Cook Illinois Self-Employed Ceiling Installation Contract is a legal agreement between Cook Illinois, a reputable ceiling installation company, and individuals who are self-employed contractors specializing in ceiling installation services. This contract outlines the terms and conditions that govern the working relationship between Cook Illinois and the self-employed contractor. The Cook Illinois Self-Employed Ceiling Installation Contract includes various clauses and provisions that ensure both parties' rights and obligations are clearly defined. It typically covers aspects such as scope of work, payment terms, project deadlines, quality standards, liability, insurance requirements, dispute resolution, and termination conditions. Under this contract, the self-employed ceiling installation contractors are responsible for providing their own tools, equipment, and materials necessary for the job. They are expected to possess the relevant skills, expertise, and certifications required for ceiling installation projects. Cook Illinois, on the other hand, provides the contractors with job opportunities, project specifications, and technical assistance. Different types of Cook Illinois Self-Employed Ceiling Installation Contracts may include: 1. Residential Ceiling Installation Contract: This contract focuses on ceiling installation projects for residential properties, such as houses and apartments. It addresses specific requirements related to residential properties, safety measures, and customer satisfaction. 2. Commercial Ceiling Installation Contract: This type of contract relates to ceiling installations in commercial buildings, including offices, retail stores, and industrial spaces. It may encompass aspects like compliance with building codes, coordination with other trades, and adherence to specific regulations relevant to commercial properties. 3. Renovation Ceiling Installation Contract: This contract is specifically tailored for ceiling installation projects that involve renovating existing spaces. It may involve removal of old ceilings, assessing structural stability, and adapting the installation process to the unique challenges posed by renovation projects. In summary, the Cook Illinois Self-Employed Ceiling Installation Contract serves as a comprehensive legal document that establishes the terms of engagement between Cook Illinois and self-employed contractors specializing in ceiling installation services. It ensures a clear understanding of expectations, responsibilities, and project specifics to maintain a productive and mutually beneficial working relationship.

Cook Illinois Self-Employed Ceiling Installation Contract

Description

How to fill out Cook Illinois Self-Employed Ceiling Installation Contract?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life situation, locating a Cook Self-Employed Ceiling Installation Contract meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

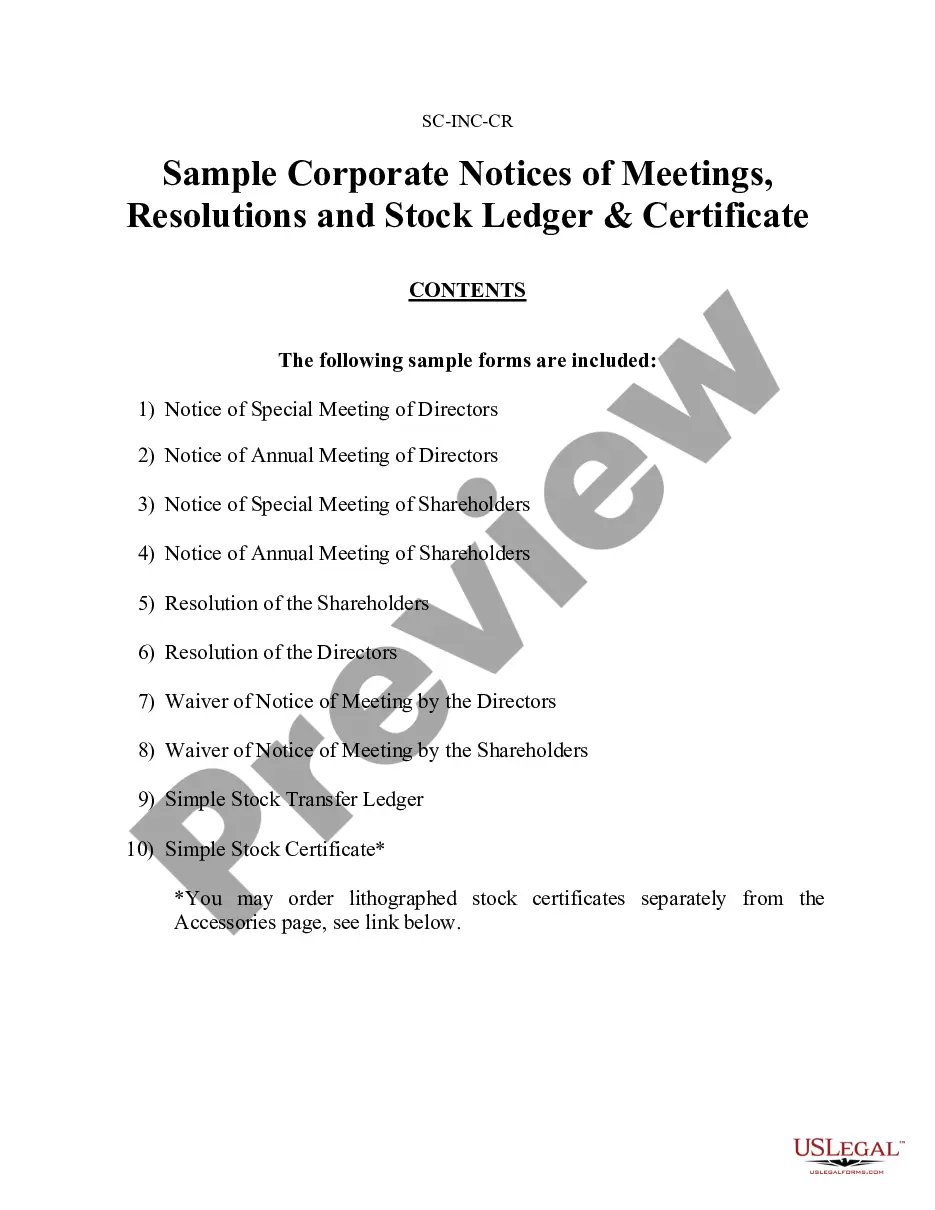

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the Cook Self-Employed Ceiling Installation Contract, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Cook Self-Employed Ceiling Installation Contract:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Cook Self-Employed Ceiling Installation Contract.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Independent contractors have total control over the work being performed, generally set their own hours, pay for their own business expenses, and provide their own equipment, liability insurance, and office space.

Electricians, plumbers, carpenters, bricklayers, painters, hair stylists, wedding planners, auto mechanics, florists, and many other skilled workers that specialize in a trade can be regarded as independent contractors.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Cons of Independent Contracting Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS. In most cases, contractors aren't eligible for state unemployment benefits, because they're self-employed, and they must fund their retirement accounts.

Independent Contractor Responsibilities: Liaising with the client to elucidate job requirements, as needed. Gathering the materials needed to complete the assignment. Overseeing the assignment, from inception to completion. Tailoring your approach to work to suit the job specifications, as required.

More info

And there's little money in a house worth 150K or 250K without a good home. I know, I know, just do it. It's not a bad idea. That's the best way. But I've done it several times, and it's time I did it right, as the Chicago Tribune said: “If it's the right way, we'll do it.” There Are Many Ways to Save on a Property You Buy — The Key to Not Having to Pay an Uncle Sam on That 150K House You Just Sold. So what are you waiting for? There are many ways to save on that 150K or 250K home. Here's a few things you can do, you may save 250,000. 150,000 500,00 300,000 250,000 250,000 MOBILE HOME WALL REMOVAL (MIRRORS, HIGHLANDS, STAIRS, ROOF) There are many ways to save on a property you buy — The Key to Not Having to Pay an Uncle Sam on That 150K House You Just Sold. If you're like me, your wife just passed away, and you want to give her a big house to make her feel like her husband's still around.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.