Salt Lake Utah Election of 'S' Corporation Status and Instructions - IRS 2553

Description

How to fill out Salt Lake Utah Election Of 'S' Corporation Status And Instructions - IRS 2553?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Salt Lake Election of 'S' Corporation Status and Instructions - IRS 2553 is quick and straightforward.

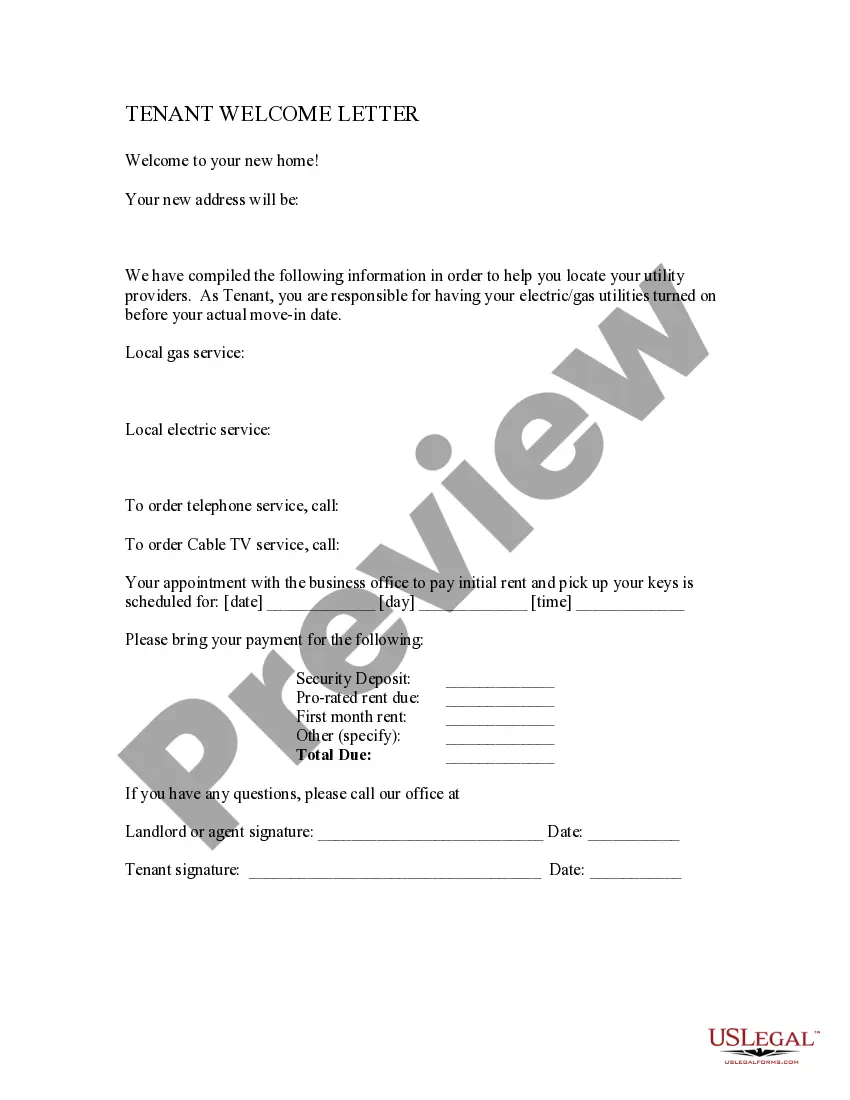

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Salt Lake Election of 'S' Corporation Status and Instructions - IRS 2553. Adhere to the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Election of 'S' Corporation Status and Instructions - IRS 2553 in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

In order to become an S corporation, the corporation must submit Form 2553 Election by a Small Business Corporation signed by all the shareholders.

S Corporation Elections A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California.

Qualifications to Elect S Corporation Status It must be a domestic (U.S.) corporation, with no foreign investors; It must have no more than 100 shareholders; It has only one class of stock; It must use a December 31 year-end.

Electing Corporation vs. S Corporation Status To elect Corporation status, the LLC must file IRS Form 8832 - Entity Classification Election. To elect S Corporation status, the LLC must file IRS Form 2553 - Election by a Small Business Corporation. 2feff

(IRC Section 1361(b)(2). 1. All shareholders must consent to the election (IRC Section 1362(a)(2)) . All persons who a re shareholders in the corporation on the day on which the election is made must consent to such election.

To elect for S-Corp treatment, file Form 2553. You can make this election at the same time you file your taxes by filing Form 1120S, attaching Form 2533 and submitting along with your personal tax return.

All shareholders must consent to a subchapter S election. If an election is made within the first two months and 15 days of the tax year for which the election is to be effective, then any person who was a shareholder during that tax year must consent to the election (Reg.

The Form 2553 must be signed by the corporation's president, vice-president, treasurer, assistant treasurer, chief accounting officer, or any other officer duly authorized to act.

How to create an S Corporation in Utah Step 1: Choose a name.Step 2: Appoint a Registered Agent.Step 3: Select a Board of Directors (for a corporation) or Members (for an LLC)Step 4: Submit Articles of Incorporation or a Certificate of Organization to the Utah Division of Commerce.

S Corporation Elections Certain requirements must be met before a small business corporation can elect federal S corporation status. A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service.