Nassau New York Mortgage Demand Letter is a legal document sent by a mortgage lender or their representative to a borrower who has defaulted on their mortgage payments. The letter serves as a formal notification demanding the borrower to make immediate repayment of the outstanding mortgage amount and bring their account up to date. Keywords: Nassau New York, Mortgage Demand Letter, legal document, mortgage lender, defaulted, repay, outstanding mortgage amount, bring account up to date. Within the scope of Nassau New York Mortgage Demand Letters, there are typically two main types: 1. Pre-foreclosure Mortgage Demand Letter: This type of demand letter is typically sent in the early stages of the mortgage default process. It acts as a warning to the borrower, signaling that they are at risk of facing foreclosure proceedings if they fail to rectify the delinquent payments promptly. 2. Post-foreclosure Mortgage Demand Letter: This demand letter is sent after the foreclosure process has been completed and the property has been repossessed by the lender. It demands the borrower to settle any remaining balance or deficiency resulting from the foreclosure sale. In both types of Nassau New York Mortgage Demand Letters, the content typically includes: 1. Introductory information: The letter begins with the lender's details, borrower's information, loan account number, and other relevant identifiers. 2. Outstanding payment details: It outlines the specific delinquent mortgage payments, including the dates the payments were due, the amount owed, and any late fees or penalties incurred. 3. Warning of potential consequences: The letter explains the potential legal consequences if the borrower fails to bring the account current, such as foreclosure, damage to the borrower's credit score, or legal action. 4. Specific instructions: Clear and concise instructions are provided for the borrower to follow in order to resolve the delinquency, including the exact amount to be paid, acceptable payment methods, and the deadline for compliance. 5. Contact information: The letter provides the lender's contact details, such as phone numbers and mailing address, allowing the borrower to reach out for further assistance or clarification. 6. Reference to applicable laws and regulations: The demand letter may reference relevant state and federal laws governing mortgage defaults and foreclosure proceedings to substantiate its legal standing. Nassau New York Mortgage Demand Letters should be drafted by or with the assistance of legal professionals with expertise in mortgage law to ensure compliance with all relevant regulations and to maximize their effectiveness in resolving the delinquency.

