Collin Texas Loan Commitment Form and Variations: A Comprehensive Overview In Collin County, Texas, the Loan Commitment Form plays a crucial role in real estate transactions and financial borrowing processes. This document serves as a binding agreement between a lender and a borrower, outlining the terms and conditions of a loan agreement and confirming the lender's commitment to providing the requested funds. The Collin Texas Loan Commitment Form typically consists of several sections, each addressing important aspects of the loan. These sections generally include: 1. Borrower and Lender Information: This section provides details about the borrower, such as their name, address, and contact information, along with the lender's information. It ensures the accuracy of all parties involved in the loan commitment process. 2. Loan Terms and Conditions: Here, the form specifies the loan amount requested, the interest rate, repayment terms, and any associated fees. This section also clarifies the loan duration and any potential penalties for late payments or early repayment. 3. Collateral Information: If the loan requires collateral, such as a property or an asset, this section describes the collateral's details and confirms its acceptance as security for the loan. 4. Loan Documents Review: The form may require the borrower to acknowledge that they have reviewed and understand all the loan documents, ensuring transparency and informed consent. 5. Expiration and Commitment Period: The Loan Commitment Form usually sets a deadline by which the loan must be accepted, and the borrower must sign the agreement. This date signifies the commitment period, after which the lender may consider the agreement null and void. Variations of the Collin Texas Loan Commitment Form include: 1. Residential Loan Commitment Form: Specifically designed for residential real estate transactions, this variation addresses unique considerations relevant to home buyers, such as mortgage insurance requirements and government regulations. 2. Commercial Loan Commitment Form: Applicable to commercial real estate or business loans, this variation addresses factors like business plans, cash flow analysis, and potential income sources, which differ from residential loan agreements. 3. Construction Loan Commitment Form: When funding a construction project, this specific variation outlines additional requirements, including detailed construction plans, contractor agreements, and specified disbursement schedules. It is essential to consult with legal professionals and financial advisors to ensure accurate completion and understanding of the Collin Texas Loan Commitment Form and its variations. The terms and conditions within these forms have legal implications, providing clear guidelines and protection for both lenders and borrowers throughout the loan commitment process.

