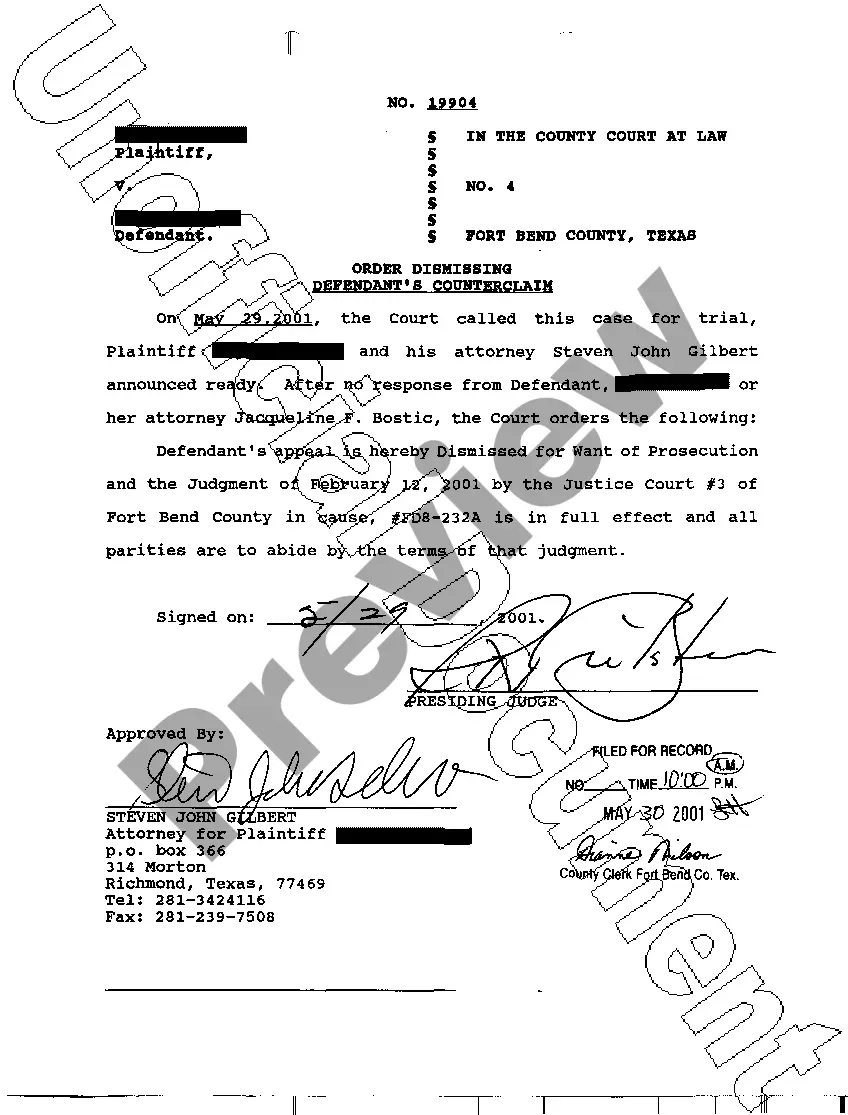

This complaint is for a plaintiff attorney who has been removed from the partnership of his former firm. The complaint requests an accounting of the former firm, stating that the plaintiff has been deprived of economic benefits rightfully due to him under the former partnership agreement, and also alleges egregious acts by his former partners.

Title: Sacramento California Alternative Complaint for Accounting: Exposing Egregious Acts in the Financial Industry Introduction: Sacramento, California, serves as a bustling hub for both personal and corporate finances. However, in certain cases, individuals and businesses may encounter unethical or fraudulent accounting practices. In such instances, filing an alternative complaint is necessary to safeguard one's interests. This article will provide a detailed description of the Sacramento California Alternative Complaint for Accounting, focusing specifically on cases involving egregious acts by accounting professionals. 1. Sacramento California Alternative Complaint for Accounting: The Sacramento California Alternative Complaint for Accounting serves as an official channel for individuals or businesses to report misconduct, dishonesty, fraud, or any other egregious acts committed by accountants. This complaint is an alternative to traditional complaints lodged with government agencies or professional accounting organizations, offering an additional avenue for reparation. 2. Types of Sacramento California Alternative Complaint for Accounting: a) Gross Misrepresentation Complaint: This type of complaint entails situations where an accounting professional deliberately misrepresents financial data to benefit themselves, the organization they represent, or any other stakeholders. Misrepresented financial information can have severe consequences, leading to financial loss, missed opportunities, or even bankruptcy. b) Embezzlement and Fraud Complaint: These complaints involve allegations of embezzlement or fraudulent activities conducted by an accountant or accounting firm. Instances may include falsifying financial records, unauthorized fund transfers, or misappropriation of funds entrusted to the accountant's care. c) Breach of Fiduciary Duty Complaint: In this type of complaint, individuals or businesses accuse an accounting professional of breaching their fiduciary duty. This breach occurs when an accountant fails to act in the best interests of their client(s) or manipulates financial data for personal gain, causing substantial harm to clients both financially and reputably. d) Confidentiality Violation Complaint: This complaint arises when an accountant knowingly or negligently discloses confidential financial information, resulting in reputational damage or financial loss for individuals or businesses. Violations of client confidentiality can often lead to legal implications against the involved accounting professional. e) Professional Negligence Complaint: Accounting professionals have a duty to provide accurate and reliable financial advice. Therefore, individuals or businesses can file a complaint when an accountant's negligence leads to significant financial losses or damages due to careless errors, omission of vital information, or improper handling of financial matters. Conclusion: The Sacramento California Alternative Complaint for Accounting provides an essential avenue for seeking justice and accountability when egregious acts occur in the financial industry. Whether it involves gross misrepresentation, fraud, breach of fiduciary duty, confidentiality violations, or professional negligence, affected parties can use this complaint method to bring financial wrongdoers to justice and protect their interests.