Kings New York Election of 'S' Corporation Status and Instructions — IRS 2553: A Comprehensive Overview In Kings, New York, businesses have the option to elect 'S' Corporation status through the IRS Form 2553, also known as the Election by a Small Business Corporation. This process allows businesses to gain the benefits of both a corporation and a partnership, avoiding the double taxation often associated with traditional C Corporations. The IRS Form 2553 serves as the official documentation for companies seeking to elect 'S' Corporation status. By filing this form, businesses can choose to be taxed under Subchapter S of the Internal Revenue Code and enjoy pass-through taxation, where the corporation's income, deductions, and credits are passed on to the shareholders' personal tax returns. The process of electing 'S' Corporation status in Kings, New York, involves several key steps. Firstly, business owners must ensure that their corporation meets the eligibility criteria set by the IRS, such as being a domestic corporation, having no more than 100 shareholders, and specifying the desired tax year. Next, they need to complete the IRS Form 2553 accurately and thoroughly. The form requires information about the corporation's name, address, tax year, and details of each shareholder, including their names, addresses, and identification numbers. Additionally, the form must be signed by all shareholders and any required consents or attachments must be included. Once the completed IRS Form 2553 is prepared, it should be filed with the IRS. In Kings, New York, businesses are required to mail the form to the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0253. It is crucial to ensure that the filing deadline is met, generally within 75 days of incorporating or starting a new tax year. Late filings can result in unintended tax consequences. There are a couple of variations or types of Kings New York Election of 'S' Corporation Status and Instructions — IRS 2553 that businesses might encounter: 1. Initial Election: This type involves businesses that have never elected 'S' Corporation status in the past and are seeking to do so for the first time. 2. Late Election: In certain situations, corporations may have missed the deadline for the initial election. The late election allows businesses to retroactively elect 'S' Corporation status and take advantage of pass-through taxation and other benefits. 3. Revocation of 'S' Corporation Status: If a corporation that previously elected 'S' Corporation status wishes to revoke it, they can file a separate IRS Form 2553 to revoke the election. This might be necessary if shareholders decide to pursue different tax strategies or if the corporation no longer meets the eligibility requirements. In conclusion, the Kings New York Election of 'S' Corporation Status and Instructions — IRS 2553 provides businesses with the opportunity to enjoy the tax advantages and flexibility that come with being an 'S' Corporation. By following the designated steps and adhering to the IRS requirements, businesses can make informed decisions and ensure proper filing to maximize their financial advantage. It is essential to consult with a qualified tax professional or legal advisor to navigate this process accurately.

Kings New York Election of 'S' Corporation Status and Instructions - IRS 2553

Description

How to fill out Kings New York Election Of 'S' Corporation Status And Instructions - IRS 2553?

