Franklin Ohio Guarantee of Performance of Contract refers to a legal mechanism adopted in Franklin, Ohio, to ensure the execution of contracts in a satisfactory manner. This guarantee serves as a protection tool for the parties involved by mitigating potential risks and providing reassurance that contractual obligations will be fulfilled. The Franklin Ohio Guarantee of Performance of Contract applies to a wide range of agreements, including but not limited to construction contracts, service contracts, lease agreements, and sales contracts. It is essential to have such a guarantee in place, particularly in situations where substantial investments, services, or goods are involved. One type of Franklin Ohio Guarantee of Performance of Contract is a Surety Bond. This bond involves three parties: the principal (contractor or service provider), the obliged (the party in need of performance), and the surety (bonding company). The surety bond provides a promise that the principal will fulfill their contractual obligations according to the agreed terms and conditions. In the event of a breach, the surety will compensate the obliged for any resulting losses, up to the stated bond amount. Another type of guarantee is Cash Escrow. In this scenario, a specified amount of money is held in escrow by a neutral third party until the terms of the contract are fulfilled. If the performing party fails to meet their obligations, the escrow funds are released to compensate the non-performing party for their losses. Additionally, the Franklin Ohio Guarantee of Performance of Contract can also be secured through Letters of Credit (LOC). A letter of credit is a document issued by a bank on behalf of its customer (contractor or service provider). It assures the recipient (the party in need of performance) that the bank will pay a specified amount if the customer fails to fulfill their contractual obligations. These various types of guarantees of performance provide peace of mind and ensure that the contracted services, goods, or projects are completed satisfactorily. They protect both parties from financial loss or damages caused by non-performance or breaches of contract. The specific type of guarantee used will depend on the nature of the contract and the preferences of the parties involved. In conclusion, the Franklin Ohio Guarantee of Performance of Contract encompasses different mechanisms such as surety bonds, cash escrow, and letters of credit. It serves as a safeguard for parties entering into contractual agreements, ensuring that obligations are met and protecting against potential financial losses.

Franklin Ohio Guarantee of Performance of Contract

Description

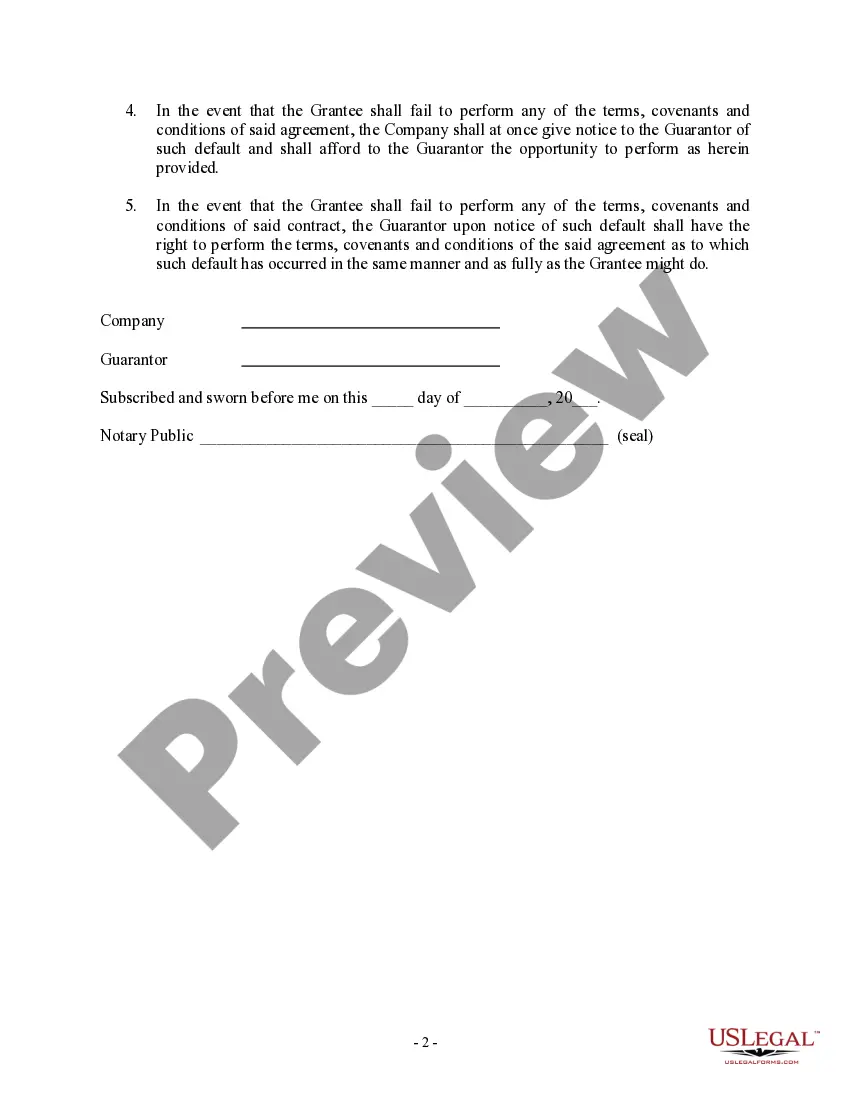

How to fill out Franklin Ohio Guarantee Of Performance Of Contract?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Franklin Guarantee of Performance of Contract, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Franklin Guarantee of Performance of Contract from the My Forms tab.

For new users, it's necessary to make some more steps to get the Franklin Guarantee of Performance of Contract:

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!