Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company to consider annual disbursement to members — Types 1. General Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company: This is a standard notice used to inform the members of an LLC in Fairfax, Virginia about an upcoming meeting to discuss and consider the annual disbursement to the members. The notice will include the date, time, and location of the meeting, as well as an agenda outlining the topics to be discussed. This type of notice is typically sent to all members of the LLC. 2. Special Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company: If there are specific circumstances or special considerations related to the annual disbursement to members, a special notice may be required. This notice will provide additional details about the meeting and any specific information the members need to be aware of before attending. It may also include any specific requirements for voting or decision-making related to the disbursement. 3. Emergency Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company: In urgent situations where an immediate decision is required regarding the annual disbursement to members, an emergency notice may be issued. This notice will provide a short timeframe for the meeting and may bypass certain procedural requirements to address the issue at hand promptly. 4. Virtual Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company: In modern times, it has become increasingly common for LCS to hold virtual meetings. This type of notice will provide details on conducting the meeting online through video conferencing or other digital platforms. It will include instructions on how to join the meeting virtually, the agenda for the discussion, and any necessary preparation the members need before attending. 5. Proxy Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company: If a member of an LLC in Fairfax, Virginia cannot attend the meeting but wishes to have their vote counted, they may appoint a proxy to represent them. This type of notice will outline the instructions and procedures for appointing a proxy, including the necessary forms and any deadlines for submission. By using these relevant keywords and understanding the different types of notices for a Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company, the content will provide comprehensive information for readers seeking details specific to their situation.

Fairfax Virginia Notice of Meeting of Members of LLC Limited Liability Company to consider annual disbursement to members

