Collin Texas Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

How to fill out Journalist - Reporter Agreement - Self-Employed Independent Contractor?

Managing documentation for the enterprise or personal requirements is consistently a significant obligation.

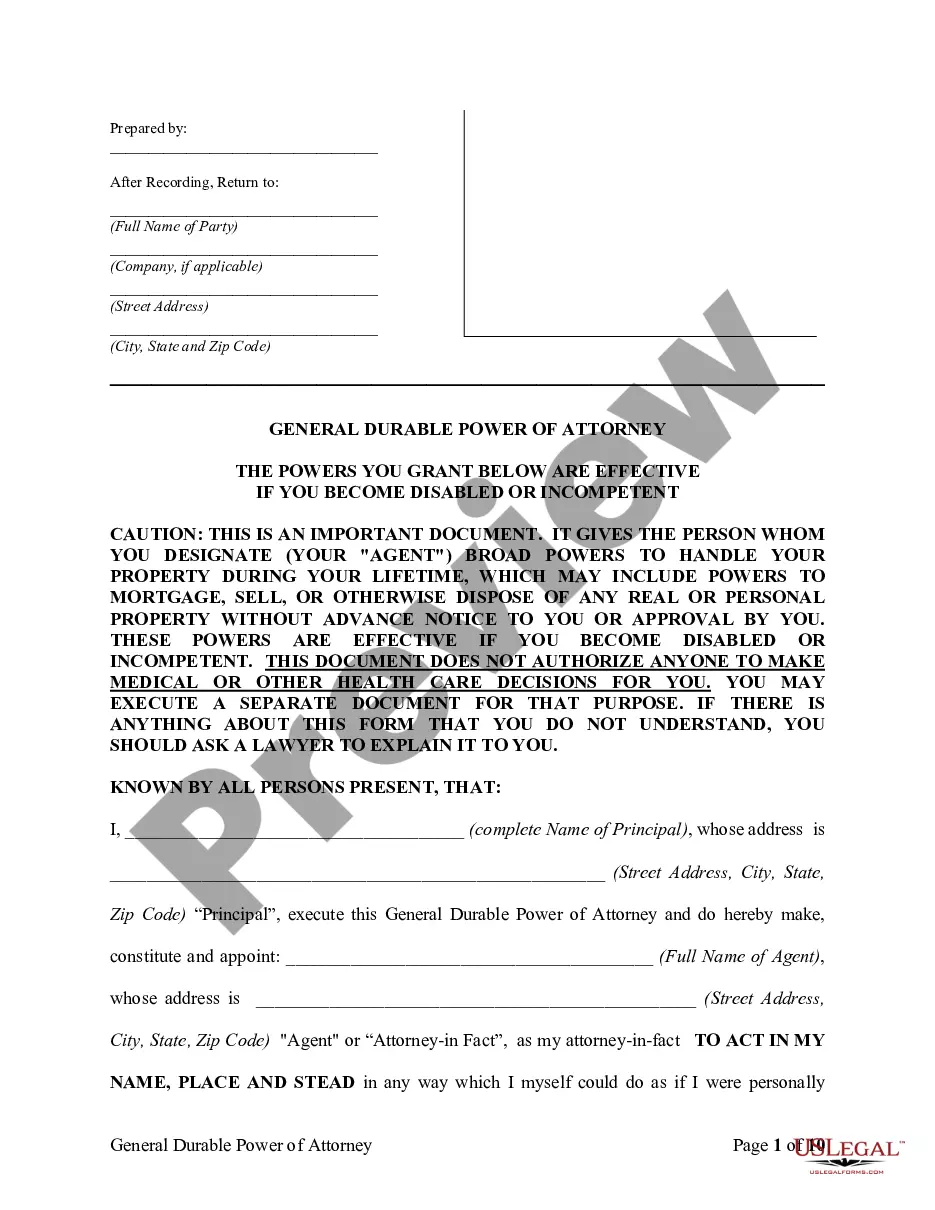

When formulating an agreement, a public service inquiry, or a power of attorney, it's crucial to consider all national and regional regulations pertinent to the area.

However, smaller counties and even municipalities also possess legislative guidelines that you must keep in mind.

The remarkable aspect of the US Legal Forms library is that all documents you've ever acquired remain accessible – you can retrieve them in your profile within the My documents section at any time.

- All these factors make it stressful and labor-intensive to prepare a Collin Journalist - Reporter Agreement - Self-Employed Independent Contractor without expert help.

- It's feasible to avoid incurring costs on lawyers drafting your documents and create a legally acceptable Collin Journalist - Reporter Agreement - Self-Employed Independent Contractor independently, utilizing the US Legal Forms online library.

- It is the largest digital compilation of state-specific legal documents that are professionally validated, ensuring their legality when selecting a template for your locality.

- Previously registered users merely need to Log In to their profiles to save the required form.

- If you do not yet possess a subscription, follow the step-by-step instructions below to obtain the Collin Journalist - Reporter Agreement - Self-Employed Independent Contractor.

- Browse the page you've opened and verify if it contains the example you require.

- To achieve this, utilize the form description and preview if these functionalities are available.

Form popularity

FAQ

To write an independent contractor agreement, begin by clearly defining the services or work to be performed. Include details such as payment terms, deadlines, and confidentiality clauses. Utilizing the Collin Texas Journalist - Reporter Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process, ensuring you cover essential legal aspects.

How Do You Become Self-Employed? Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The National Labor Relations Board, which determines whether workers are employees who have the right to unionize, specifically ruled in 2005 that newspaper carriers were independent contractors, and thus could not unionize.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

A freelancer is similar to an independent contractor, but they tend to work on a project-to-project basis and have multiple employers at the same time. Independent contractors will be on long-term contracts, where freelancers are usually hired on short-term contracts.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4. California's stringent '"ABC test"which took effect on Jan.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.