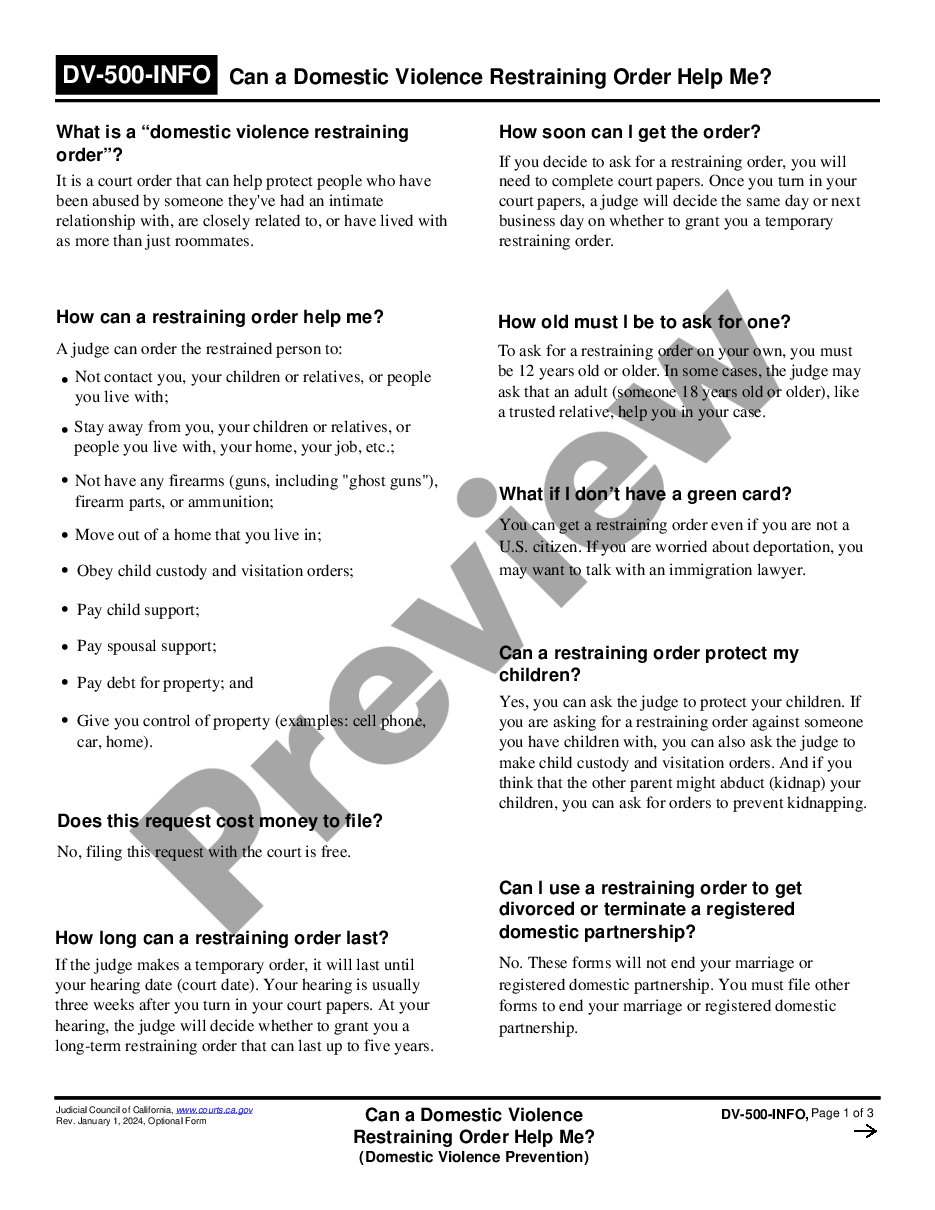

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Kings Election of 'S' Corporation Status and Instructions - IRS 2553 is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Kings Election of 'S' Corporation Status and Instructions - IRS 2553. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Kings Election of 'S' Corporation Status and Instructions - IRS 2553 in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

