Travis Texas Ordinance Adopting the Budget is a legislative mandate that outlines the financial plan and allocation of resources for a specific period within Travis County, Texas. This budget serves as a roadmap for the county's operations and public services, ensuring the efficient utilization of taxpayer funds towards community well-being. One type of Travis Texas Ordinance Adopting the Budget includes the Annual Budget Ordinance. This ordinance is passed by the Travis County Commissioners Court and details the estimated revenue, proposed expenditures, and desired outcomes for the upcoming fiscal year. It sets priorities, such as funding for education, public safety, infrastructure development, healthcare services, environmental protection, and more. The Annual Budget Ordinance considers inputs from various county departments, elected officials, and community stakeholders before finalization. Another type is the Supplemental Budget Ordinance. This budget amendment is introduced when unforeseen circumstances arise or priorities change during the fiscal year, necessitating adjustments to the existing budget. The Supplemental Budget Ordinance allows for the allocation of additional funds or redistribution of resources to meet emerging needs or address unanticipated circumstances that might impact the county's operations. The Travis Texas Ordinance Adopting the Budget incorporates comprehensive financial documents and reports, including revenue projections, expenditure breakdowns, and an analysis of key financial indicators. It reflects a transparent and accountable approach by providing detailed information about revenue sources (such as property taxes, grants, and fees), as well as how the funds are allocated across departments and programs. In addition, the Travis Texas Ordinance Adopting the Budget typically includes an overview of the economic factors considered during the budget planning process, including population growth, inflation rates, and other key indicators that may impact revenue and expenditure projections. This ensures that the budget is aligned with the county's broader economic goals and development strategies. Furthermore, public participation is an integral part of the Travis Texas Ordinance Adopting the Budget process. County residents have the opportunity to provide feedback and suggestions during public hearings, workshops, or through online platforms. This citizen engagement enables the county to consider the community's needs and demands while formulating the budget. Overall, Travis Texas Ordinance Adopting the Budget is a comprehensive legislative measure that guides the financial planning and resource allocation for Travis County. It emphasizes accountability, transparency, public participation, and responsiveness to changing circumstances to best serve the community's interests and promote its overall well-being.

Travis Texas Ordinance Adopting the Budget

Description

How to fill out Travis Texas Ordinance Adopting The Budget?

