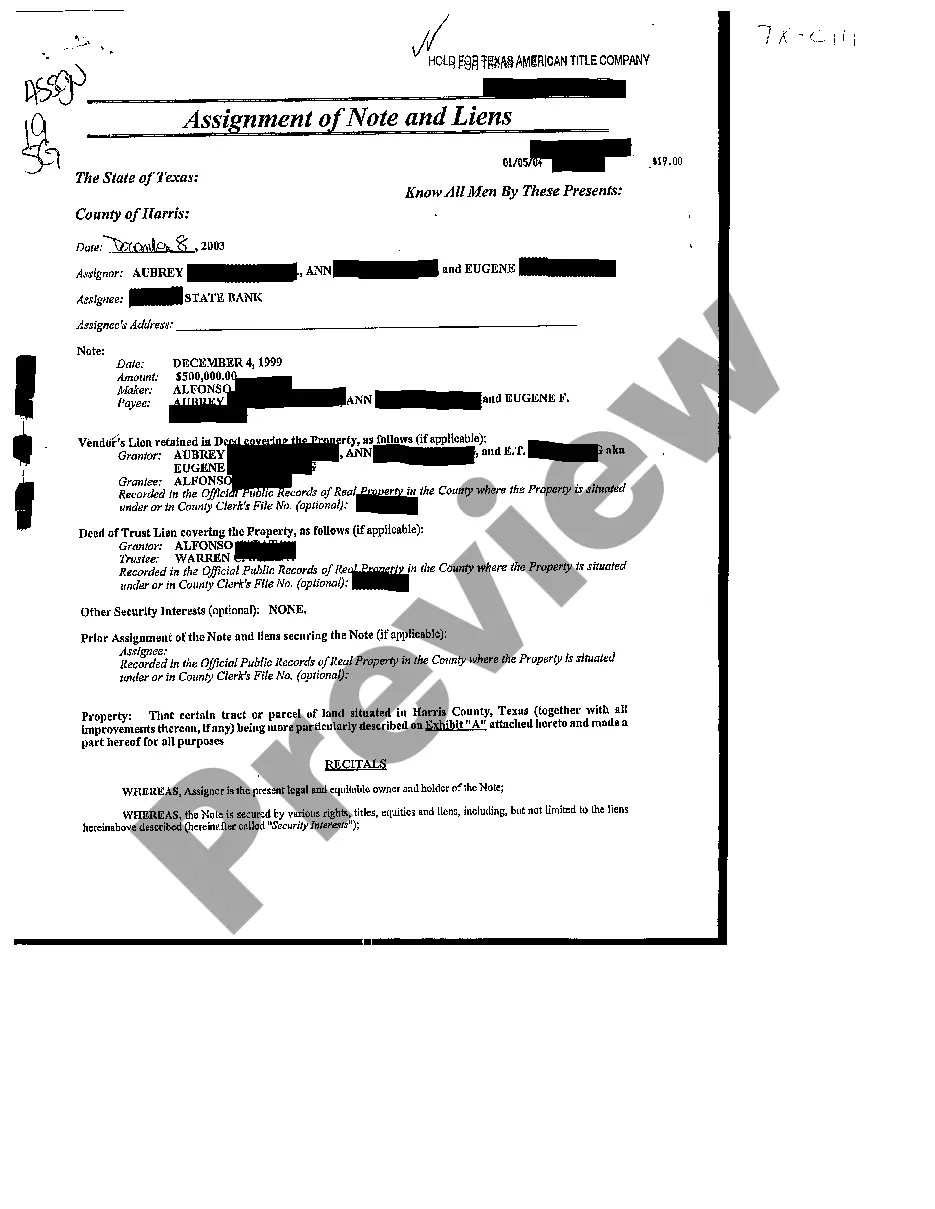

This complaint is for a plaintiff attorney who has been removed from the partnership of his former firm. The complaint requests an accounting of the former firm, stating that the plaintiff has been deprived of economic benefits rightfully due to him under the former partnership agreement, and also alleges egregious acts by his former partners.

Travis Texas Alternative Complaint for an Accounting which includes Egregious Acts is a legal process that allows individuals or businesses to file a detailed complaint against an accountant or accounting firm engaging in serious misconduct or fraudulent practices. This type of complaint is typically pursued when the allegations involve egregious acts that go beyond minor errors or negligence. In Travis Texas, several types of Alternative Complaints for an Accounting, involving egregious acts, can be filed depending on the specific circumstances. Some examples include the following: 1. Fraudulent Financial Reporting Complaint: This type of complaint involves allegations of intentional misrepresentation or manipulation of financial statements, such as overstating assets, understating liabilities, or inflating profits to deceive stakeholders. 2. Misappropriation of Funds Complaint: A complaint of this nature relates to the accountant or accounting firm being accused of embezzling or misusing funds entrusted to them by clients or employers. 3. Breach of Fiduciary Duty Complaint: This complaint is filed when an accountant or accounting firm breaches their fiduciary duty towards their clients by acting against their best interests, engaging in conflicts of interest, or disclosing confidential information without proper authorization. 4. Professional Negligence Complaint: In cases where an accountant or accounting firm's grossly negligent actions or omissions lead to significant financial harm or loss for their clients, a complaint for professional negligence may be filed. 5. Tax Evasion or Fraud Complaint: If an accountant or accounting firm is involved in assisting clients in evading taxes, fabricating tax documents, or engaging in fraudulent tax practices, a complaint can be filed under this category. When preparing an Alternative Complaint for an Accounting that includes Egregious Acts in Travis Texas, it is crucial to provide a detailed account of the alleged misconduct, including supporting evidence, financial records, and any other relevant documentation. It is advisable to seek the assistance of a qualified attorney specializing in accounting malpractice or professional misconduct to ensure the complaint is comprehensive, adheres to legal requirements, and maximizes the chances of achieving a favorable resolution or legal remedy.