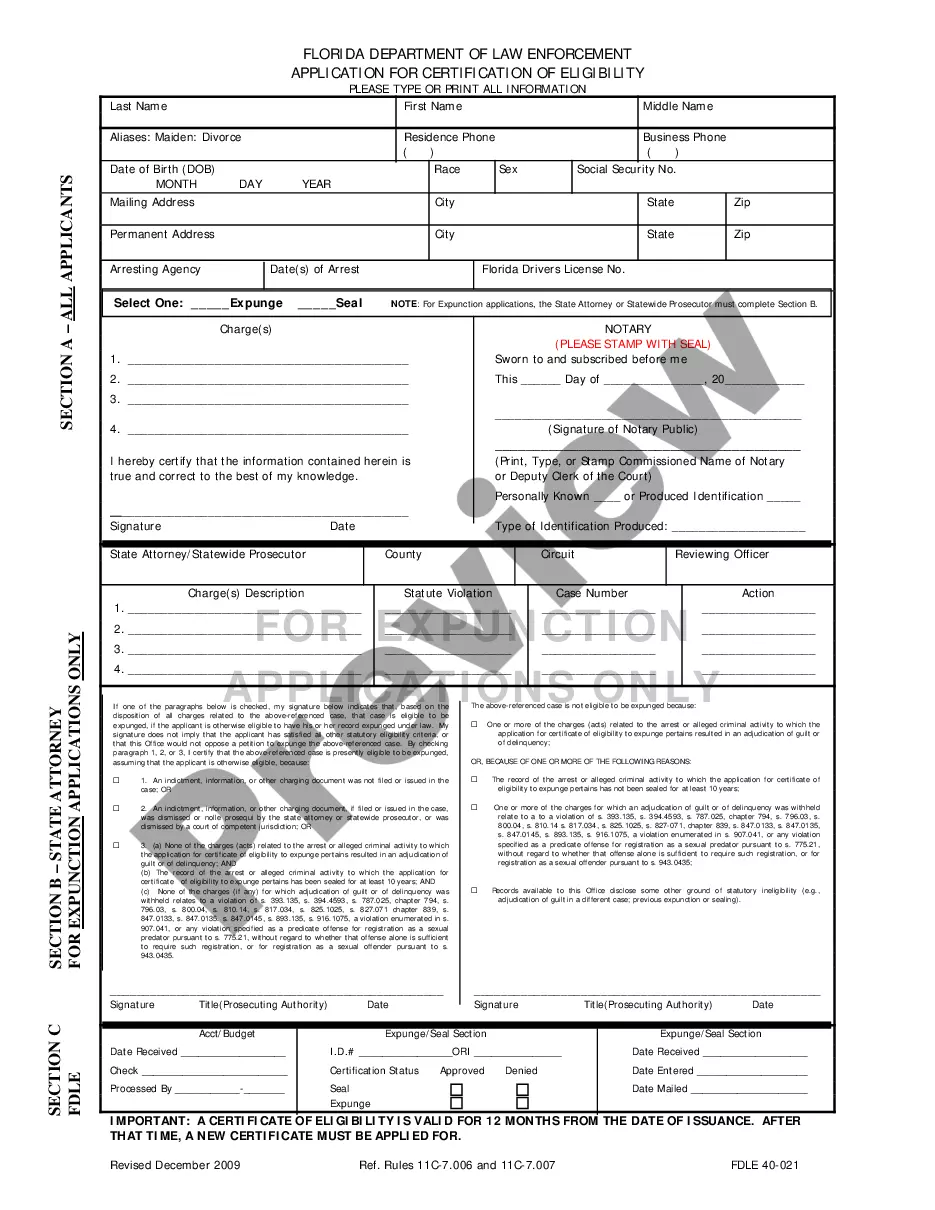

Effective Date of Election. Form 2553 generally must be filed no later than 2 months and 15 days after the date entered for item E. For details and exceptions, see When To Make the Election and Relief for Late Elections, earlier.

If you want to elect S-Corp status for 2020, technically you are too late. The instructions say to Complete and file Form 2553: No more than 2 months and 15 days after the beginning of the tax year the election is to take effect, or.

Your S-corporation election requires your entity must be a domestic business, meaning it must have been formed or incorporated within the United States. Your S-corporation must also not be an ineligible corporation.

How to Fill out IRS Form 2553: Easy-to-Follow Instructions - YouTube YouTube Start of suggested clip End of suggested clip So the IRS doesn't lose any of your paperwork. In this table you'll enter the name and address ofMoreSo the IRS doesn't lose any of your paperwork. In this table you'll enter the name and address of each shareholder who's required to consent to your S corp election.

Form 2553 cannot be filed online.

To elect S corporation tax status, you need to file IRS Form 2553, Election by a Small Business Corporation. You can file an election for S corporation tax status at any time after setting up your SMLLC. However, there are limitations on when the election can take effect.

Attach Form 2553 to your current year Form 1120S, as long as the form is filed within three years and 75 days after the intended date of S-Corp election. Attach to a late-filed Form 1120S, which will be under the same time restrictions (three years and 75 days of intended S-Corp election date).

Step 1: Check S Corp Eligibility. The following statements must be true in order to elect S corp status: Form 2553 was filed on time by an eligible business entity.Step 2: Check Form 2553 Due Dates. You must file form 2553:Step 3: Complete and File Form 2553. Start by accessing Form 2553 PDF on the IRS website.

Even if you file a late S-Corp election, the most important information will be the date of incorporation and your corporation's fiscal year. This form will need to be signed by an officer, as well as all associated shareholders. Next, file Form 2553 with your corporation's IRS Service Center.

Step 1: Check S Corp Eligibility. The following statements must be true in order to elect S corp status: Form 2553 was filed on time by an eligible business entity.Step 2: Check Form 2553 Due Dates. You must file form 2553:Step 3: Complete and File Form 2553. Start by accessing Form 2553 PDF on the IRS website.