Philadelphia Pennsylvania Election of 'S' Corporation Status and Instructions — IRS 2553 The Philadelphia Pennsylvania Election of 'S' Corporation Status refers to the process of officially electing to be treated as an S Corporation for tax purposes in the state of Pennsylvania, specifically in the city of Philadelphia. This election is made by filing Form IRS 2553 with the Internal Revenue Service (IRS). By electing 'S' Corporation status, a business can enjoy several benefits, including potential tax advantages and limited liability protection. This election is particularly attractive to small to medium-sized businesses, as it allows them to pass corporate income, losses, deductions, and credits through to their shareholders, avoiding the double taxation that can occur with regular C Corporations. The Form IRS 2553 serves as the official document to make this election, and it must be filed within a specific timeframe. The IRS requires that the form be filed no later than two months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the preceding tax year. It is crucial to adhere to these deadlines to ensure the timely recognition of the election. In order to complete the IRS 2553 form accurately, it is essential to have the necessary information at hand, including the corporation's name, address, tax year, applicable EIN (Employer Identification Number), the date of incorporation, and detailed information about the corporation's shareholders, including their names and Social Security numbers. Once the form is prepared, it must be signed and dated by an authorized officer or representative of the corporation. It is important to keep a copy of the filed form for record-keeping purposes. Different types of Philadelphia Pennsylvania Election of 'S' Corporation Status and Instructions — IRS 2553 include: 1. Initial Election: This refers to the first time a corporation elects 'S' Corporation status. 2. Late Filing: If a corporation misses the initial filing deadline, it may still be possible to make a late election through a process known as "S Corporation late election relief." 3. Revocation of 'S' Corporation Status: A corporation can also choose to revoke its 'S' Corporation status by filing Form IRS 2553. This may be done if the corporation no longer meets the eligibility criteria or wishes to switch to a different tax status. In summary, the Philadelphia Pennsylvania Election of 'S' Corporation Status and Instructions — IRS 2553 is a crucial tax filing requirement for businesses looking to enjoy the benefits of 'S' Corporation taxation in Philadelphia. Careful attention to the instructions and deadlines outlined by the IRS is essential to ensure a smooth and timely election process.

Philadelphia Pennsylvania Election of 'S' Corporation Status and Instructions - IRS 2553

Description

How to fill out Philadelphia Pennsylvania Election Of 'S' Corporation Status And Instructions - IRS 2553?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Philadelphia Election of 'S' Corporation Status and Instructions - IRS 2553 without expert help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Philadelphia Election of 'S' Corporation Status and Instructions - IRS 2553 by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Philadelphia Election of 'S' Corporation Status and Instructions - IRS 2553:

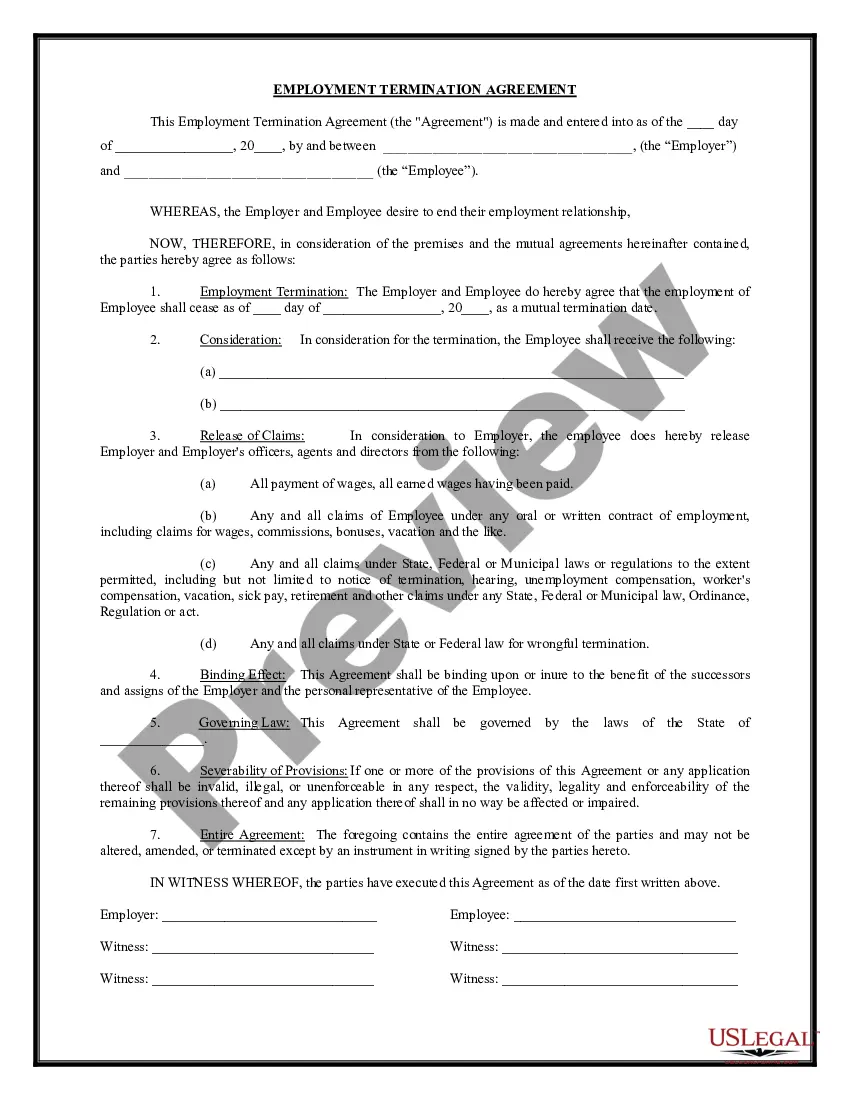

- Examine the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a few clicks!