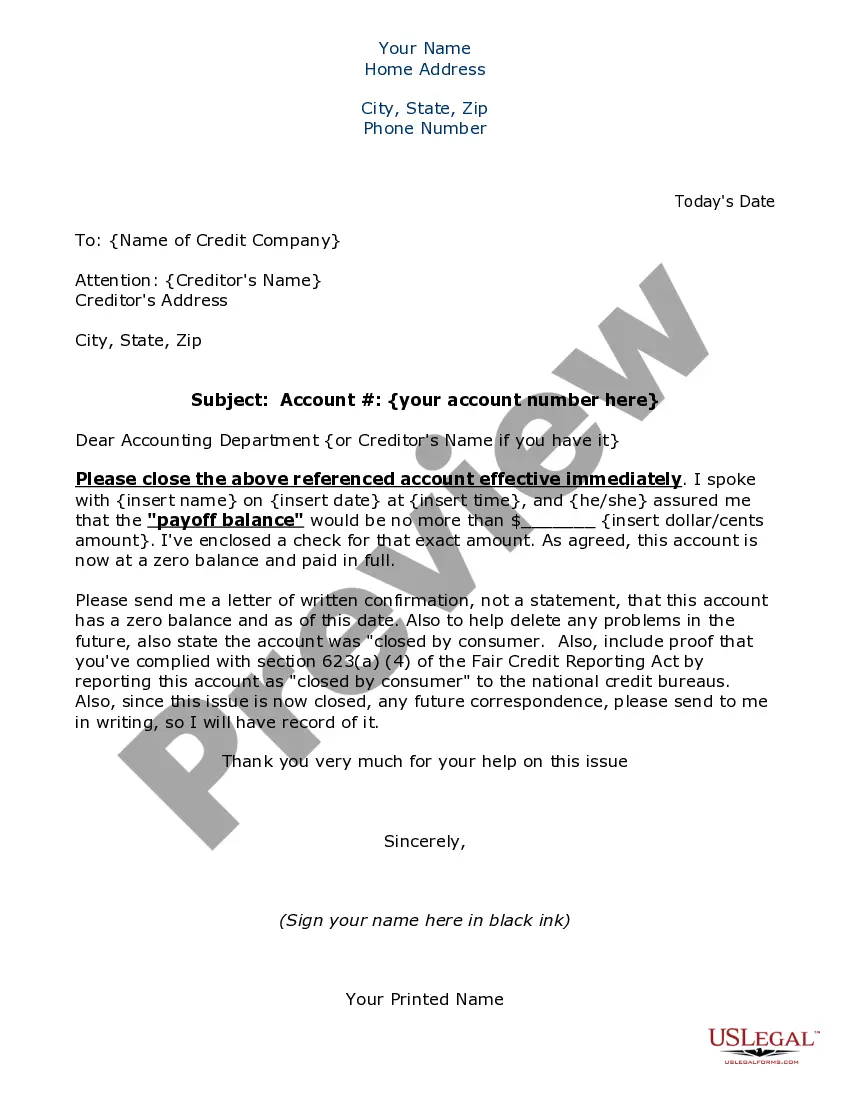

Miami-Dade Florida Credit Letter to Close Account is a document that is used by individuals or businesses to formally request the closure of a credit account with a financial institution based in Miami-Dade County, Florida. This letter serves as an official notification to terminate any ongoing credit agreement, avoid further transactions, and settle any remaining outstanding balance. The purpose of this letter is to communicate the account holder's intention to close the credit account and to request confirmation from the financial institution regarding the account closure procedure. It is important to state the reasons for closure, such as financial restructuring, personal choice, or transferring the credit to another institution. When writing a Miami-Dade Florida Credit Letter to Close Account, it is essential to include specific details such as the account holder's full name, account number, contact information, and the date the account was opened. Additionally, the letter should specify the desired closing date for the account and request the financial institution to confirm the closure in writing. Different types of Miami-Dade Florida Credit Letters to Close Account may include: 1. Personal Credit Account Closure Letter: This letter is used by individual consumers to close their personal credit accounts, such as credit cards, personal loans, or lines of credit. The account holder may choose to close the account due to various reasons, including high interest rates, excessive fees, or simply to reduce the number of credit obligations. 2. Business Credit Account Closure Letter: This type of letter is written by a business entity to request the closure of a credit account, such as a business credit card or a line of credit. It may be used when a business is undergoing financial restructuring, closing down operations, or changing its financial institution. 3. Mortgage Account Closure Letter: In the case of mortgage loans, a specific letter is required to request the closure of the mortgage account. This letter typically includes additional information such as the property address, loan number, and any instructions on the final payment or mortgage discharge process. 4. Auto Loan Account Closure Letter: When an individual or business wants to close their auto loan account, they need to submit a letter specifying the loan details, such as the vehicle identification number (VIN), loan account number, and the desired closure date. This ensures that the lien on the vehicle is released and ownership is transferred properly. In conclusion, a Miami-Dade Florida Credit Letter to Close Account is a formal request to terminate a credit account with a financial institution in Miami-Dade County, Florida. It is crucial to provide accurate and detailed information to facilitate a smooth account closure process.

Miami-Dade Florida Credit Letter to Close Account

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-MC-0001

Format:

Word;

Rich Text

Instant download

Description

Credit Letter to Close Account

Miami-Dade Florida Credit Letter to Close Account is a document that is used by individuals or businesses to formally request the closure of a credit account with a financial institution based in Miami-Dade County, Florida. This letter serves as an official notification to terminate any ongoing credit agreement, avoid further transactions, and settle any remaining outstanding balance. The purpose of this letter is to communicate the account holder's intention to close the credit account and to request confirmation from the financial institution regarding the account closure procedure. It is important to state the reasons for closure, such as financial restructuring, personal choice, or transferring the credit to another institution. When writing a Miami-Dade Florida Credit Letter to Close Account, it is essential to include specific details such as the account holder's full name, account number, contact information, and the date the account was opened. Additionally, the letter should specify the desired closing date for the account and request the financial institution to confirm the closure in writing. Different types of Miami-Dade Florida Credit Letters to Close Account may include: 1. Personal Credit Account Closure Letter: This letter is used by individual consumers to close their personal credit accounts, such as credit cards, personal loans, or lines of credit. The account holder may choose to close the account due to various reasons, including high interest rates, excessive fees, or simply to reduce the number of credit obligations. 2. Business Credit Account Closure Letter: This type of letter is written by a business entity to request the closure of a credit account, such as a business credit card or a line of credit. It may be used when a business is undergoing financial restructuring, closing down operations, or changing its financial institution. 3. Mortgage Account Closure Letter: In the case of mortgage loans, a specific letter is required to request the closure of the mortgage account. This letter typically includes additional information such as the property address, loan number, and any instructions on the final payment or mortgage discharge process. 4. Auto Loan Account Closure Letter: When an individual or business wants to close their auto loan account, they need to submit a letter specifying the loan details, such as the vehicle identification number (VIN), loan account number, and the desired closure date. This ensures that the lien on the vehicle is released and ownership is transferred properly. In conclusion, a Miami-Dade Florida Credit Letter to Close Account is a formal request to terminate a credit account with a financial institution in Miami-Dade County, Florida. It is crucial to provide accurate and detailed information to facilitate a smooth account closure process.