Chicago, Illinois is a bustling city located in the state of Illinois, in the United States. As the largest city in the state and the third-largest city in the country, Chicago is a major economic and cultural hub. It is known for its stunning architecture, vibrant arts scene, world-class museums, and delicious cuisine. If you are starting a business or organization in Chicago, it is important to obtain a federal identification number from the Internal Revenue Service (IRS). This number, also known as an Employer Identification Number (EIN), is a unique nine-digit identifier used for tax purposes. To obtain your federal identification number in Chicago, Illinois, you will need to complete the relevant IRS Form SS-4. The SS-4 form is specifically designed for businesses and organizations to apply for an EIN. It collects important information such as the legal name of the entity, its address, responsible party details, type of organization, and more. When filling out the Chicago, Illinois IRS Form SS-4, ensure that you provide accurate information and select the appropriate entity type. There are several variations of the SS-4 form based on the type of organization you are applying for the federal identification number. The different types of organizations that commonly apply for an EIN using the SS-4 form include: 1. Sole Proprietorship: A sole proprietorship is an unincorporated business owned and operated by one individual. This type of business does not have a separate legal entity from its owner. 2. Corporation: A corporation is a separate legal entity distinct from its shareholders. It can be formed as either a C corporation or an S corporation, each with different tax implications. 3. Partnership: A partnership is a business carried on by two or more individuals or entities as co-owners. This includes general and limited partnerships. 4. Limited Liability Company (LLC): An LLC is a flexible form of business entity that combines the limited liability features of a corporation with the tax benefits and operational flexibility of a partnership. 5. Nonprofit Organization: Nonprofit organizations are typically formed for charitable, educational, religious, scientific, or literary purposes. They are exempt from federal income tax and must meet specific criteria to qualify for tax-exempt status. Once you have completed the relevant IRS Form SS-4 for your specific organization type, you can submit it to the IRS. The processing time for obtaining your federal identification number may vary, but it is important to ensure accurate and timely submission to avoid unnecessary delays. In summary, Chicago, Illinois requires individuals and organizations to complete the appropriate IRS Form SS-4 to obtain a federal identification number. The form varies depending on the type of organization, such as sole proprietorship, partnership, corporation, LLC, or nonprofit organization. Submitting the SS-4 form accurately and promptly is crucial to efficiently obtaining your EIN for proper tax reporting and compliance purposes in Chicago, Illinois.

Chicago Illinois I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out Chicago Illinois I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

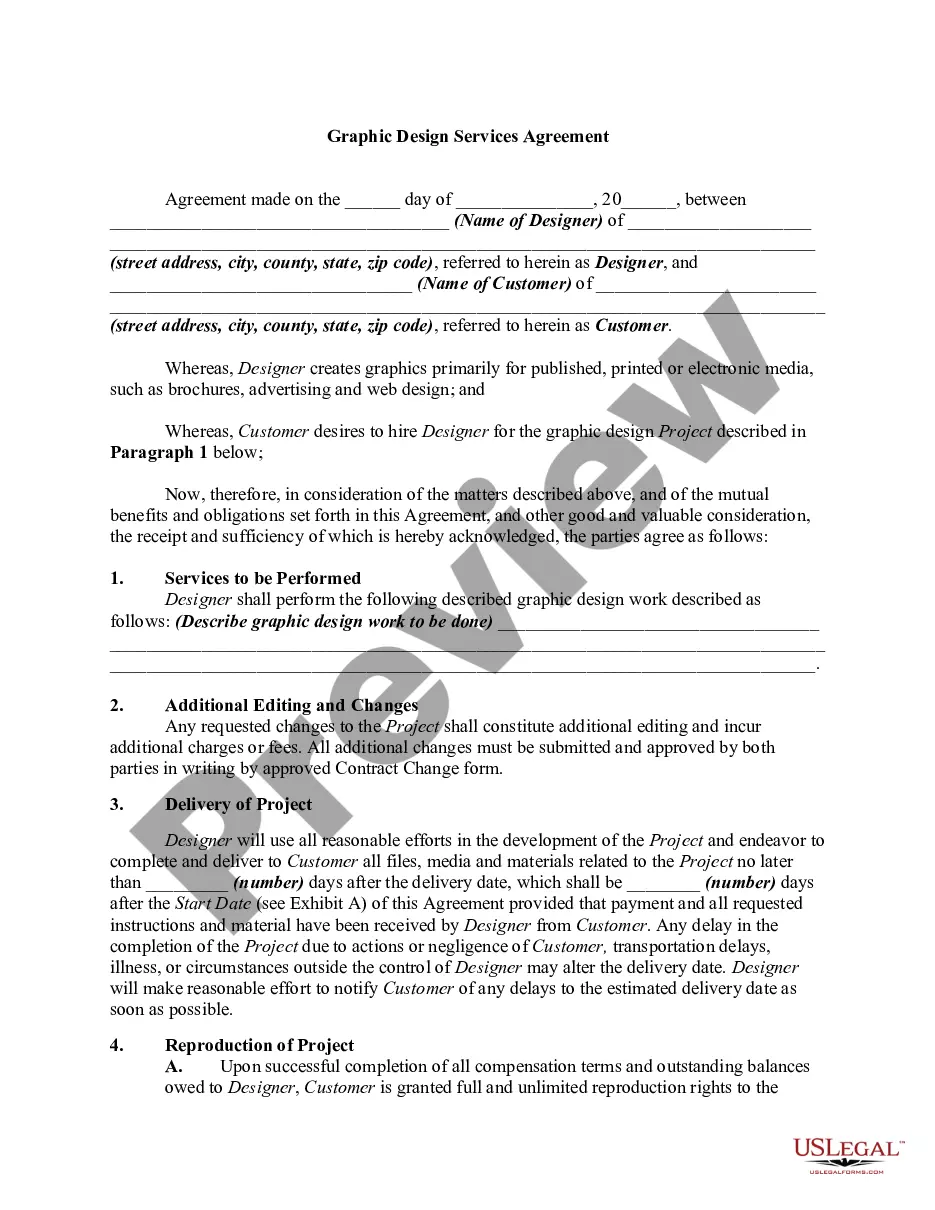

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life situation, locating a Chicago I.R.S. Form SS-4 (to obtain your federal identification number) meeting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the Chicago I.R.S. Form SS-4 (to obtain your federal identification number), here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Chicago I.R.S. Form SS-4 (to obtain your federal identification number):

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago I.R.S. Form SS-4 (to obtain your federal identification number).

