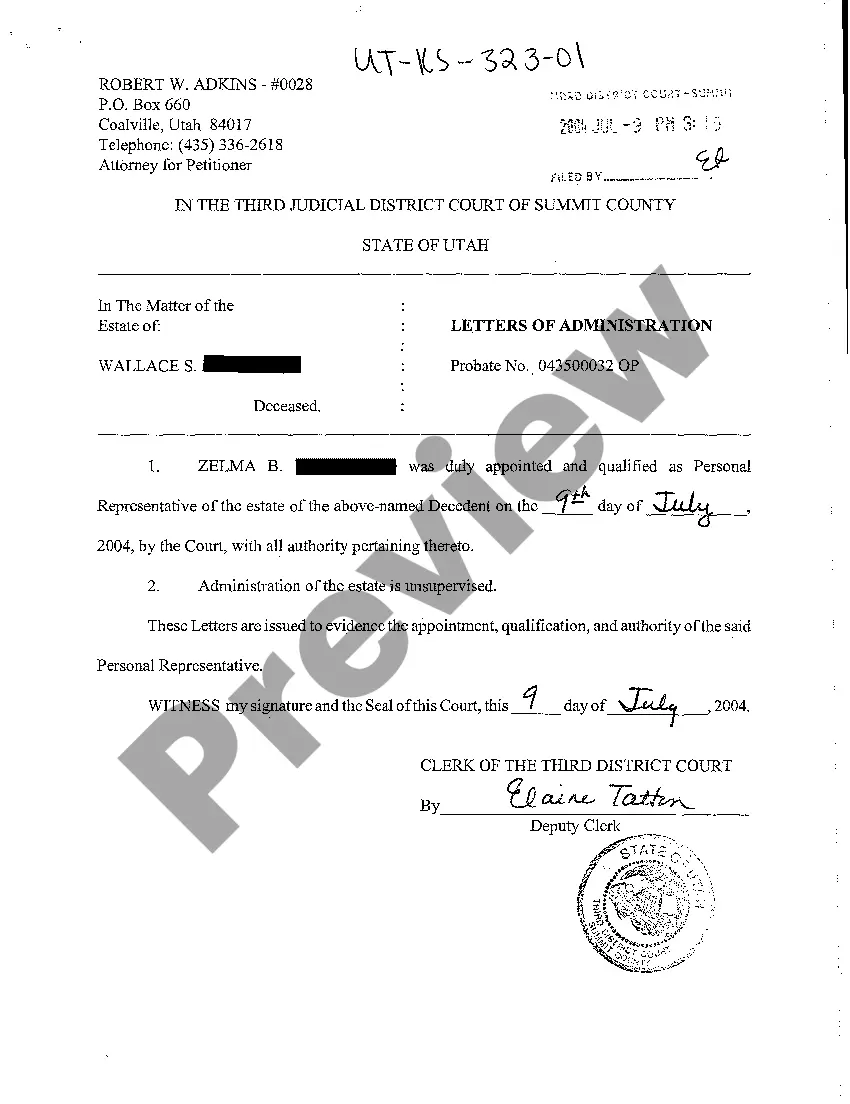

This is an order to resolve an action for accounting of a former partner's law firm. The order is the result of a motion filed by the defendant firm, and the defendant firm shall allow the plaintiff's accountant access to all records and documents necessary for the accounting.

A Salt Lake Utah Court Order Resolving an Action for Accounting refers to a legally binding judgment issued by a court in Salt Lake City, Utah, that aims to resolve disputes pertaining to financial accounting between two parties. This type of court order specifically addresses situations where an individual or entity requests an accurate and complete account of financial transactions, assets, and liabilities from another party. In Salt Lake City, there are various types of Court Orders Resolving an Action for Accounting, each catering to specific scenarios. Some of them include: 1. Divorce or dissolution-related accounting disputes: This type of court order is commonly relevant in divorce or dissolution cases, where there is a need to divide marital property, assess financial earnings, or determine child and spousal support obligations. The court may order an action for accounting to resolve disputes over hidden assets, undisclosed income, or inaccurate financial statements. 2. Business partnership accounting disputes: In cases involving business partnerships, conflicts may arise regarding financial matters, such as the distribution of profits, debt allocation, or suspected embezzlement. A court order for accounting can be sought to investigate and settle such disputes, ensuring transparency in financial records. 3. Probate accounting disputes: A court order for accounting in probate cases addresses issues related to the administration and distribution of a deceased person's estate. It ensures that the executor or administrator accurately accounts for assets, debts, and expenses, preventing any mismanagement or potential mishandling of the estate. 4. Trust or estate accounting disputes: This type of court order is relevant when conflicts arise among beneficiaries, trustees, or executors related to the management and accounting of trusts or estates. It helps resolve disputes regarding any alleged misappropriation of funds, unauthorized transactions, or failure to provide accurate financial reports. A Salt Lake Utah Court Order Resolving an Action for Accounting aims to bring clarity, promote fairness, and ensure compliance with legal and financial obligations. It requires the parties involved to provide comprehensive financial records and authorizes the court to review, audit, and scrutinize the accounts to facilitate a just resolution. Keywords: Salt Lake Utah, court order, action for accounting, disputes, financial transactions, assets, liabilities, divorce, dissolution, marital property, child support, spousal support, business partnerships, hidden assets, undisclosed income, financial statements, probate, estate, executor, administration, beneficiaries, trusts, misappropriation of funds, unauthorized transactions.