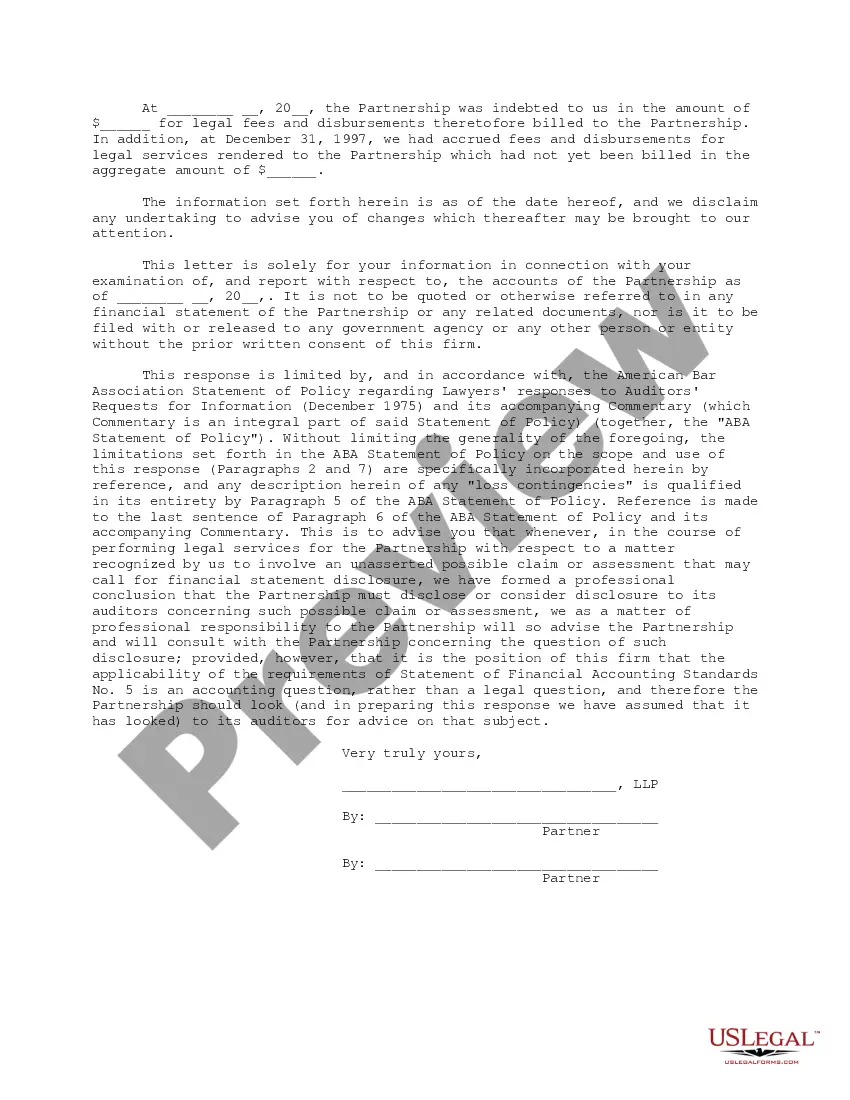

This is a law firm opinion letter in response to a request from a client. The letter conforms to the ABA Statement of Policy regarding opinion letters.

Bexar Texas Law Firm Opinion Letter is a legal document prepared by a law firm based in Bexar County, Texas, to provide an expert assessment and legal advice on various legal matters. These letters play a significant role in transactions involving real estate, securities, corporate mergers, acquisitions, and other business operations. The Bexar Texas Law Firm Opinion Letter is drafted by experienced attorneys who specialize in specific areas of law, ensuring the accuracy and reliability of the information contained within. These letters are often requested by clients, shareholders, lenders, and other parties involved in complex legal transactions to gain assurance and mitigate potential risks. There are several types of Bexar Texas Law Firm Opinion Letters, each serving a specific purpose: 1. Real Estate Opinion Letters: These letters are commonly used in real estate transactions, such as property purchases, mortgages, and leases. They provide an expert assessment of the title, ownership, and valuation of the property, ensuring its legality and marketability. 2. Corporate Opinion Letters: These letters are prepared for corporate transactions, including mergers, acquisitions, and initial public offerings (IPOs). They address legal matters related to the corporation's formation, corporate governance, compliance with laws, contractual obligations, and financial status. 3. Securities Opinion Letters: Securities transactions, such as public offerings and private placements, require expert legal analysis. These letters provide an assessment of compliance with state and federal securities laws, the validity of securities issuance, and the scope of any exemptions utilized. 4. Intellectual Property Opinion Letters: These letters address legal matters related to intellectual property, such as patents, trademarks, or copyrights. They evaluate the validity and enforceability of intellectual property rights, potential infringement issues, and due diligence related to licensing or transfers. 5. Tax Opinion Letters: In transactions involving tax implications, tax opinion letters are prepared to assess the tax consequences and compliance with applicable tax laws. These letters offer expert advice on tax planning, potential liabilities, and tax-related risks. Bexar Texas Law Firm Opinion Letters are highly regarded in legal and business communities due to the expertise and local knowledge they represent. They serve as a crucial tool in ensuring transparency, compliance, and a clear understanding of the legal implications within complex transactions in Bexar County, Texas.Bexar Texas Law Firm Opinion Letter

Description

How to fill out Bexar Texas Law Firm Opinion Letter?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Bexar Law Firm Opinion Letter.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Bexar Law Firm Opinion Letter will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Bexar Law Firm Opinion Letter:

- Make sure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Bexar Law Firm Opinion Letter on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!