Lima, Arizona IRS Form SS-4 is an essential document required to obtain a Federal Identification Number (FIN) for businesses, nonprofit organizations, and other entities operating in the United States. This form serves as a crucial step in establishing legal and tax compliance. The Lima, Arizona IRS Form SS-4 acts as an application for an Employer Identification Number (EIN), which is an identifier used by the Internal Revenue Service (IRS) to track business activities and tax filings. This unique nine-digit code, also known as a Federal Tax Identification Number (TIN), enables the IRS to categorize and monitor entities for tax purposes. The Lima, Arizona IRS Form SS-4 encompasses various details necessary for the application of an EIN, including: 1. Business Entity Information: This section requires the legal name, mailing address, and type of entity (such as corporation, sole proprietorship, partnership, etc.). 2. Responsible Party Information: Here, the form asks for details about the individual responsible for the entity's operations, including their name, social security number, contact information, and position in the organization. 3. Reasons for Applying: This part requires a brief explanation of the reasons for obtaining an EIN, be it starting a business, hiring employees, opening a bank account, or other relevant purposes. 4. Process and Signature: The final section guides applicants through the submission process, including providing the date of formation or acquisition, estimated employment, and anticipated first payroll date, followed by the authorized signature. While there may not be different types of Lima, Arizona IRS Form SS-4, it is crucial to accurately complete the form based on the specific entity type and intended tax classification. Different sections of the form may require additional information depending on the entity's structure, such as the number of partners in a partnership or the type of trust being established. Applying for an EIN through Lima, Arizona IRS Form SS-4 involves careful adherence to the provided instructions, ensuring accurate identification and classification of the entity. It is essential to review the completed form for any errors before submission to avoid potential delays or complications in obtaining the EIN. Remember, obtaining an EIN through the Lima, Arizona IRS Form SS-4 is necessary for maintaining legal and tax compliance, facilitating business operations, and ensuring accurate filing and reporting with the IRS.

Pima Arizona I.R.S. Form SS-4 (to obtain your federal identification number)

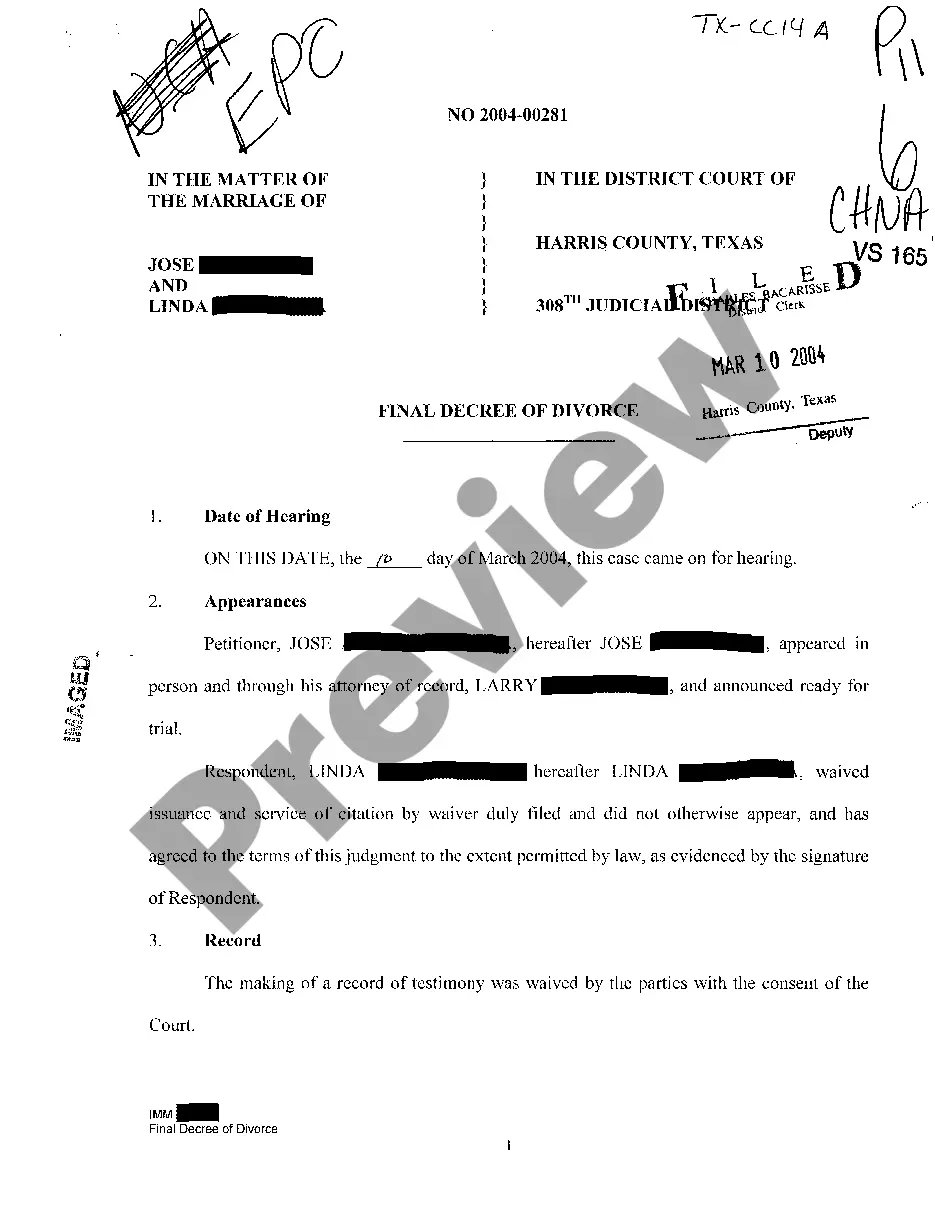

Description

How to fill out Pima Arizona I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Pima I.R.S. Form SS-4 (to obtain your federal identification number) is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Pima I.R.S. Form SS-4 (to obtain your federal identification number). Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Pima I.R.S. Form SS-4 (to obtain your federal identification number) in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!