Cook Illinois Credit Letter to Close Account is a formal written document issued by Cook Illinois, a renowned financial institution, when a customer requests to close their credit account. This letter outlines all the necessary details and procedures that need to be followed to successfully close the account. Cook Illinois Credit Letter to Close Account is crucial in ensuring a smooth and hassle-free closure process. The main purpose of Cook Illinois Credit Letter to Close Account is to inform the customer about the steps they need to take to terminate their credit account. It typically includes the customer's personal information, such as their name, account number, and contact details, ensuring accurate identification of the account in question. The letter also specifies the effective date of account closure, ensuring both the customer and the institution are aware of the closure timeline. Cook Illinois provides different types of Credit Letter to Close Account to cater to various scenarios and services. Some types of letters include: 1. Personal Credit Card Closure Letter: This letter is specifically used when customers want to close their personal credit card accounts. It includes details like the credit card number, outstanding balance, and any pending dues. 2. Business Credit Account Closure Letter: Cook Illinois also offers credit services to businesses. In such cases, the Business Credit Account Closure Letter includes specific company information, such as the business name, tax ID, and account details related to credit lines or loans extended to the business. 3. Joint Account Closure Letter: Joint account holders who wish to close their shared credit account will receive a Joint Account Closure Letter. This letter requires input from all account holders, including their signatures, to validate the closure request. Regardless of the specific type, Cook Illinois Credit Letter to Close Account emphasizes the importance of settling any outstanding balances, updating automatic bill payments or direct deposits, returning any physical credit cards, and providing a forwarding address for future communications or refunds. It is crucial to read the letter thoroughly, adhere to the provided instructions, and complete any necessary paperwork or documentation as specified by Cook Illinois. Failure to comply with the requirements may result in delays or complications in closing the account.

Cook Illinois Credit Letter to Close Account

Description

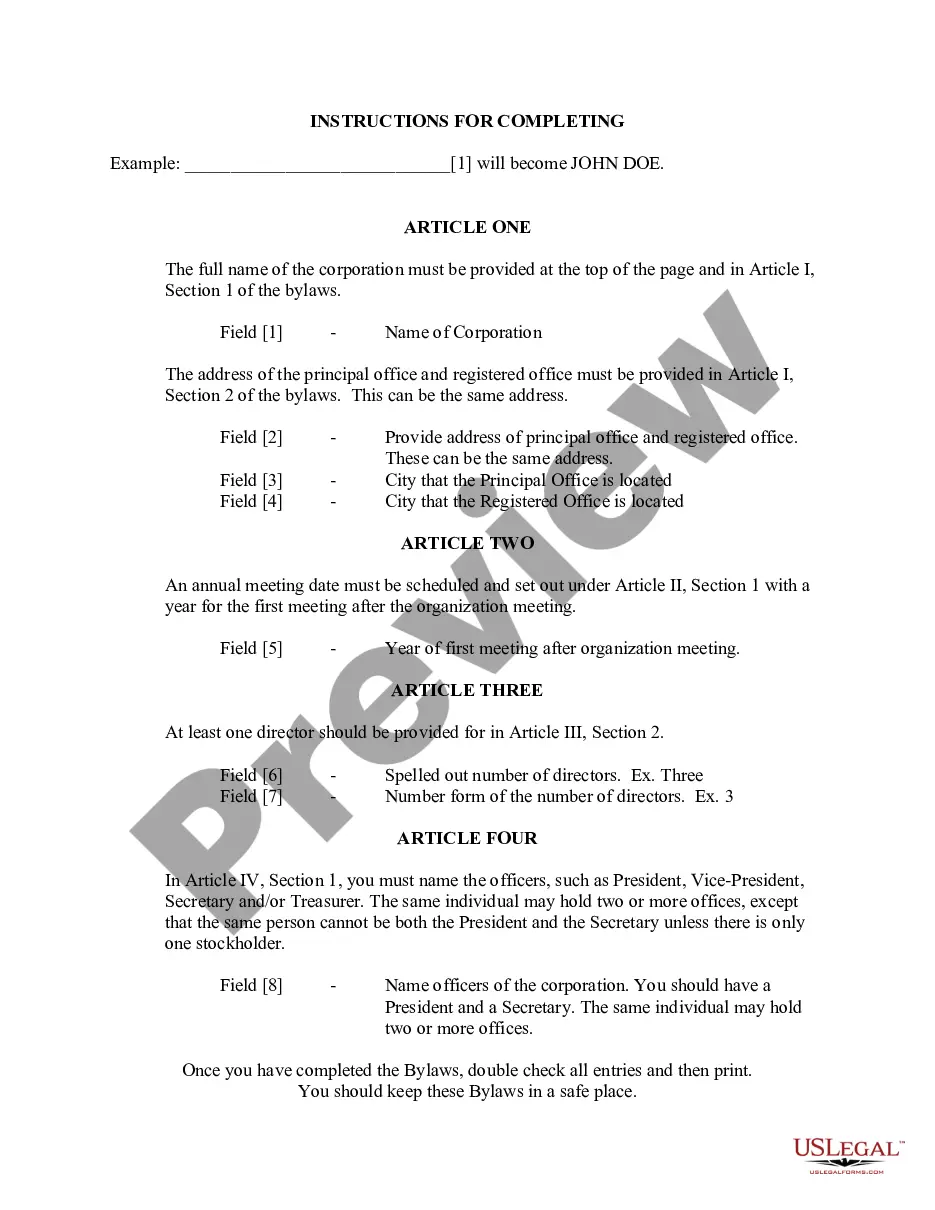

How to fill out Cook Illinois Credit Letter To Close Account?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Cook Credit Letter to Close Account is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Cook Credit Letter to Close Account. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Credit Letter to Close Account in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!