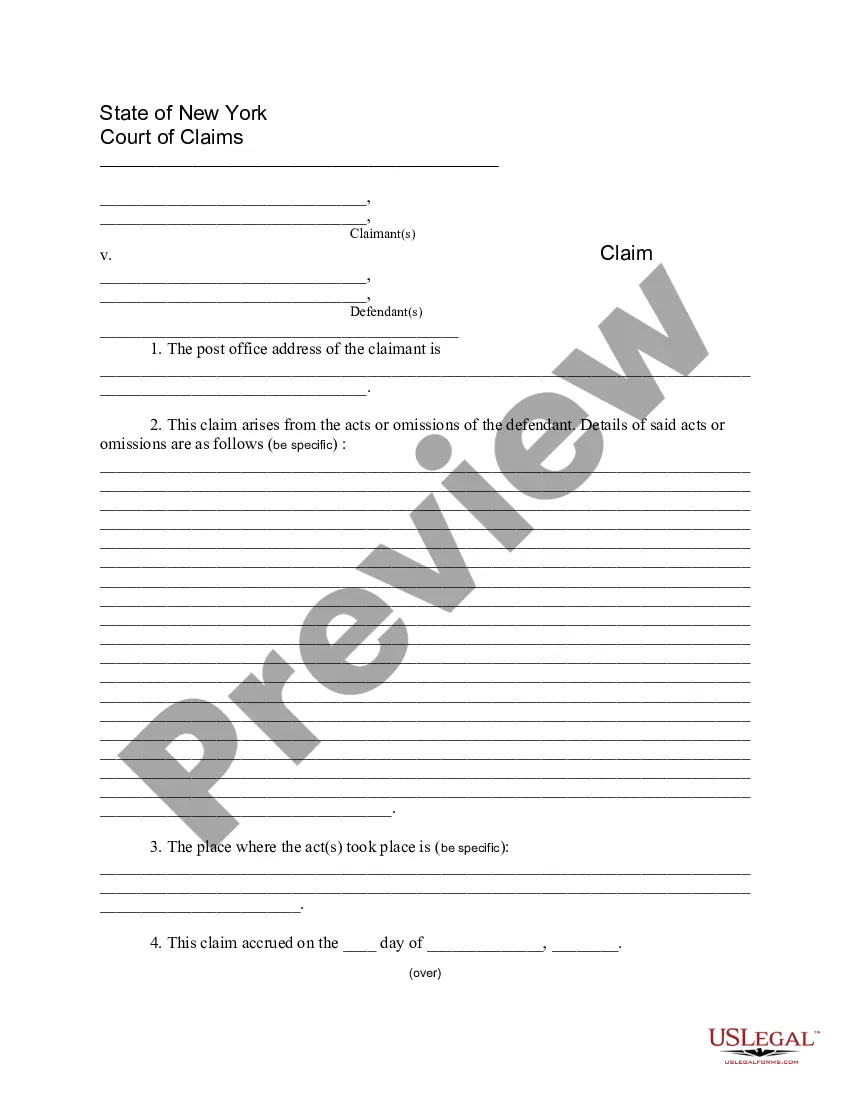

Are you looking to quickly create a legally-binding Travis Ordinance Adopting the Budget or maybe any other document to handle your own or corporate affairs? You can select one of the two options: hire a professional to write a valid document for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant document templates, including Travis Ordinance Adopting the Budget and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, carefully verify if the Travis Ordinance Adopting the Budget is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's intended for.

- Start the searching process again if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Travis Ordinance Adopting the Budget template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Government and infrastructure Like other Texas counties, Travis County is governed by a Commissioners' Court composed of the county judge and four county commissioners. The court levies county taxes and sets the budgets for county officials and agencies.

This administrative body was established by the Texas Constitution of 1876 and is comprised of a County Judge and four County Commissioners, all elected officials. The major duties of the Commissioners Court involve overseeing the budgetary and policymaking functions of county government.

Finally, the county with the highest property tax in Texas is Fort Bend at an average rate of 2.23% about double the national average. A lot of this comes from various special tax districts that impose specific levies. Fort Bend County has more than 811,000 people and a median home value of $233,300.

Notice of 2019 Tax Year Proposed Property Tax Rate for Travis County, Texas. A tax rate of $0.369293 per $100 valuation has been proposed by the governing body of Travis County, Texas.

Texas has no state property tax. All property is appraised at full market value, and taxes are assessed by local county assessors on 100% of appraised value....Property tax rates (%) in selected Austin metro area communities, 2021. CITYLeanderCOUNTY0.4408CITY0.4797SCHOOL DISTRICT1.3370COMM. COLLEGE0.104824 more columns

General Fund is the main general operating fund for Travis County. The source of these funds is primarily property taxes, but also includes fines and fees, interest, intergovernmental transfers, and charges for services.

Property taxes are calculated by multiplying the assessed value of the property minus applicable homestead, age 65+ and disability exemption amounts by the mil rates levied by the taxing authorities that have jurisdiction where the property is located.

1 Nearly half (47.1%) of this revenue came from the state and federal governments, and local property taxes made up almost one-fifth (19.5%) of the total.

Travis County commissioners on Sept. 21 unanimously approved a total fiscal year 2021-22 tax rate of $0.357365 per $100 valuation, an effective increase of 3.5% from the previous year.

County government is governed by the County Commissioners Court, comprised of one County Judge and four County Commissioners. A major responsibility of the Commissioners Court relates to setting the county budget.