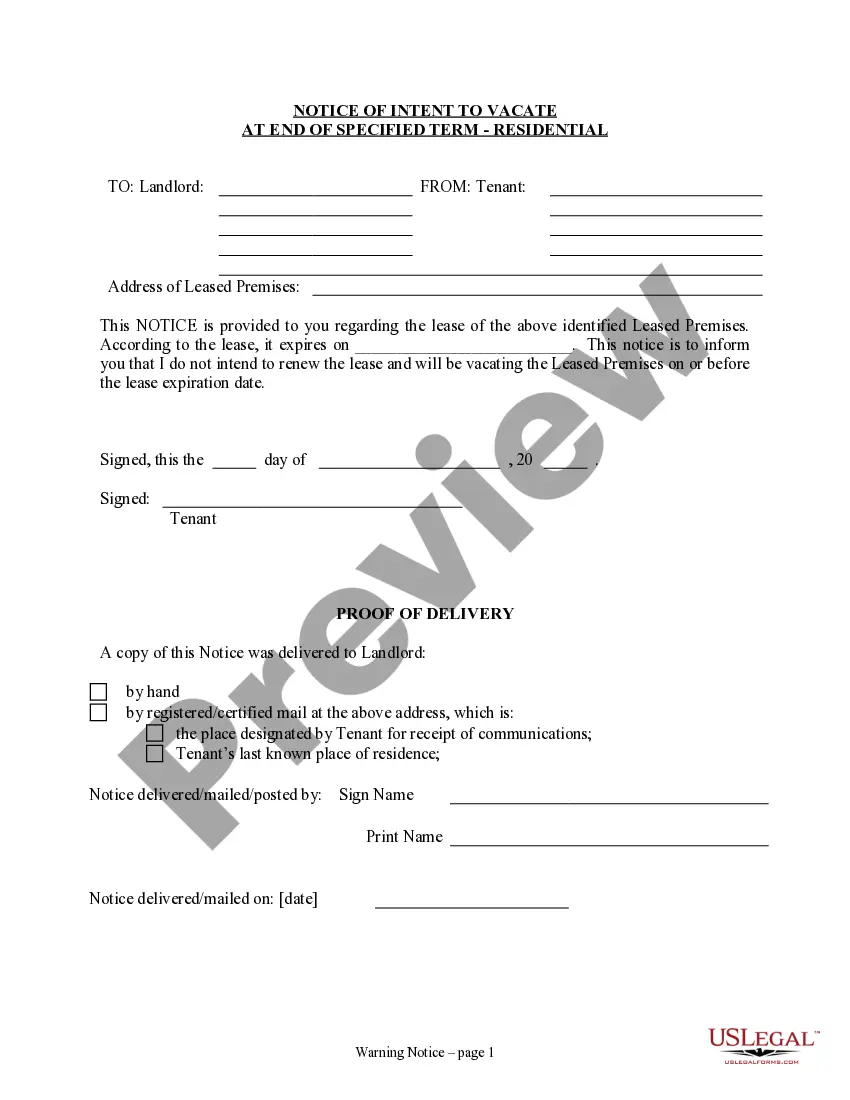

Don't have an account? It's easy to get started! Simply locate the Wake Self-Employed Animal Exercise Services Contract template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less costly and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Wake Self-Employed Animal Exercise Services Contract - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

Assuming you are already registered with SARS personally, then by default your sole proprietorship will also be registered. If you are not yet registered with SARS, you can register at a physical SARS branch, or online through the SARS eFiling service.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

contract is kind of commitment where you write down what you want to achieve as well as how to achieve it. Often, it also clearly states any rewards for completing the contract as well as any penalties for breaking it.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

employed person does not work for a specific employer who pays them a consistent salary or wage. Selfemployed individuals, or independent contractors, earn income by contracting with a trade or business directly.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.