Collin Texas Loan Commitment Form and Variations

Description

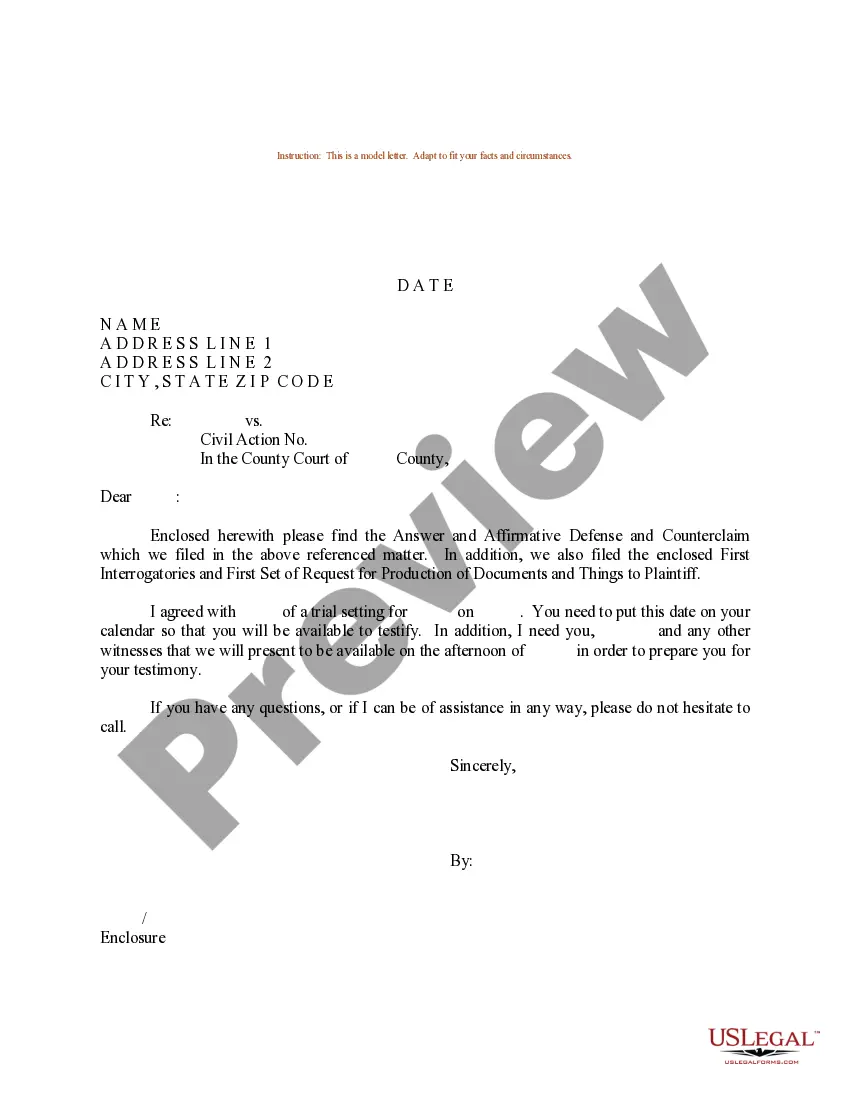

How to fill out Collin Texas Loan Commitment Form And Variations?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Collin Loan Commitment Form and Variations, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Collin Loan Commitment Form and Variations from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Collin Loan Commitment Form and Variations:

