Nassau New York I.R.S. Form SS-4 is a crucial document required by individuals and businesses located in Nassau County, New York, who need to obtain a federal identification number. This form is essential for tax-related purposes and serves as an application for an Employer Identification Number (EIN) or a Social Security Number (SSN). The I.R.S. Form SS-4 is a comprehensive form that requires detailed information about the applicant, including their personal or business name, address, contact details, tax filing status, and the reason for applying for an identification number. This form is used to establish the taxpayer's identity and allows them to accurately report and pay their taxes. While there is typically only one version of the Nassau New York I.R.S. Form SS-4, it is worth mentioning that there may be different variations of this form for specific entities. For instance: 1. Form SS-4 for Sole Proprietorship: This version is intended for individuals operating their business as sole proprietors in Nassau County. It is designed to collect the necessary information to establish the individual's federal identification number, which will be used to track taxes and other financial obligations related to their business activity. 2. Form SS-4 for Corporations: This variation of the form is specifically designed for corporations based in Nassau County, New York. It requires detailed information about the corporation, including its legal name, registered agent, principal business activity, and other necessary details to obtain a federal identification number. 3. Form SS-4 for Partnerships: Businesses operating as partnerships within Nassau County can utilize this particular form to obtain a federal identification number. It gathers information about the partnership's general partners, their responsibilities, and other relevant details vital for tax purposes. Submitting a completed Nassau New York I.R.S. Form SS-4 is important for individuals and businesses to ensure compliance with tax regulations and facilitate smooth interactions with the Internal Revenue Service (IRS). By accurately completing this form, applicants can obtain their federal identification number promptly, enabling them to fulfill their tax obligations while conducting business within Nassau County, New York.

Nassau New York I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out Nassau New York I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Nassau I.R.S. Form SS-4 (to obtain your federal identification number), it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Nassau I.R.S. Form SS-4 (to obtain your federal identification number), you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Nassau I.R.S. Form SS-4 (to obtain your federal identification number):

- Look through the page and verify there is a sample for your area.

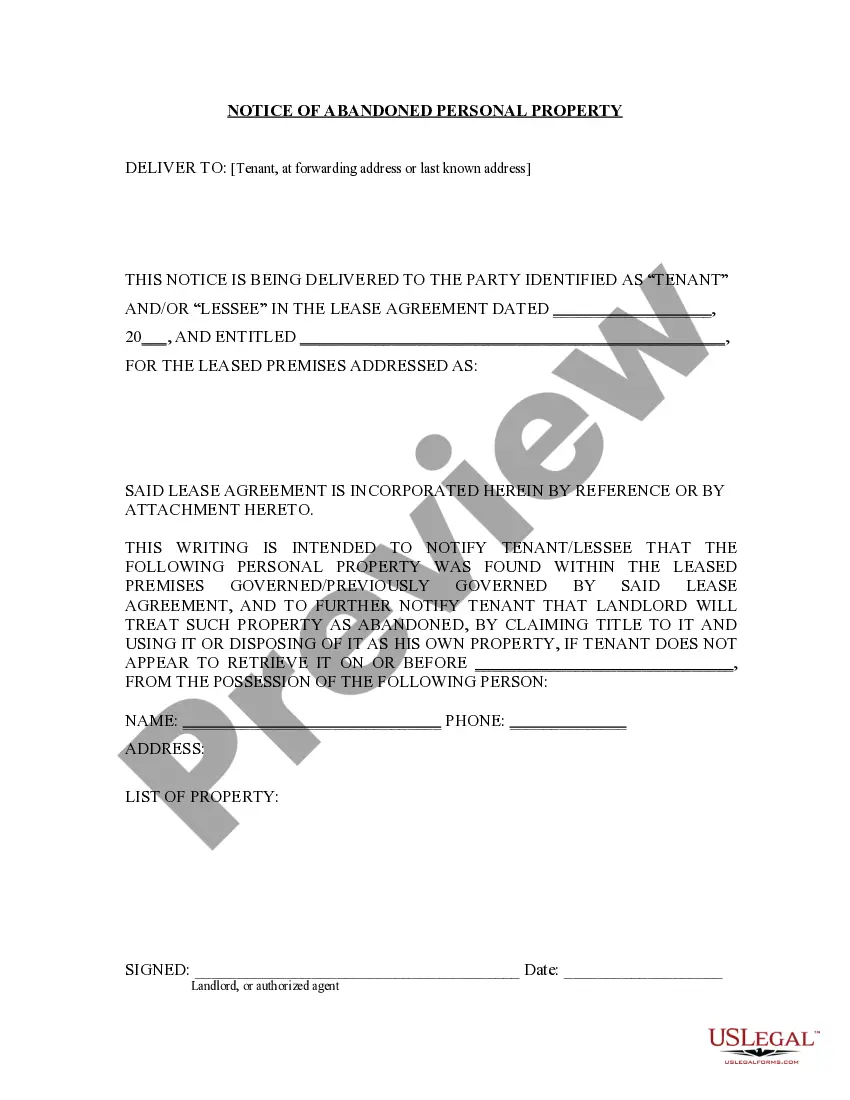

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Nassau I.R.S. Form SS-4 (to obtain your federal identification number) and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!