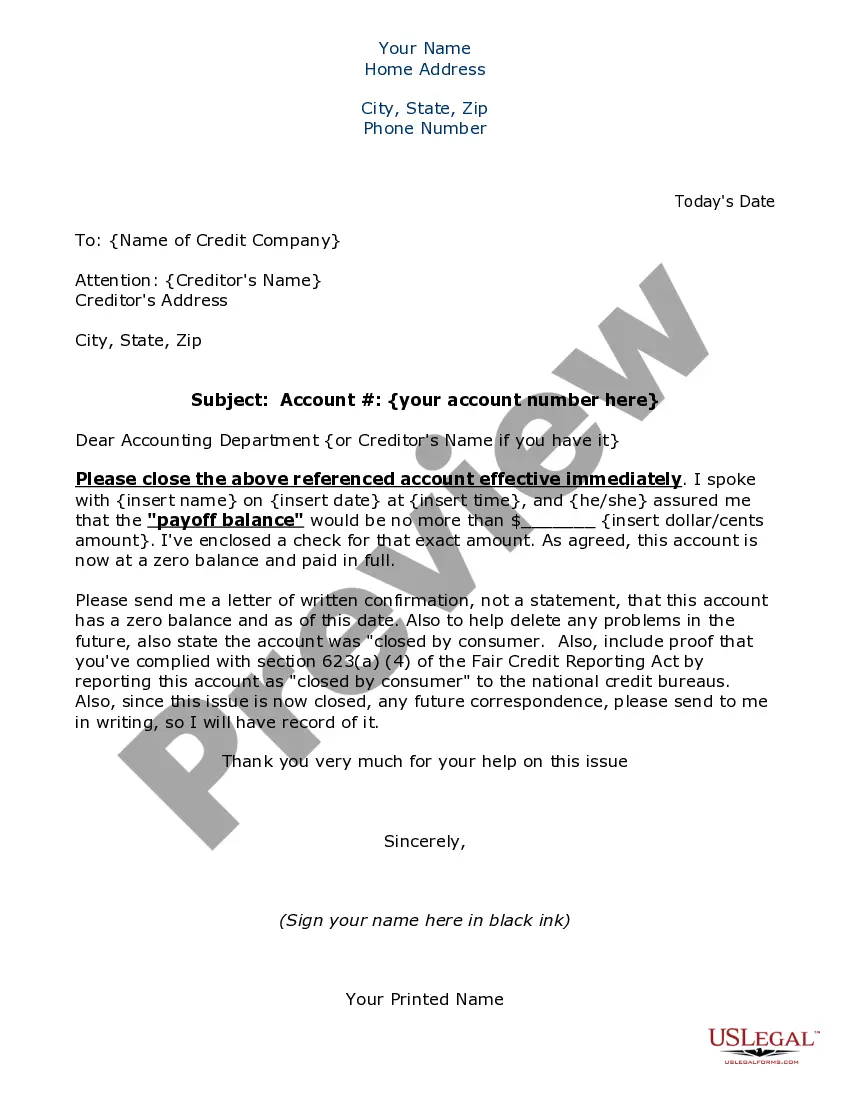

Tarrant Texas Credit Letter to Close Account is a formal document used by individuals in Tarrant County, Texas, to inform their credit institutions about their decision to close their accounts. It is a crucial step in the process of terminating an existing credit account and is typically required by financial institutions to ensure a smooth closure procedure. The Tarrant Texas Credit Letter to Close Account serves as an official record of the account holder's intent to close the account and includes specific details required by the credit institution. The letter typically includes the following key elements: 1. Account Holder's Information: The account holder's full name, address, contact number, and any other pertinent information required for identification purposes. 2. Account Details: The letter should provide specific information about the account being closed, such as the account number, type of account (e.g., credit card, personal loan, mortgage), and the date the account was opened. 3. Reason for Closure: The letter should state the reason for closing the account, whether it is due to financial constraints, personal preference, or switching to another financial institution. Providing a clear and concise explanation helps credit institutions improve their services and address any customer concerns. 4. Request for Confirmation: It is essential to request a confirmation of the account closure from the credit institution. Accurate record-keeping is crucial to avoid any misunderstandings or future disputes. 5. Final Balance Settlement: If there is an outstanding balance on the account, the letter should mention how the account holder intends to settle the remaining amount. This can be through a one-time payment, installment plan, or any other agreed-upon arrangement. Different types of Tarrant Texas Credit Letter to Close Account may vary based on the specific financial institution or type of account being closed. For instance: 1. Tarrant Texas Credit Card Account Closure Letter: Used when closing a credit card account with a Tarrant County-based financial institution. 2. Tarrant Texas Mortgage Account Closure Letter: Used when terminating a mortgage account with a Tarrant County-based bank or lender. 3. Tarrant Texas Personal Loan Closure Letter: Used when closing a personal loan account with a Tarrant County-based financial institution. By using these relevant keywords in the content, the description effectively highlights the purpose and various types of Tarrant Texas Credit Letter to Close Account.

Tarrant Texas Credit Letter to Close Account

Description

How to fill out Tarrant Texas Credit Letter To Close Account?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Tarrant Credit Letter to Close Account, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any tasks related to paperwork completion straightforward.

Here's how you can purchase and download Tarrant Credit Letter to Close Account.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the similar document templates or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Tarrant Credit Letter to Close Account.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Tarrant Credit Letter to Close Account, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you need to cope with an extremely challenging situation, we recommend getting a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-specific documents effortlessly!