Contra Costa California Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. Contra Costa County, located in California, is a hub of economic activity and home to numerous businesses operating as Limited Liability Companies (LCS). As members of an LLC, individuals have the right to request detailed financial information from the company. This provision exists to ensure transparency, accountability, and enable proper decision-making by LLC members regarding the company's financial affairs. A Demand for Information from an LLC member is a formal request to gain access to various financial records and relevant information that allow members to evaluate the company's financial health, performance, and direction. The demand may include, but is not limited to, the following financial records and documents: 1. Balance sheets: These documents provide a snapshot of the company's financial position at a given point in time, detailing its assets, liabilities, and equity. 2. Income statements: Also known as profit and loss statements, income statements offer a comprehensive overview of the company's revenues, expenses, and net profit or loss within a specified period. 3. Cash flow statements: Cash flow statements disclose the company's cash inflows and outflows, showcasing how cash is generated and utilized within a specific timeframe. 4. General ledgers: General ledgers provide a summary of all transactions and financial activities recorded by the LLC. They assist in tracking transactions, verifying balances, and ensuring financial accuracy. 5. Tax returns: Copies of the LLC's filed tax returns can be requested by members to gain insights into the company's taxable income, deductions, and compliance with tax laws. 6. Financial projections and forecasts: Some LLC members might require access to financial projections and forecasts to assess the company's anticipated performance and growth potential. 7. Bank statements and financial institution records: These documents reveal the LLC's banking activities, including deposits, withdrawals, loans, and other pertinent financial transactions. The demand for financial information can be made by an LLC member for various reasons, such as auditing the company's financial statements, monitoring its financial stability, evaluating profitability, assessing compliance, or safeguarding member interests. It is important to note that the specific information requested may vary depending on the member's objectives and the relevance to their decision-making process. Different names for this type of demand may include Contra Costa California LLC Member Request for Financial Records, Contra Costa California LLC Member Demand for Financial Information, or Contra Costa California LLC Member Inquiry into Financial Records. Overall, Contra Costa California recognizes and provides legal provisions for LLC members to access financial records and ensure the necessary information is available for decision-making purposes, fostering trust and transparency among members and the LLC itself.

Contra Costa California Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

How to fill out Contra Costa California Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

Drafting documents for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Contra Costa Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. without expert help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Contra Costa Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Contra Costa Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.:

- Look through the page you've opened and verify if it has the document you need.

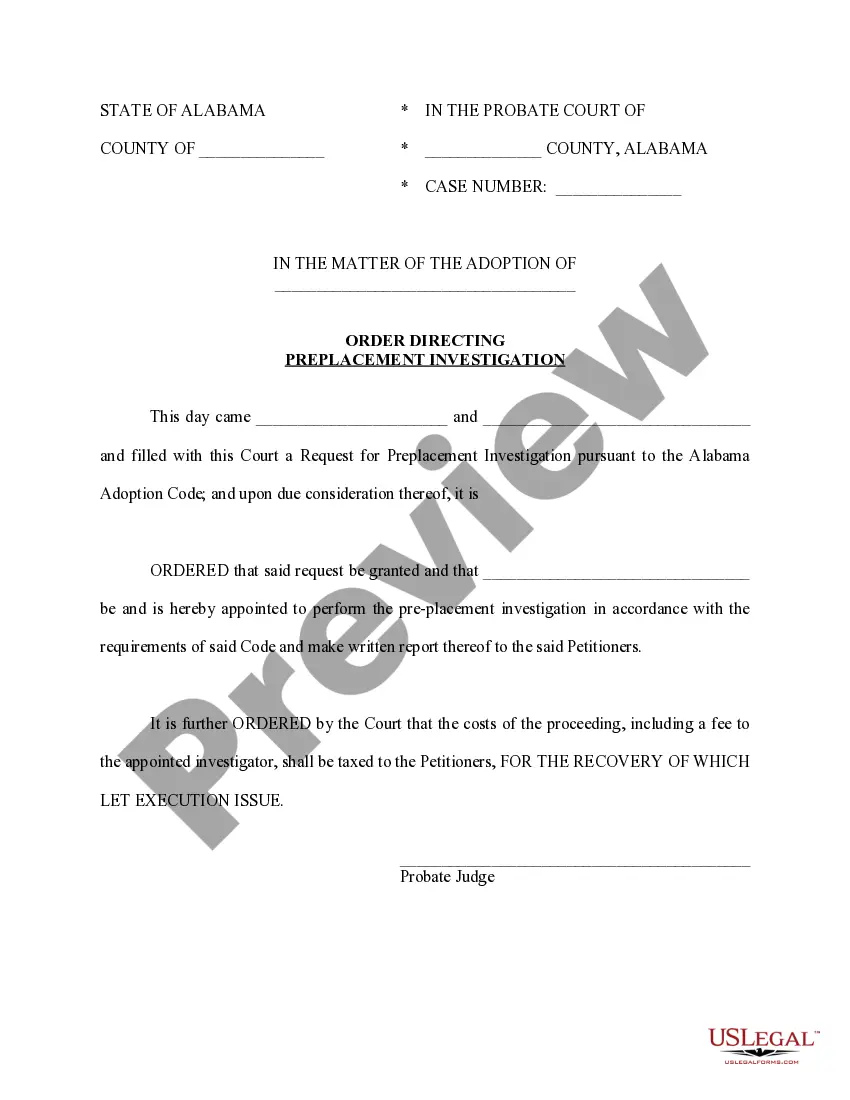

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!