Nassau New York Mortgage Demand Letter

Description

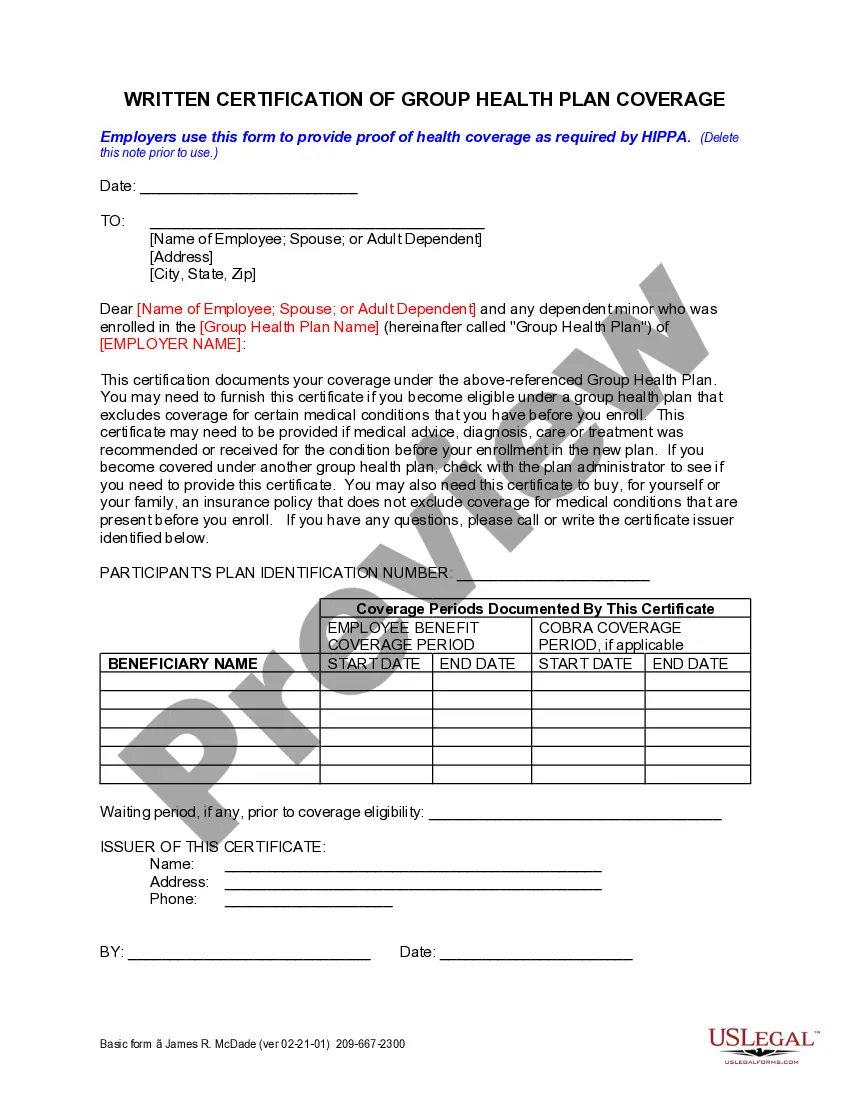

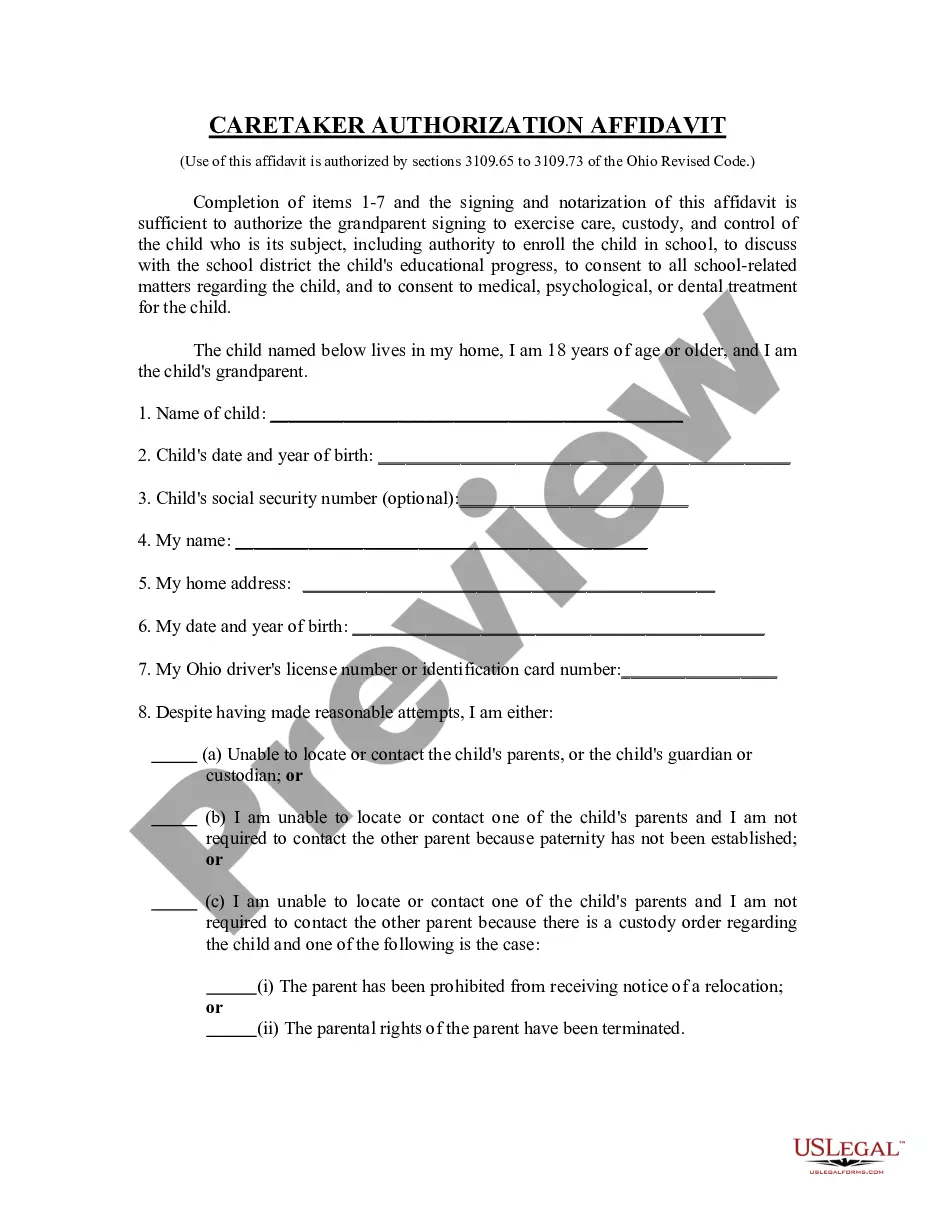

How to fill out Nassau New York Mortgage Demand Letter?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Nassau Mortgage Demand Letter, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Nassau Mortgage Demand Letter from the My Forms tab.

For new users, it's necessary to make some more steps to get the Nassau Mortgage Demand Letter:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!