Description

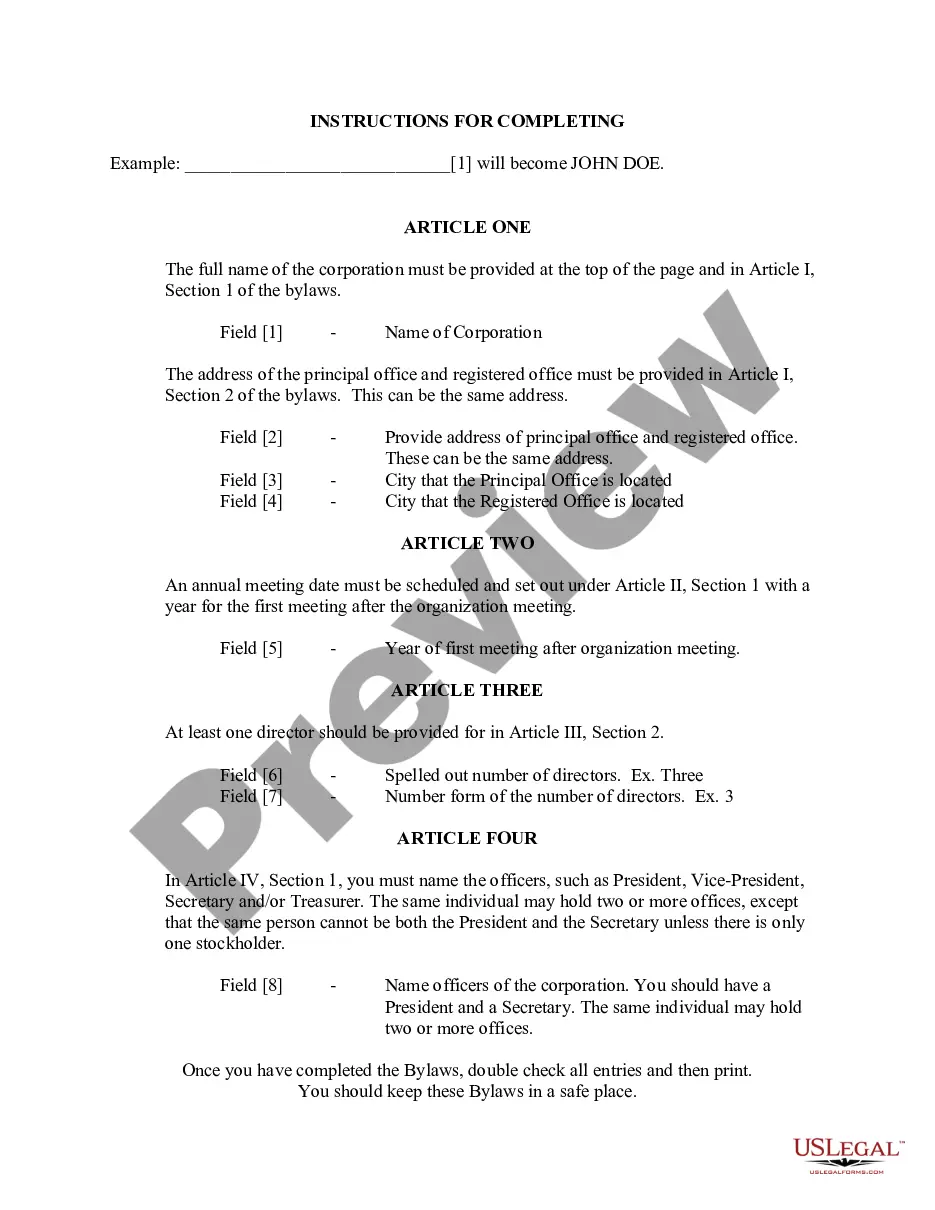

How to fill out Fairfax Virginia Notice Of Meeting Of Members Of LLC Limited Liability Company To Consider Annual Disbursement To Members?

Creating paperwork, like Fairfax Notice of Meeting of Members of LLC Limited Liability Company to consider annual disbursement to members, to manage your legal matters is a difficult and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents created for a variety of scenarios and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Fairfax Notice of Meeting of Members of LLC Limited Liability Company to consider annual disbursement to members form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before getting Fairfax Notice of Meeting of Members of LLC Limited Liability Company to consider annual disbursement to members:

- Make sure that your form is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Fairfax Notice of Meeting of Members of LLC Limited Liability Company to consider annual disbursement to members isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and get the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Indemnification is a way to provide limited liability protection to the people whose role is to manage, operate or oversee a company.

Dissociation typically means the voluntary withdrawal of a member from an LLC, but it can also occur involuntarily when the other members vote to expel a particular member. A member can voluntarily withdraw from an LLC at any time.

Many LLC Acts have a provision dealing with indemnification. Some have a general statement that an LLC must indemnify members or managers for liabilities they incurred in the ordinary course of the business of the company.

An LLC's profits must be allocated among its members every year. As long as the operating agreement contains provisions governing how profits are to be allocated, the profit allocation rules as set out in the operating agreement will be followed, rather than the default state rules.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

Indemnification is a key protection for officers, directors and key employees, and the scope of an LLC's or corporation's indemnity provisions demands close attention. In an LLC, indemnification is completely discretionary and the scope of indemnification, if any, can be defined in the LLC's Operating Agreement.

Updated October 28, 2020: LLC distributions to members refer to shares of profits that a limited liability company (LLC) distributes to its owners. The way profits are distributed is specified in the LLC's operating agreement. The members of an LLC are required to pay taxes on the distributions they receive.

Shareholder shall indemnify, defend and hold harmless the Company and its officers, directors, employees, agents, affiliates and permitted assigns (each, a Company Indemnitee) from and against any and all losses, claims, damages, liabilities, judgments, costs and expenses (including reasonable attorneys' fees)

Member-managed LLC. A member-managed LLC is a business entity in which all members participate in the decision-making process. Each member has an equal right to manage the LLC's business, unless otherwise stated in the operating agreement. If a dispute arises, the vote of a majority generally rules.

In the context of business law, distribution of profits is the dispensing of the profits amongst partners of partnership, members of a Limited Liability Company, or employees in a company, as per the terms outlined in a profit-sharing agreement.