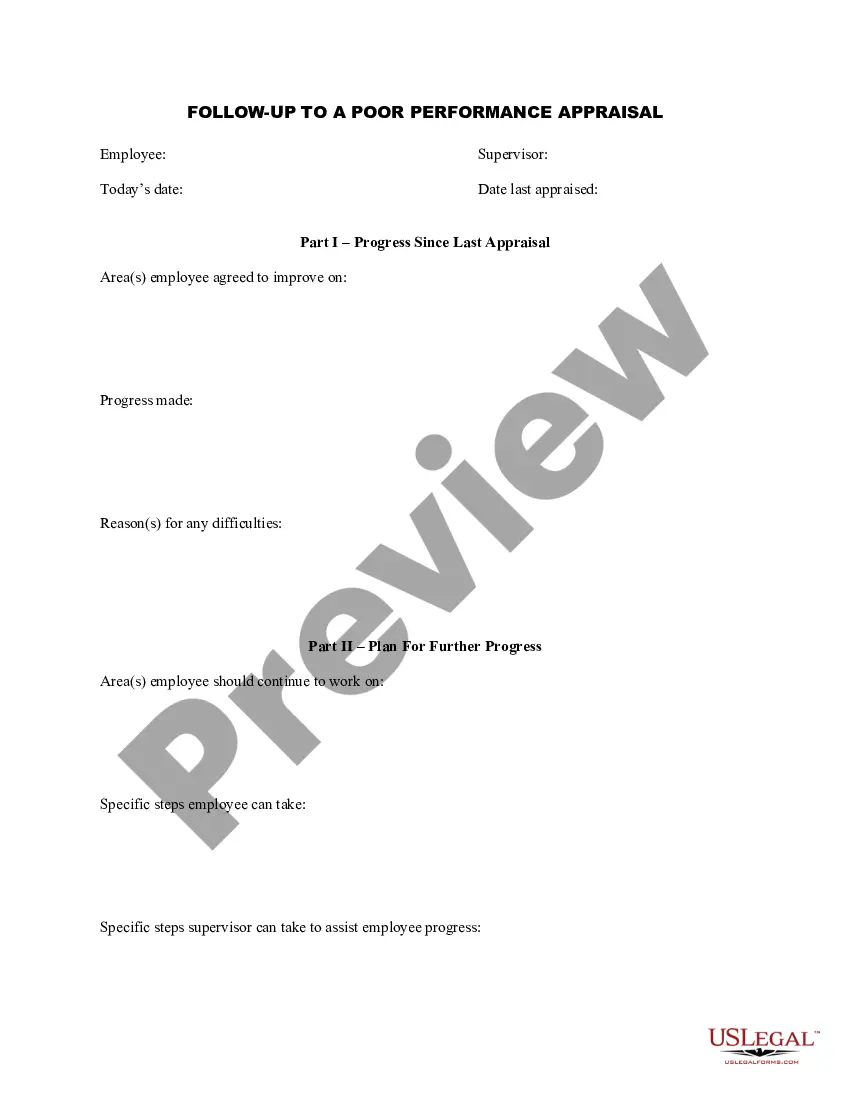

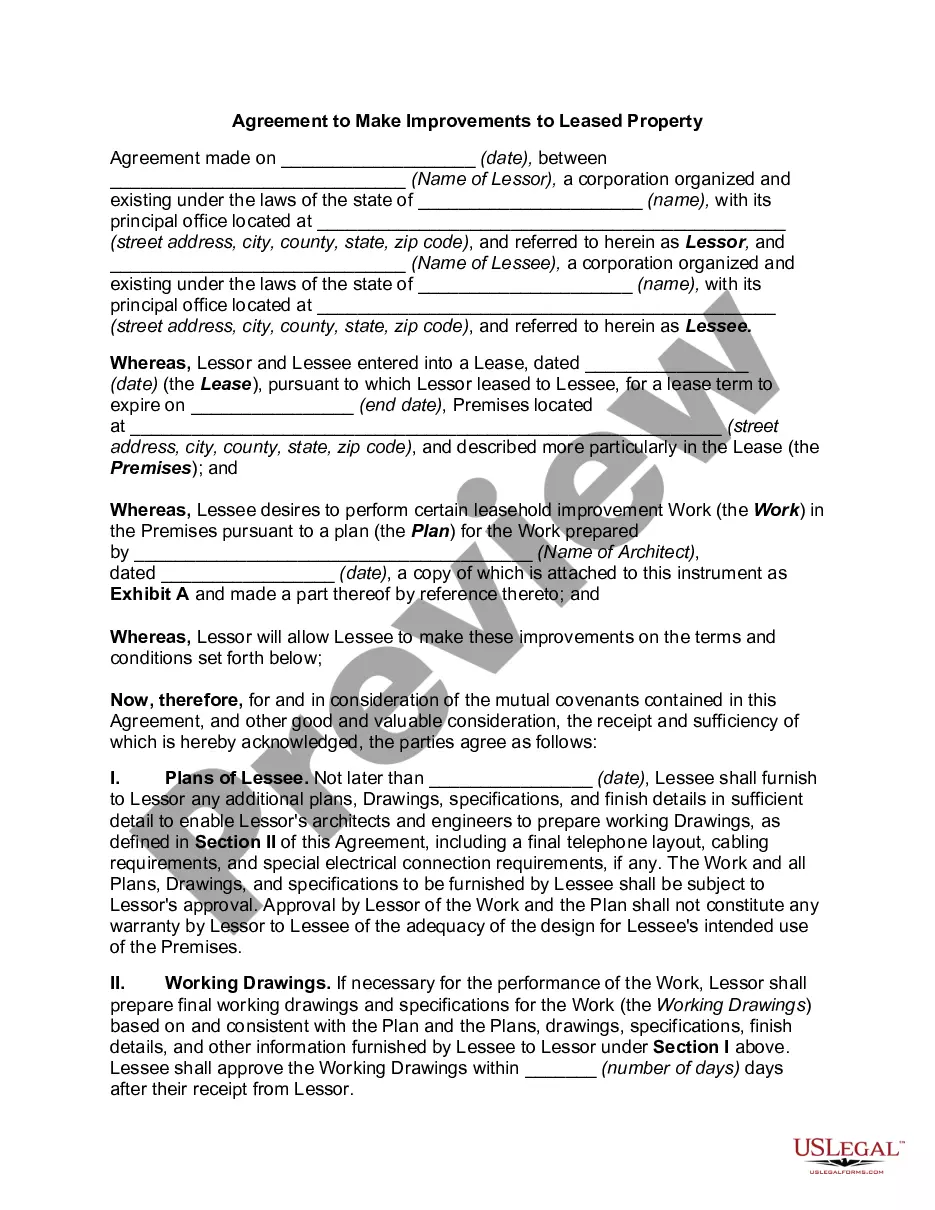

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

What happens after receiving your mortgage commitment letter? Once your mortgage commitment letter has been submitted, you've entered the final stage of the mortgage process. The letter is not a final approval, but more so a pledge to the borrower that the mortgage lender will grant the loan if all conditions are met.

A loan commitment takes the pre-approval a step further. After the lender has compiled everything needed from the pre-approval stage, they take the time to verify the documents provided. After being verified, they issue a loan commitment for the amount they're willing to let the buyer borrow.

A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

How Long Does it Take to Get a Mortgage Commitment Letter? Exactly when you'll receive the letter varies, but it typically takes between 20 and 45 days. The commitment letter is issued after you submit your application with all the required documents, such as pay stubs, bank statements, etc.

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.

A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

A conditional mortgage commitment letter doesn't mean you're approved for the loan; it means that the lender is committed to helping you buy a home if certain conditions are satisfied, such as: A home inspector evaluates the property, and any issues that come up are resolved.

In general, it should take about 30 days from accepted offer through the date your loan closes. As a reminder, this is just a general timeline; the process can be faster or slower.

Once your loan is approved, you will get a commitment letter from the lender. This document outlines the loan terms and your mortgage agreement. Your monthly costs and the annual percentage rate on your loan will be available for review. Any conditions that must be met before closing will also be documented.