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

How Do I Apply for an Employer ID Number? Online. You can apply online using the IRS EIN Assistant process. You must complete the application in one session.Phone. Call the IRS Business and Specialty tax line at 800-829-4933. Fax your completed ? and signed ? SS-4 form to the IRS.

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Income Tax Return for Estates and Trusts.

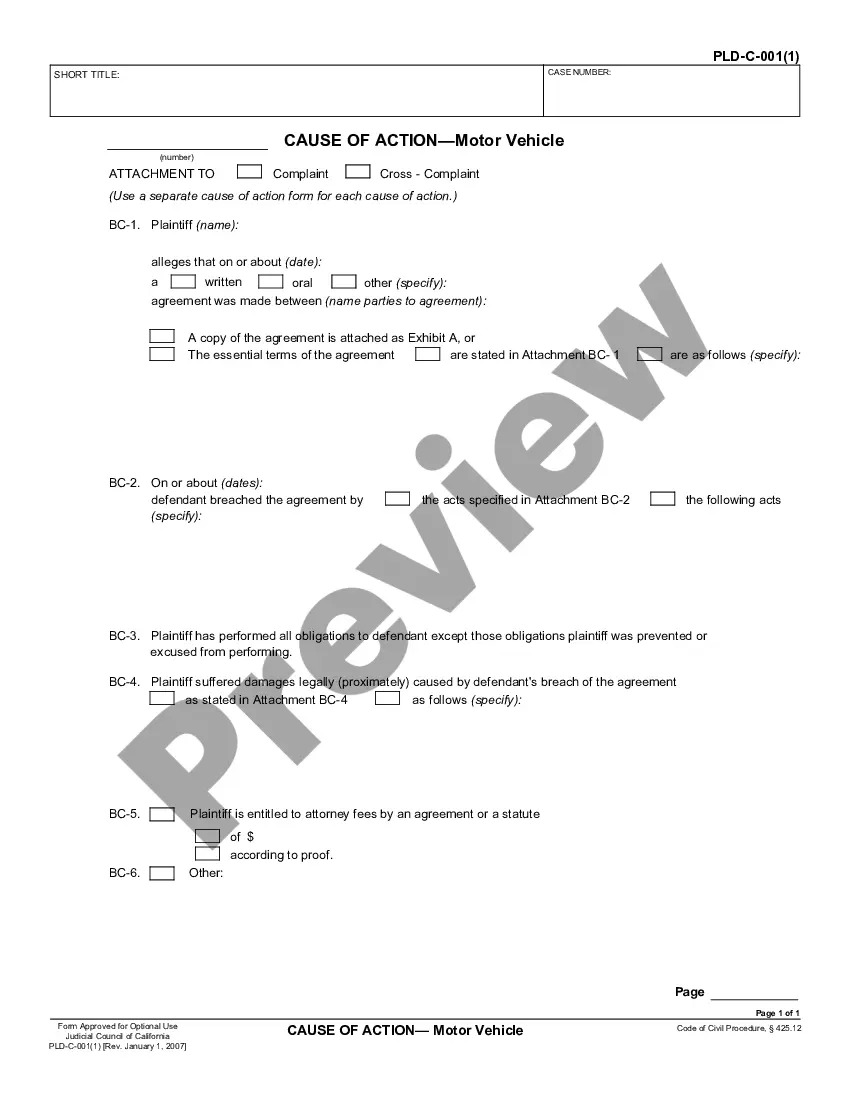

The IRS Form SS-4, Application for Employer Identification Number (EIN), is the form you file with the IRS to request an Employer Identification Number. There are three ways to obtain an SS-4 form from the IRS. The form can be obtained from the IRS website, from your local IRS office, or by mail.

You can request a replacement copy by calling the IRS Business and Specialty Tax Line. The phone number is (800) 829-4933, and the line is open from 7 a.m. to 7 p.m., taxpayer local time, Monday through Friday.

Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online. The IRS will not email or fax the letter, they will send it via mail within eight to ten weeks of issuing your company a Federal Tax ID Number.

If you don't have a copy of Form SS-4, or have not yet applied for an EIN, you can now use the IRS' online application tool to submit your Form SS-4 and obtain it.

Apply for a FEIN online, by phone or through the mail. If you are required to have a FEIN, there are several ways you can apply for one: By phone: (800) 829-4933. By fax or mail: You can find Form SS-4 here and locate the fax number and mailing addresses for your location on the IRS website.

SS4 EIN Verification Letter (147C) The only way to get the EIN verification letter or 147C is to call the IRS at 1800-829-4933. You can either receive the EIN verification letter via mail or fax. Due to security reasons and data privacy, the IRS doesn't send the letter via email.

You can get an EIN immediately by applying online. International applicants must call 267-941-1099 (Not a toll-free number). If you prefer, you can fax a completed Form SS-4 to the service center for your state, and they will respond with a return fax in about one week.

Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are a.m. - p.m. local time, Monday through Friday.